Crypto Market Plunges $2 Trillion Amid Extreme Fear and Institutional Selling

- The crypto market cap has dropped nearly 48%, falling from its $4.38T high to $2.24T

- CryptoQuant analysis points to institutional selling adding pressure to crypto prices.

The crypto market has fallen more than 6%, and pushed the total market cap towards $2.24 trillion today, as widespread selling pressure continues. The sharp decline reflects growing uncertainty, as most of the cryptos are struggling to find support.

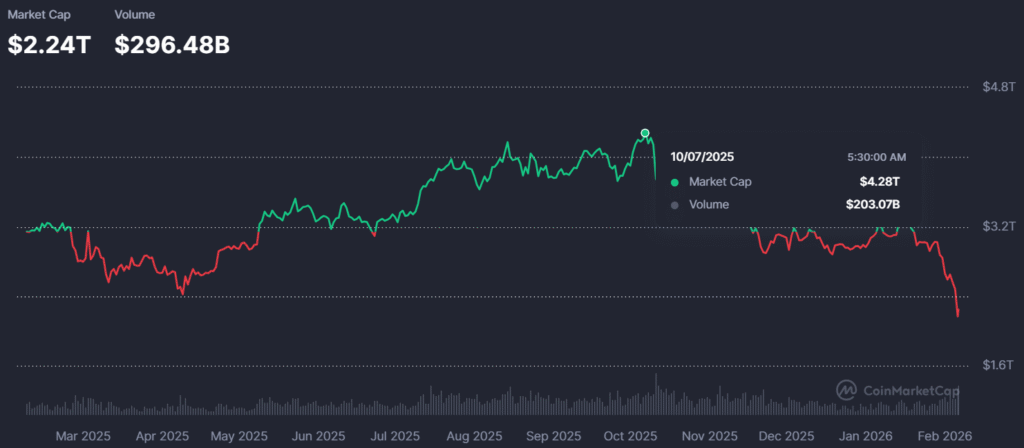

The current crypto market cap is down around 48%, nearly half of its October 2025 peak of $4.28 trillion, as per CoinMarketCap data. Also, this day, the crypto Fear and Greed Index has dropped to 5, an extreme fear condition, down from 11 recorded yesterday, highlighting heightened caution among traders.

Source: CoinMarketCap

Source: CoinMarketCap

As of writing, the major cryptocurrency Bitcoin plunges beyond 8% and is trading near $64,800, which is down 48% from its October all-time high of $126,198. Secondly, Ethereum is down by more than 9% and trading around $1,900. Then, Solana is down by 13%, followed by Cardano, XRP, and other assets.

The Coinglass data shows that nearly 577,082 traders were liquidated, and the total liquidations come in at $2.60 billion over the past 24 hours, with the highest liquidation coming from Bitcoin, around $16.26 million, followed by Ethereum, about $9 million.

Rising Institutional Selling Pressure

Further, CryptoQuant contributor named Darkfost said, “The Coinbase Premium Gap has never been this negative since the beginning of the year,” and explained that Coinbase is mostly used by professionals and institutions, while Binance has more retail investors, which signals that institutional players are selling more, which intensifies the price decline.

The analysis ended with, “The current period is extremely challenging and highly uncertain, a climate that is not conducive to risk-taking and therefore to significant investments in BTC, which remains a volatile and risky asset.”

Which has been reflected in massive exchange-traded fund outflows, according to SoSoValue, where the Bitcoin ETF has recorded around $434.15 million daily outflows on February 5, with none of the funds posting inflows.

While Chanpeng Zhao, co-founder of Binance, commented, “Poor again,” in his X handle on February 5 and reshared a remark he posted during a previous price slump in January 2022, and said, “Last time I posted this was when bitcoin dropped from $67k to $30k ish. Did alright in the end,” which highlights the cyclical volatility of the crypto market and can reshape investor sentiment over time.

Highlighted Crypto News:

Banks and Crypto Could End Up Offering Similar Products: Bessent

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

SEI Technical Analysis Feb 6