Altcoins Crash Deepens as Fear Peaks: Is the Market Near a Turning Point?

The post Altcoins Crash Deepens as Fear Peaks: Is the Market Near a Turning Point? appeared first on Coinpedia Fintech News

Crypto markets extended their downside momentum on Friday as selling pressure intensified across both majors and altcoins. Bitcoin fell nearly 9% on the day, briefly touching the $65,000 level, while Ethereum slid below $2,000. The weakness quickly spilled into the broader market, pushing several large-cap and mid-cap altcoins into double-digit losses.

This phase of the altcoin crash did not unfold gradually. Instead, price action accelerated once key intraday supports failed, triggering forced liquidations across derivatives markets. Liquidity thinned rapidly, bids pulled back, and volatility expanded in a way typically seen during late-stage risk unwinds rather than the start of fresh bearish trends. With sentiment deteriorating sharply and leverage exiting the system, the market now faces a critical question: Is this the exhaustion phase of the selloff, or merely another step lower?

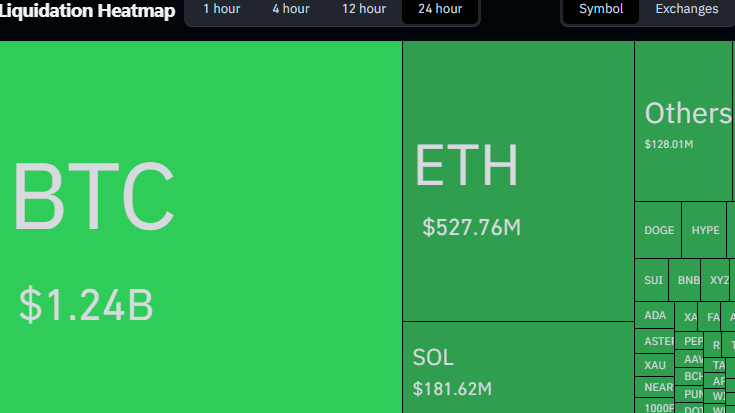

Liquidations Data Shows Capitulation Spreading Beyond Bitcoin

The scale of forced selling offers a clearer view of the current altcoin crash. According to derivatives data, total liquidations crossed $2.59 billion over the past 24 hours, marking one of the largest single-day wipeouts in recent months. Bitcoin led the move with $1.34 billion in liquidations, reflecting the cascade triggered once price broke below the $67,000 zone. Ethereum followed with $562 million, while altcoins collectively absorbed more than $1.1 billion in liquidations. Solana alone saw close to $187 million, with the remainder spread across high-beta Layer-1s, DeFi tokens, and speculative mid-caps. This distribution matters. In earlier corrections, Bitcoin typically carried the majority of leverage risk.

During this altcoin crash, forced selling extended far deeper into the market, confirming that speculative positioning had built up aggressively beyond BTC. Once prices turned, leverage exited quickly, accelerating downside momentum. Historically, liquidation-heavy sessions of this magnitude tend to reset market structure by flushing excess risk rather than marking the start of prolonged downside trends.

Extreme Fear Readings Reflect Late-Stage Panic Conditions

Market sentiment data reinforces the view that the current altcoin crash is driven by fear rather than complacency. The Crypto Fear & Greed Index fell to 5, placing sentiment firmly in “Extreme Fear” territory. Readings below 10 have appeared only a handful of times across past cycles, including 2018, March 2020, and late 2022.

In each instance, such levels reflected emotional capitulation rather than early-stage bearish conviction. While prices did not reverse immediately in every case, downside momentum typically slowed as panic peaked.

- Also Read :

- Crypto Crash: Should You Buy the Dip or Wait for More Downside?

- ,

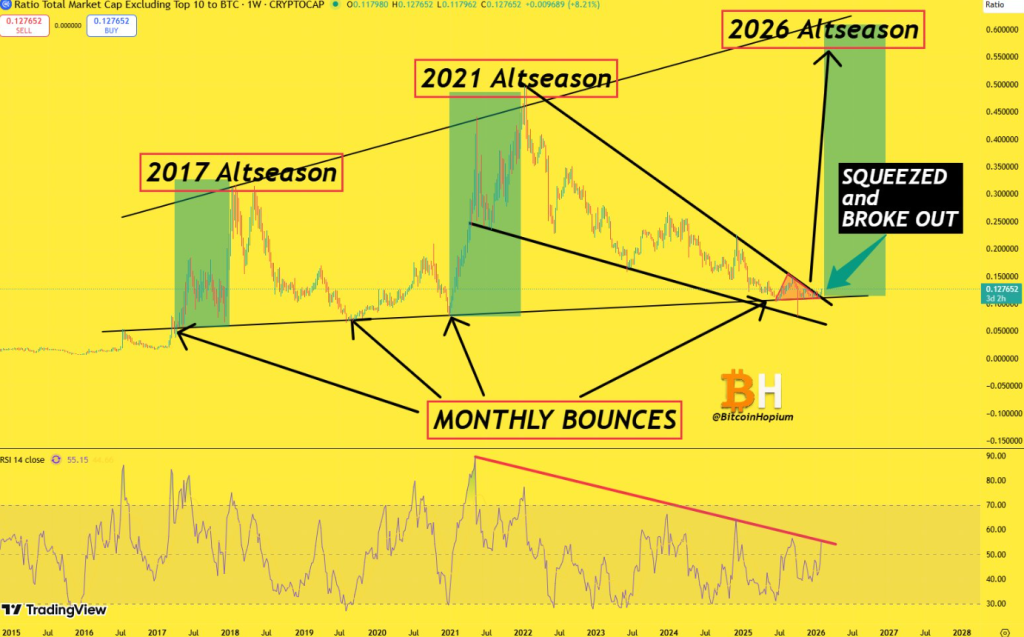

Altcoin Crash Mirrors Historical Pre-Rotation Phases

Despite the severity of the ongoing altcoin crash, long-term structure paints a more nuanced picture. Historical market-cap trends show that altcoin cycles often experience deep compression phases before meaningful rotation begins. In 2017, 2021, and following the 2022 bear market, altcoins endured extended periods of underperformance marked by repeated breakdown fears, declining relative strength, and sharp monthly selloffs. These phases typically preceded strong upside expansions once capital rotation resumed.

Current charts reflect a similar pattern. Altcoin market capitalization remains locked in a long-term consolidation range, with downside moves repeatedly attracting demand near historical support zones. While this does not confirm an immediate altcoin season, it suggests the present altcoin crash resembles structural compression rather than outright collapse. Notably, these transitions have historically occurred during periods of extreme fear conditions that closely mirror the current environment.

Final Thoughts

The altcoin crash appears driven more by liquidation pressure than fresh selling. With sentiment near extreme fear and leverage largely flushed, downside momentum may be slowing. Volatility can persist, but the data suggests the market is closer to stabilization than collapse. Caution remains key, yet conditions for a gradual base may be forming.

FAQs

Crypto prices fell as key supports broke, triggering mass liquidations. High leverage, thin liquidity, and panic selling accelerated losses across coins.

Not necessarily. Data suggests forced liquidations drove the drop, which often marks late-stage selloffs rather than the start of long bear markets.

Large liquidations usually flush excess leverage. This can reduce selling pressure and help prices stabilize once panic-driven trades are cleared.

Crashes can create long-term opportunities, but timing is risky. Many investors wait for volatility to cool and price action to stabilize.

You May Also Like

The Channel Factories We’ve Been Waiting For

Top AI Crypto Presales 2026: IPO Genie Crushes the Competition with Pre-IPO Deal Intelligence and Massive Upside