Centrifuge’s TVL surpasses $1b milestone on strength of tokenized credit fund

Centrifuge’s TVL has surpassed $1 billion milestone, joining Securitize $3.1b and Ondo Finance $1.3b among platforms that have reached this milestone.

- Centrifuge’s TVL has surpassed $1 billion milestone, joining Securitize ($3.1B) and Ondo Finance ($1.3B) among platforms that have reached this milestone.

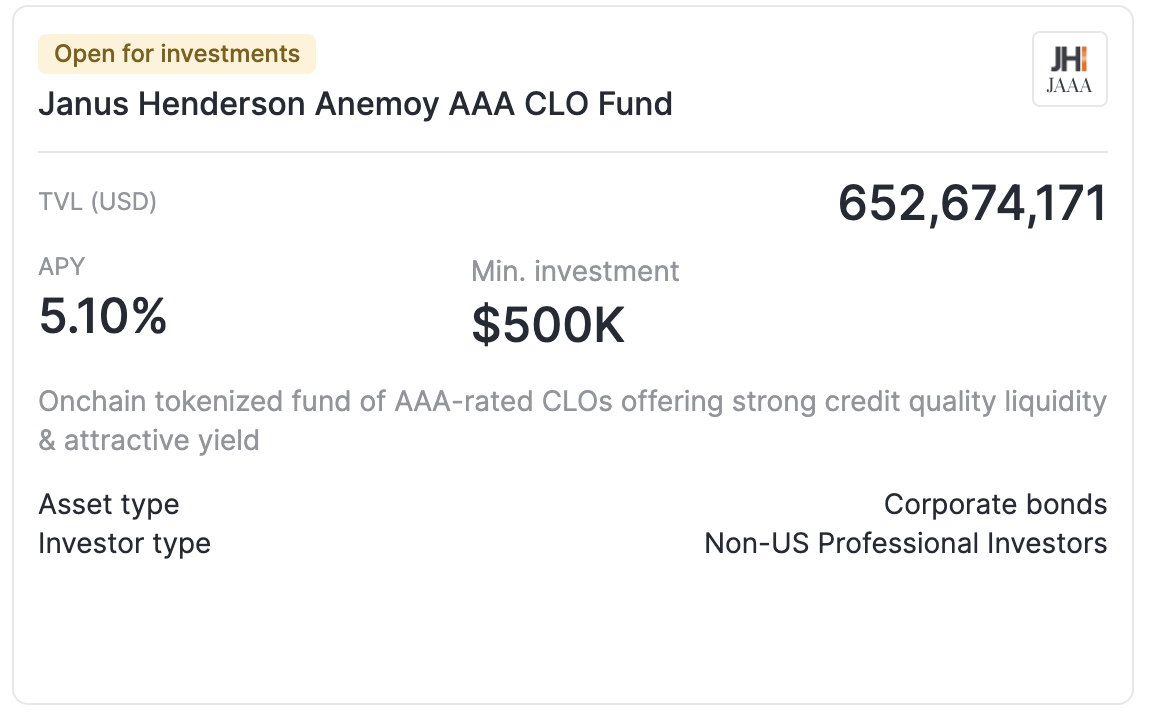

- The milestone is driven by strong demand for the Janus Henderson Anemoy AAA CLO Fund, a tokenized pool of AAA-rated corporate loans.

- Growth follows the launch of a tokenized S&P 500 fund and the platform’s migration to Ethereum with Centrifuge V3.

Blockchain infrastructure platform Centrifuge’s TVL has crossed $1.1 billion, fueled by demand for its Janus Henderson Anemoy AAA CLO Fund — a tokenized pool of top-rated collateralized loan obligations.

The JAAA fund, which currently manages more than $653 million on-chain, offers investors exposure to corporate loan-backed securities with AAA ratings, combining strong credit quality with liquidity and an annual yield of around 5.10%. Structured as a professional fund domiciled in the British Virgin Islands, it’s open to non-U.S. professional investors with a minimum ticket size of $500,000.

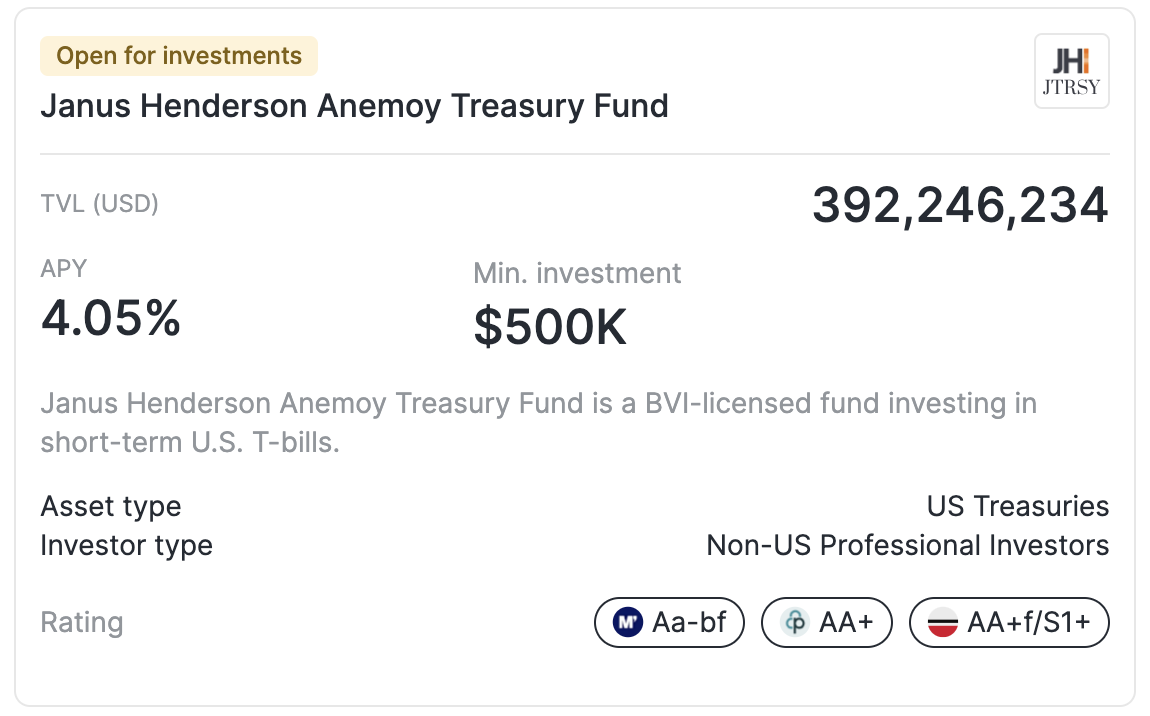

Alongside JAAA, Centrifuge also offers the Janus Henderson Anemoy Treasury Fund, a vehicle investing in short-term U.S. government bills, which has attracted more than $392 million in assets.

The $1 billion milestone places Centrifuge alongside Securitize, which tokenized BlackRock’s BUIDL fund and holds over $3.1B, and Ondo Finance, with $1.3B.

As Centrifuge CEO Bhaji Illuminati told Cointelegraph, products like the JAAA fund are attracting rapid interest as institutions seek higher yields and diversified credit exposure, even though U.S. Treasurys remain the primary entry point for many allocators. Illuminati also highlighted that private credit and other differentiated fixed-income strategies are gaining traction, and hinted at forthcoming launches aimed at expanding these offerings.

S&P 500 fund launch and Ethereum migration

The $1 billion TVL milestone follows Centrifuge’s early July launch of a tokenized S&P 500 fund in partnership with S&P Dow Jones Indices.

It also comes after the platform’s major infrastructure upgrade, with Centrifuge completing its migration from Polkadot to Ethereum on July 24 with Centrifuge V3, becoming a multichain, EVM-native protocol that enhances DeFi composability and strengthens integration across its expanding suite of tokenized real-world assets.

You May Also Like

Recovery extends to $88.20, momentum improves

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail