OpenAI’s ChatGPT Predicts the Price of XRP, XMR, and ADA After Recent Market Crash

The latest upgrade of ChatGPT, ChatGPT-5, predicts that XRP, Monero, and Cardano could deliver standout returns in the months ahead, potentially rewarding investors just in time for the holiday season.

However, the path to upside is turbulent for now. Last Thursday, Bitcoin soared to a new record high of $124,128, edging past its previous peak of $122,838 set only a month earlier.

The rally quickly cooled after the Bureau of Labor Statistics reported higher-than-expected U.S. inflation numbers for July, triggering a wave of profit-taking that briefly crashed BTC’s price below $115,000 the following Monday.

But there’s a silver lining: the industry is getting clearer guidance from US authorities. President Trump recently signed the GENIUS Act, the nation’s first fully fledged stablecoin law mandating that all stablecoins must be backed by reserves. Around the same time, the SEC introduced Project Crypto, a sweeping modernization effort designed to clarify how securities rules apply to digital assets.

With these shifts paving the way, analysts say the market may be primed for another explosive rally in meme coins and alternative tokens, potentially surpassing the mania of 2021, with XRP, Monero and Cardano at the front of the pack if ChatGPT’s outlook proves correct.

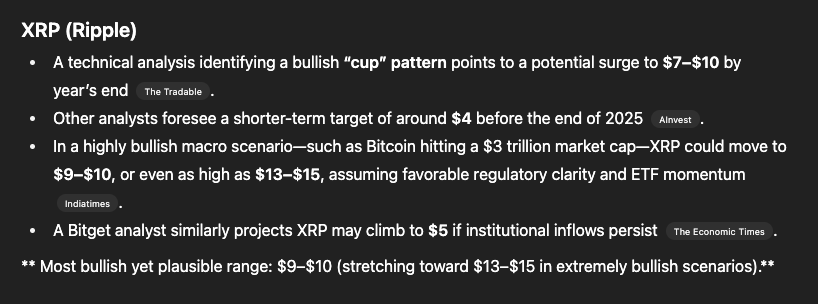

XRP (Ripple): ChatGPT Predicts 5× Growth, Potentially Reaching $10 by Year-End

ChatGPT predicts XRP ($XRP) could climb toward $10 before the end of 2025, more than 5x up from its current trading price of $2.97.

The token’s performance this year has been notable. On July 18, it spiked to $3.65, eclipsing its 2018 record of $3.40, before correcting roughly 18.5% to today’s levels.

Adoption continues to expand. In 2024, the UN Capital Development Fund pointed out XRP as a viable solution for international transfers in developing economies.

Ripple also put an end to its years-long legal battle with the SEC earlier this year when the regulator officially dropped its case, cementing a 2023 ruling that retail XRP sales are not securities. This landmark outcome essentially cleared the way for most legitimate altcoins to avoid similar SEC overreach.

If XRP revisits its highs, ChatGPT sees $10 as a realistic milestone, with $15 achievable under a strong bull market scenario.

Technicals look balanced, with the relative strength index (RSI) at 50, signaling just slightly more selling momentum that will soon ease once traders have finished cashing in on recent gains.

Over the past year, XRP has surged 427%, vastly outperforming Bitcoin’s 93% and Ethereum’s 64% gains over the same period.

Monero ($XMR) Privacy Coin Holds the Fort Amidst Market-Wide Downturn

Monero (XMR) is one of the most popular privacy-focused cryptocurrencies, built to keep transactions completely anonymous and untraceable.

Unlike Bitcoin or Ethereum, which record every transaction on a transparent blockchain, Monero uses advanced cryptography like ring signatures, stealth addresses, and confidential transactions to hide both the sender and receiver. This makes it a favorite for users who value financial privacy.

Launched in 2014, it has grown into a top project with a strong community. While regulators often scrutinize Monero due to its privacy features, supporters see it as a crucial tool for true financial freedom in the digital era.

After sharp dip to below $240, Monero is now rebounding sharply. Today, XMR weathered a market wide crash that took 4.8% off the price of XRP, 2.5% from Bitcoin and 6.1% from Ethereum while XMR added 1.5% to trade at $272.

Additionally, the chart shows a sharp upspike in XMR’s RSI, indicating gathering buying momentum. Should this develop into a rally, XMR could go as high as $400, where it is likely to face resistance, but with strong support just above $300, its conceivable that a bull market could result in a new ATH for the top privacy coin.

Monero’s current ATH is $542.33, set way back in 2018.

Cardano ($ADA): ChatGPT Predicts the Eco-Friendly Blockchain Could See 158% Growth

Cardano ($ADA) has rallied 171% over the past 365 days, outperforming Bitcoin, Ethereum and Solana to become the second best performing multibillion dollar cap coin after XRP. This is largely due to growing demand for sustainable and scalable blockchain solutions, alongside a surge of interest in stablecoins and real world asset tokenization.

It’s even caught the attention of the most powerful leader in the world. In a post on Truth Social, Donald Trump mentioned ADA as part of his proposal for a U.S. Strategic Crypto Reserve. While Bitcoin was the main focus, ADA is a proposed addition, though only if acquired through government seizures rather than direct purchases.

Created by Charles Hoskinson, a co-founder of Ethereum, Cardano stands out for its Proof-of-Stake mechanism, low energy footprint, and academically peer-reviewed development, traits that continue to attract institutional and retail interest alike.

Currently valued at $0.9123 with a market cap of $33.2 billion, ChatGPT predicts ADA could climb to $2.36 by the end of 2025. That would mark a 158% increase from its current price, although it would still be 24% down from its previous record high of $3.09, set in September 2021.

From a charting perspective, ADA has been consolidating in a falling wedge since late 2024. A breakout above $1.10 resistance could pave the way toward $1.50 by autumn, while a successful bull run could ultimately propel the token to the projected target or higher.

Bitcoin Hyper ($HYPER): Meme-Powered Layer 2 Unlocking Speed for Bitcoin

One of the hottest presale stories of the year is flying under ChatGPT’s radar, as it’s still only in presale. Bitcoin Hyper ($HYPER) is the first Bitcoin Layer 2 to merge advanced scaling features with meme-driven culture and community-led adoption.

Its mission is to accelerate BTC transactions, expand functionality, and remain true to a community-first philosophy.

The presale has already brought in $10.3 million, with some analysts eyeing possible 10× or greater returns once it goes live.

Built on the Solana Virtual Machine (SVM), Bitcoin Hyper enables lightning-fast smart contracts for the Bitcoin ecosystem, removing bottlenecks like slow confirmation times and costly fees.

Its Canonical Bridge allows near-instant BTC transfers across its custom Layer 2, while ultra-low fees open the door for dApps, meme tokens, and payment applications. A recent Coinsult audit confirmed zero smart contract vulnerabilities, bolstering investor confidence.

The $HYPER token powers the system, providing staking rewards, gas fee coverage, and governance rights. Early presale investors can earn up to 105% APY and influence future platform upgrades through voting.

Visit the official presale website or follow Bitcoin Hyper on X and Telegram for more information.

Click Here to Participate in the PresaleYou May Also Like

Over $9 billion flowed out of Bitcoin and Ethereum ETFs in four months

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse