Best Crypto for Late 2025: Layer Brett Predicted to Outperform Solana and Cardano Into 2026

The next big crypto opportunity has arrived with the presale of Layer Brett. As the crypto market gears up for the 2025 bull run, analysts are buzzing about Layer Brett’s explosive presale and its potential to eclipse established giants like SOL and ADA.

With a bold blend of meme power and Layer 2 technology, Layer Brett is being called the best crypto to buy now for those seeking the next 100x altcoin. The project’s presale is live, offering early access at just $0.0047 per token and staking rewards as high as 9,000% APY.

Why Layer 2 gives Layer Brett the edge over Solana and Cardano

The Layer 2 architecture behind Layer Brett allows it to sidestep the high gas fees and network congestion often plaguing Ethereum Layer 1. Unlike SOL, which is renowned for its scalability and low transaction fees, or ADA, famous for academic rigor but slower upgrades, Layer Brett delivers near-instant transactions and pennies-on-the-dollar gas fees.

This “where meme meets mechanism” approach fuses the viral appeal of a memecoin with the performance and reliability of a robust blockchain. With Ethereum Layer 2 solutions projected to process trillions annually by 2027, Layer Brett is positioned for massive adoption, making it a clear best crypto to buy now.

How LBRETT rewards early buyers—staking crypto for explosive gains

Staking is a core part of the Layer Brett ecosystem. Early buyers can lock up their tokens directly via MetaMask or Trust Wallet, earning APYs that rival any DeFi coin on the market.

For comparison, neither Solana nor Cardano currently offer staking rewards on this level or with this kind of meme-fueled community energy. The presale offers up to 9,000% APY, far surpassing most altcoin staking programs and drawing FOMO-driven investors seeking the next top gainer crypto.

Layer Brett comes with numerous features driving its appeal as the best crypto. They include:

- Built on Ethereum Layer 2: Ultra-fast, low-cost, and scalable for real-world adoption.

- Massive staking rewards: Early participants can access up to 9,000% APY.

- Presale access: Entry at just $0.0047 per token, with ETH, USDT, or BNB.

- $1 Million giveaway: Community campaigns and reward incentives drive engagement.

What makes Layer Brett different from Brett (original), Shiba Inu, and Pepe?

Layer Brett is not just another meme token. Unlike the original Brett on Base, which relies mainly on community hype, Layer Brett delivers real utility, transparent tokenomics, and a scalable Layer 2 foundation.

Compared to SOL and Cardano, Layer Brett’s unique blend of meme culture and blockchain utility offers both fun and function, standing apart from feature-light meme projects like Shiba Inu and Pepe. The transparent supply of 10 billion tokens, robust staking, and interoperable roadmap make it a standout among trending cryptocurrencies.

Why investors are looking toward LBRETT after disappointing Cardano price predictions

Despite recent rebounds, Cardano has faced periods of slow growth and underwhelming protocol updates. In contrast, Layer Brett offers a smaller market cap and much higher upside potential, appealing to investors searching for the best long-term crypto.

Similarly, while SOL has performed steadily, it is already a top altcoin with less room for 100x gains compared to a low-cap crypto gem like Layer Brett. This has shifted investor attention to projects with both growth and reward potential.

Layer Brett is the best crypto to buy now for outsized 2025 gains

With the presale window closing soon, Layer Brett stands out as the best crypto to buy now for those chasing the next crypto bull run. Its Layer 2 technology, massive staking rewards, and community-first ethos position it to outperform SOL and Cardano into 2026.

Don’t miss your chance to get in on the most scalable memecoin to ever launch on Ethereum—stake, earn, and ride the next 100x wave with Layer Brett.

Presale: Layer Brett | Fast & Rewarding Layer 2 Blockchain

Telegram: Telegram: View @layerbrett

X: (1) Layer Brett (@LayerBrett) / X

This article is not intended as financial advice. Educational purposes only.

You May Also Like

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

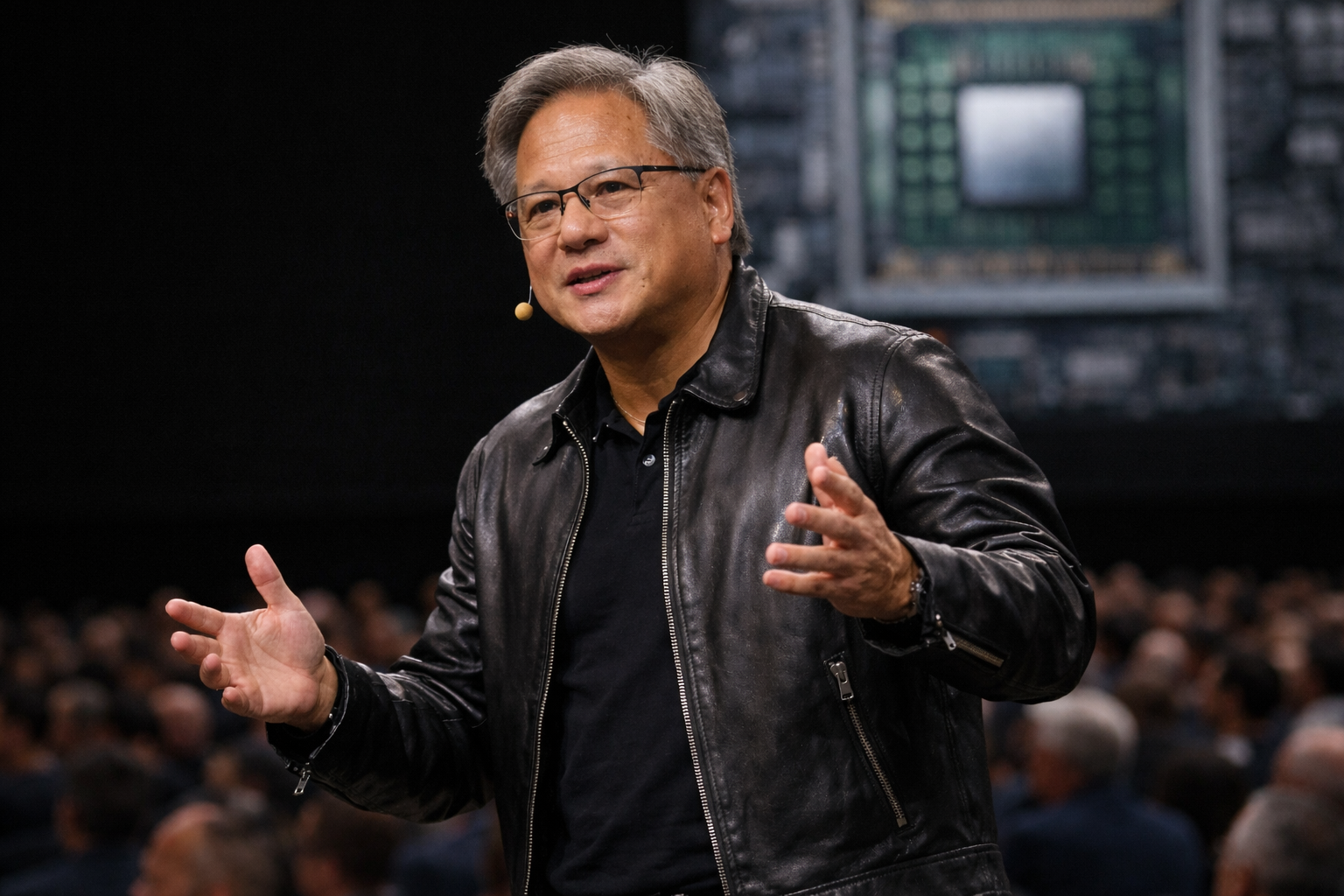

Nvidia’s Jensen Huang believes markets are wrong on software selloff