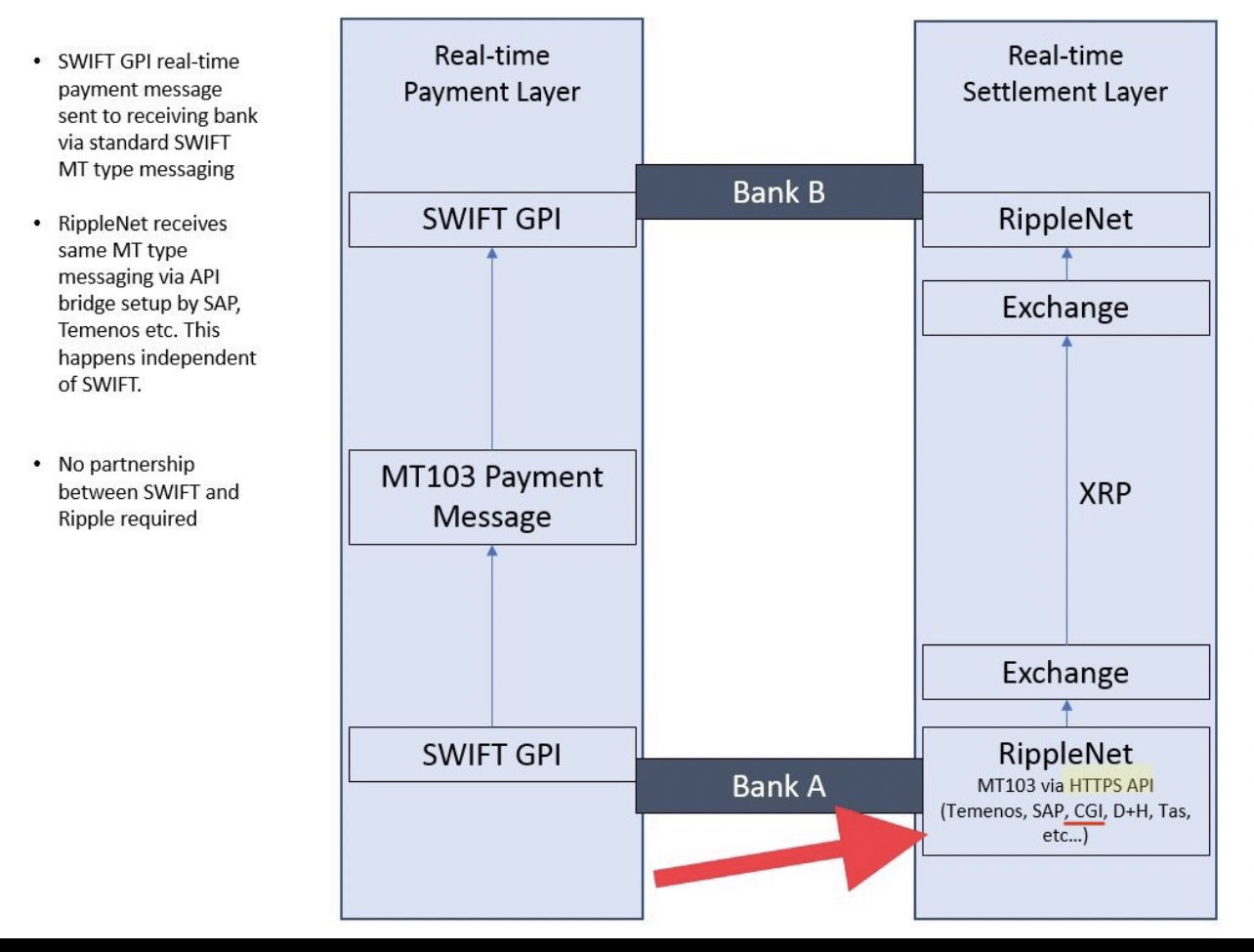

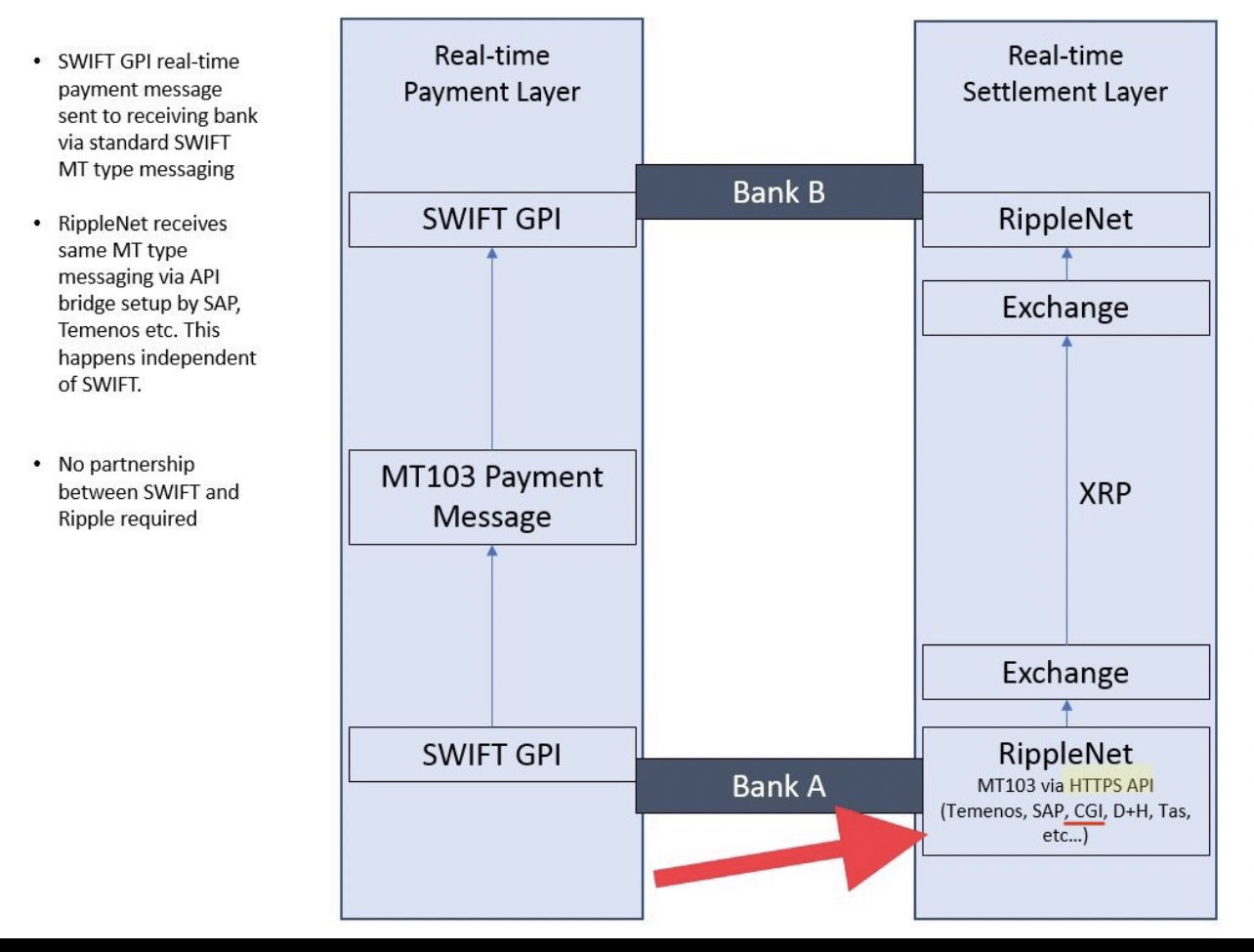

XRP community researcher SMQKE recently shared an analysis outlining how Ripple Payments and XRP can interact with SWIFT without any formal partnership. According to him, instead of direct integration, the connection is possible through third-party vendors and API bridges developed by firms such as SAP, Temenos, and CGI. These intermediaries enable RippleNet to receive SWIFT’s MT103 payment messages via HTTPS APIs, creating an indirect but functional pathway between the two networks. How the Flow Works When a payment is initiated on SWIFT GPI, the message is transmitted through the traditional banking system. RippleNet receives the same MT103 message through vendor-managed APIs. From there, RippleNet can route the transaction through exchanges and leverage XRP as a liquidity tool within its settlement layer. This setup allows banks connected to RippleNet to settle transactions that originated on the SWIFT network, without SWIFT and Ripple working together directly.  Does This Actually Work? Ripple Dev Responds SMQKE’s recent revelation about how Ripple, XRP, and the SWIFT system could work together raised eyebrows across the crypto community, including among influential voices in the XRP space. Many have questioned the legitimacy of the document he presented. One of the most vocal critics was XRP-focused YouTuber Crypto Eri. She publicly called on Neil Hartner, a software engineer at Ripple specializing in Ripple Payments, to weigh in on the document and clarify whether the proposed workflow is technically viable, especially since SMQKE did not cite a source. In response, Hartner described the scenario as “plausible”. He added that, from a technical view, the flow could indeed be implemented. He noted that, theoretically, a bank could send the MT103 message to the Ripple Payments (formerly RippleNet) API using the additional_info field. However, Hartner also stated that he could not comment on specific vendor names, cautioning: “Don’t read too much into my answer.” https://twitter.com/illneil/status/1956357863393358148 ISO 20022 at Work A crucial factor behind this interoperability is ISO 20022, the global standard for financial messaging. Ripple is one of the foremost payment institutions to adopt this standard. By aligning with ISO 20022, RippleNet ensures compatibility with traditional networks like SWIFT and newer blockchain-based systems. This reduces fragmentation and paves the way for APIs and distributed ledger technology to support real-time settlement and improved cross-border efficiency. XRP Ledger to Capture Part of SWIFT Volume While Ripple and SWIFT have no formal partnership, members of the XRP community continue to hold out hope for either a future partnership or for a scenario in which Ripple ultimately replaces SWIFT. At the 2025 XRPL Apex event, Ripple CEO Brad Garlinghouse stated that the XRP Ledger (XRPL) could manage up to 14% of SWIFT’s transaction volume by 2030. According to Forbes, SWIFT processes approximately $150 trillion in annual transaction volume. If XRPL were to capture 14% of that, it would amount to roughly $21 trillion flowing through XRPL each year. Based on this projection, an analysis estimated that if XRP were to turn over 30 times per year, a liquidity pool of around $700 billion would be required. With XRP’s circulating supply, this would imply a token price in the range of approximately $11 to $24. However, it’s important to note that these projections are purely speculative.

Does This Actually Work? Ripple Dev Responds SMQKE’s recent revelation about how Ripple, XRP, and the SWIFT system could work together raised eyebrows across the crypto community, including among influential voices in the XRP space. Many have questioned the legitimacy of the document he presented. One of the most vocal critics was XRP-focused YouTuber Crypto Eri. She publicly called on Neil Hartner, a software engineer at Ripple specializing in Ripple Payments, to weigh in on the document and clarify whether the proposed workflow is technically viable, especially since SMQKE did not cite a source. In response, Hartner described the scenario as “plausible”. He added that, from a technical view, the flow could indeed be implemented. He noted that, theoretically, a bank could send the MT103 message to the Ripple Payments (formerly RippleNet) API using the additional_info field. However, Hartner also stated that he could not comment on specific vendor names, cautioning: “Don’t read too much into my answer.” https://twitter.com/illneil/status/1956357863393358148 ISO 20022 at Work A crucial factor behind this interoperability is ISO 20022, the global standard for financial messaging. Ripple is one of the foremost payment institutions to adopt this standard. By aligning with ISO 20022, RippleNet ensures compatibility with traditional networks like SWIFT and newer blockchain-based systems. This reduces fragmentation and paves the way for APIs and distributed ledger technology to support real-time settlement and improved cross-border efficiency. XRP Ledger to Capture Part of SWIFT Volume While Ripple and SWIFT have no formal partnership, members of the XRP community continue to hold out hope for either a future partnership or for a scenario in which Ripple ultimately replaces SWIFT. At the 2025 XRPL Apex event, Ripple CEO Brad Garlinghouse stated that the XRP Ledger (XRPL) could manage up to 14% of SWIFT’s transaction volume by 2030. According to Forbes, SWIFT processes approximately $150 trillion in annual transaction volume. If XRPL were to capture 14% of that, it would amount to roughly $21 trillion flowing through XRPL each year. Based on this projection, an analysis estimated that if XRP were to turn over 30 times per year, a liquidity pool of around $700 billion would be required. With XRP’s circulating supply, this would imply a token price in the range of approximately $11 to $24. However, it’s important to note that these projections are purely speculative.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact

crypto.news@mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.