Polygon Ecosystem Crisis: AAVE and Lido Withdrew Collectively, Caused by the "Borrowing Chickens and Laying Eggs" Proposal

Author: Frank, PANews

As an important promoter of multi-chain interoperability, zero-knowledge proof applications, and DeFi and NFT ecosystems, Polygon once shined in the last bull market cycle. However, in the past year, many public chain projects such as Polygon have failed to achieve new breakthroughs, but have gradually been submerged in the light of new competitors such as Solana, Sui or Base. When Polygon returned to the discussion on social media again, it was not because of any major updates, but because of the withdrawal of ecological partners such as AAVE and Lido.

"Borrowing chickens and eggs" proposal raises concerns

On December 16, Aave Chan, a contributor to Aave, published a proposal in the community to withdraw its lending services from Polygon's Proof of Stake (PoS) chain. The proposal was written by Aave Chan founder Marc Zeller and aims to gradually phase out Aave's lending protocol on Polygon to prevent possible security risks in the future. Aave is the largest decentralized application on Polygon, with more than $466 million in deposits on the PoS chain.

Coincidentally, on the same day, the liquidity pledge protocol Lido announced that Lido on the Polygon network will be officially deactivated in the next few months. The Lido community stated that the strategic refocus on Ethereum and the lack of scalability of Polygon POS are the reasons for deactivating Lido on the Polygon network.

The loss of two major ecological applications in one day is a heavy blow to Polygon. The main reason is that the Polygon community released the "Polygon PoS Cross-Chain Liquidity Plan" Pre-PIP improvement proposal on December 13. The main goal of the proposal is to use the more than $1 billion in stablecoin reserves held on the PoS chain bridge to generate income.

It is understood that the Polygon PoS bridge holds about $1.3 billion in stablecoin reserves, and the community recommends deploying these idle funds into carefully selected liquidity pools to generate income and promote the development of the Polygon ecosystem. Based on the current loan interest rate, these funds may bring about $70 million in income per year.

The proposal proposes to gradually put these funds into a vault that complies with the ERC-4626 standard. Specific strategies include:

DAI: Deposit Maker’s sUSDS, the official yield token of the Maker ecosystem.

USDC and USDT: Morpho Vaults are used as the main source of income, and Allez Labs is responsible for risk management. Initial markets include Superstate's USTB, Maker's sUSDS, and Angle's stUSD.

Additionally, Yearn will manage a new ecosystem incentive program, using these proceeds to incentivize activity within the Polygon PoS and broader AggLayer ecosystem.

It is worth noting that the proposal was signed by Allez Labs, Morpho Association, and Yearn. According to Deflama data on December 17, the total TVL of Polygon is 1.23 billion US dollars, of which the TVL on AAVE is about 465 million US dollars, accounting for about 37.8%. Yearn Finance's TVL ranks 26th in the ecosystem, with a TVL of about 3.69 million US dollars. This may explain why AAVE proposed to withdraw from Polygon for security reasons.

Obviously, from the perspective of AAVE, this proposal is to take AAVE's money and put it into other lending protocols to earn interest. As the largest application of Polygon POS cross-chain bridge funds, AAVE cannot benefit from such a proposal, but instead has to bear the risk of fund security.

However, Lido’s withdrawal may have nothing to do with this proposal. After all, Lido’s proposal and vote to re-evaluate Polygon was released a month ago, but it just happened to be released at this time.

A helpless move due to weak ecological development

If the AAVE withdrawal proposal is officially passed, the TVL on Polygon will drop to $765 million, which is no longer possible to achieve the $1 billion fund reserve mentioned in the Pre-PIP improvement proposal. Uniswap, which ranks second in the ecosystem, has a TVL of about $390 million. If Uniswap also follows up with a similar plan to AAVE, the TVL on Polygon will drop sharply to around $370 million. Not only will the annual interest-bearing target of $70 million not be achieved, but all aspects of the entire ecosystem will be affected, such as the price of governance tokens, active users, etc. Perhaps the loss will be far more than $70 million.

So, judging from this result, this proposal does not seem to be a wise move. Why did the Polygon community propose this plan? In the past year of development, what is the status of the Polygon ecosystem?

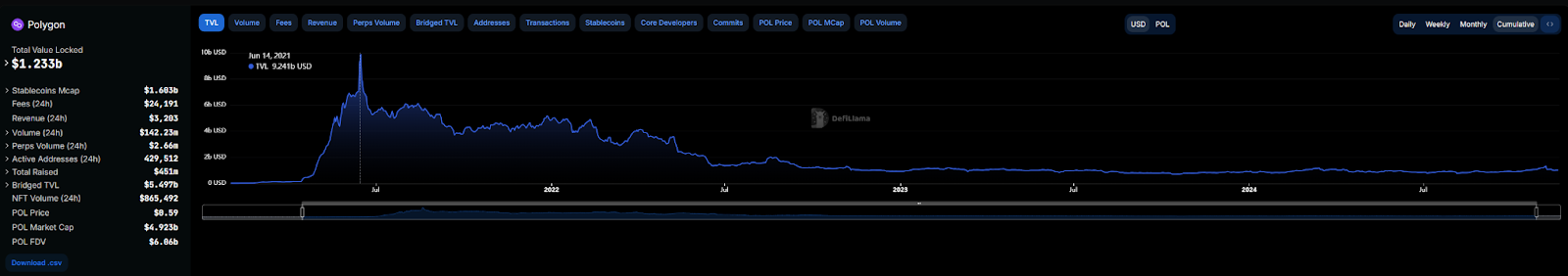

The most prosperous time for Polygon's ecosystem was in June 2021, when the total TVL reached 9.24 billion US dollars, 7.5 times that of today. As time went by, Polygon's TVL curve declined all the way, and it has been maintained at around 1.3 billion US dollars since June 2022, without much fluctuation. By 2023, it once fell to around 600 million US dollars. In 2024, the market rebounded, and Polygon's TVL volume was still below 1 billion US dollars in most cases, and it barely rose to more than 1 billion US dollars from October.

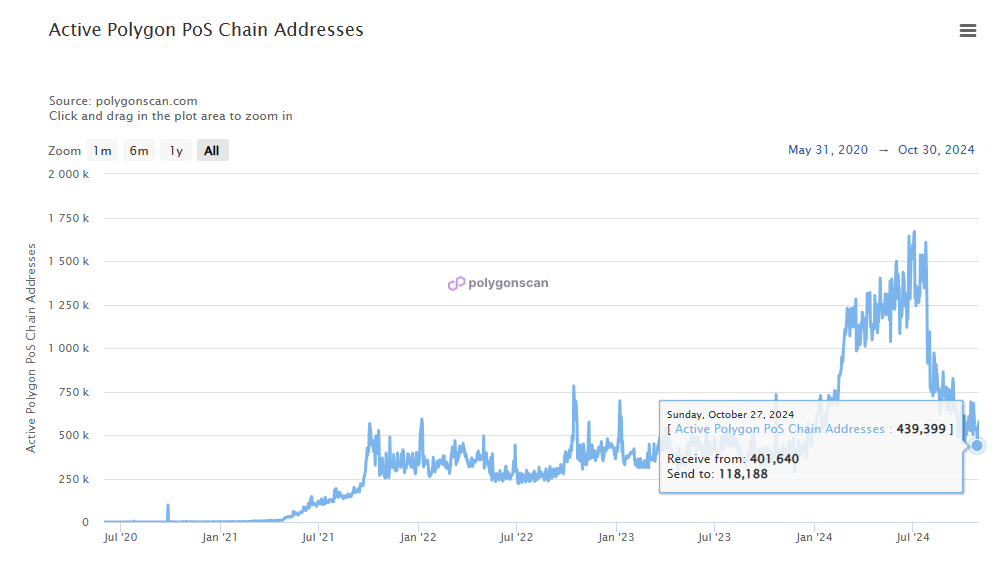

In terms of the number of active addresses, the number of active addresses of Polygon PoS on October 29 was about 439,000, which is almost the same as the data a year ago. Although the number of active addresses of Polygon PoS increased significantly from March to August this year, reaching 1.65 million at one time, it cooled down rapidly when the market was hottest for some reason.

The market performance of the token is also poor. From March to November 2024, the price of POL tokens did not follow the rise of the Bitcoin market, but fell all the way, from $1.3 at the beginning of the year to $0.28, a drop of more than 77%. It has only started to rebound in the past one or two months. The price has recently rebounded to around $0.6, but it still needs to increase by about 5 times to reach the historical high of nearly $3. In 2022, MATIC (the predecessor of POL) once ranked in the top ten in terms of market value, but now its market value has fallen outside the top 100.

Technological innovation + brand upgrade is not as good as "giving money"

Despite the weak development of the ecosystem, Polygon has not given up on technology and products, and has repeatedly released information on technology innovation and product layout in the past year. The most eye-catching performance is naturally the development of the prediction market Polymarket in the past year. In addition, in October, Polygon released a new unified blockchain ecosystem AggLayer. According to the official introduction, Agglayer = unified chain (L1, L2, L∞), but it is obvious that the positioning of this new ecosystem seems difficult to understand. In November, the official also published an article specifically explaining AggLayer.

In addition, the ZK proof system toolkit Polygon Plonky3 in the ecosystem has become the fastest zero-knowledge proof system. Vitalik also interacted on Twitter and said, "You won the game."

In addition to technology, this year many established public chains like to reshape their brands by changing their names and tokens. Polygon has already reshaped its brand, changing its name from Matic to Polygon. And in the current market environment, non-disruptive technological innovation seems to have difficulty becoming a narrative advantage for a project. This is indeed a cruel fact for projects like Polygon that are still obsessed with technological innovation or hope to reshape their brands through integration.

What can really attract users and keep them interested is often the reward distribution or incentive plan, such as the recently popular Hyperliquid. Polygon wants to reform in this regard, but it obviously has few cards to use. In terms of on-chain fees, Polygon only generates tens of thousands of dollars a day, and these revenues cannot arouse users' interest. Therefore, there is the "borrowing chickens to lay eggs" proposal mentioned at the beginning.

But obviously, the owner of the "hen" does not agree with this business, and Polygon may lose more because of it. Overall, the fundamental reason for the stagnation of Polygon's ecological development is that it lacks sufficient user incentives and new narrative driving force. Faced with intensified market competition, Polygon needs to find more attractive market strategies in addition to technological innovation. This is also the common dilemma of most old blockchains at present.

You May Also Like

GBP/USD rises as Fed rate cut odds boost Sterling

Crossmint Partners with MoneyGram for USDC Remittances in Colombia