How to Use Plasma Stablecoin Layer 2 with OnFinality RPC

The rise of stablecoins has quietly reshaped crypto. From DeFi settlements to cross-border payments, stablecoins now power a large share of onchain transaction volume. Yet most blockchains were not designed specifically for stablecoin-first use cases.

That is where Plasma comes in.

Plasma is a high-performance, EVM-compatible Layer 2 designed specifically for stablecoin payments and financial applications. With Plasma now accessible via OnFinality infrastructure, developers can build stablecoin-native applications with reliable RPC access and production-grade performance.

Table of Contents

- What Is Plasma?

- Why Plasma Matters

- Key Benefits and Use Cases of Plasma

- What People Are Building on Plasma

- How Plasma Works

- How to Access Plasma RPC on OnFinality

- Frequently Asked Questions About Plasma

- Summary

- About OnFinality

What is Plasma

Source: https://www.plasma.to/learn/is-blockchain-the-future

Source: https://www.plasma.to/learn/is-blockchain-the-future

Plasma is a stablecoin-focused Layer 2 blockchain built to optimize payment flows and financial applications.

Unlike general-purpose Layer 2s, Plasma is designed around stablecoin-native features such as:

- Zero-fee stablecoin transfers at the protocol level

- Custom gas tokens for flexible fee payments

- High throughput for payment-heavy workloads

- Full EVM compatibility

Because Plasma is EVM compatible, developers can deploy existing Ethereum smart contracts without rewriting code and continue using familiar tooling such as Hardhat, Foundry, and MetaMask.

Why Plasma Matters

Stablecoins have become the settlement layer for:

- Onchain trading

- Remittances

- Treasury management

- Consumer payments

- Fintech-style apps

However, friction still exists:

- Gas token requirements

- Network congestion

- Fee unpredictability

- Latency during peak usage

Plasma addresses this by making stablecoins the default experience rather than an afterthought. Instead of adapting payment flows to general-purpose chains, Plasma is optimized for them from the ground up.

For developers building payment infrastructure, this shift is significant.

Key Benefits and Use Cases of Plasma

Stablecoin Payments

- Merchant payments

- Global remittances

- Payroll systems

- High-volume settlement

DeFi Infrastructure

- Stablecoin liquidity hubs

- Credit markets

- Onchain FX routing

- Automated treasury systems

Consumer Apps

- Wallet-based payments

- Loyalty systems

- Subscription services

Fintech Integration

- Onchain card settlement

- Embedded finance

- Payment rails for Web3-native businesses

By focusing on stablecoin throughput and UX, Plasma reduces friction for both users and developers.

What People Are Building on Plasma

As a stablecoin-first chain, Plasma attracts builders focused on financial infrastructure:

- Stablecoin-native DeFi protocols

- Payment aggregation platforms

- Wallet solutions optimizing gas abstraction

- Treasury and payroll tools

- Cross-border settlement apps

Because Plasma is EVM compatible, projects can port over Ethereum contracts while benefiting from payment-optimized infrastructure.

How Plasma Works

Plasma combines several architectural decisions to optimize for stablecoin-heavy workloads:

1. EVM Compatibility

Smart contracts written for Ethereum can run on Plasma without modification.

2. Stablecoin-Native Design

Protocol-level design supports optimized stablecoin transfers and flexible gas handling.

3. High Throughput Execution

Plasma is built to support high transaction volume typical in payment systems.

4. Custom Gas Tokens

Developers can configure supported tokens for transaction fees, reducing friction for end users.

This architecture positions Plasma as a settlement-focused Layer 1 rather than a general experimentation chain.

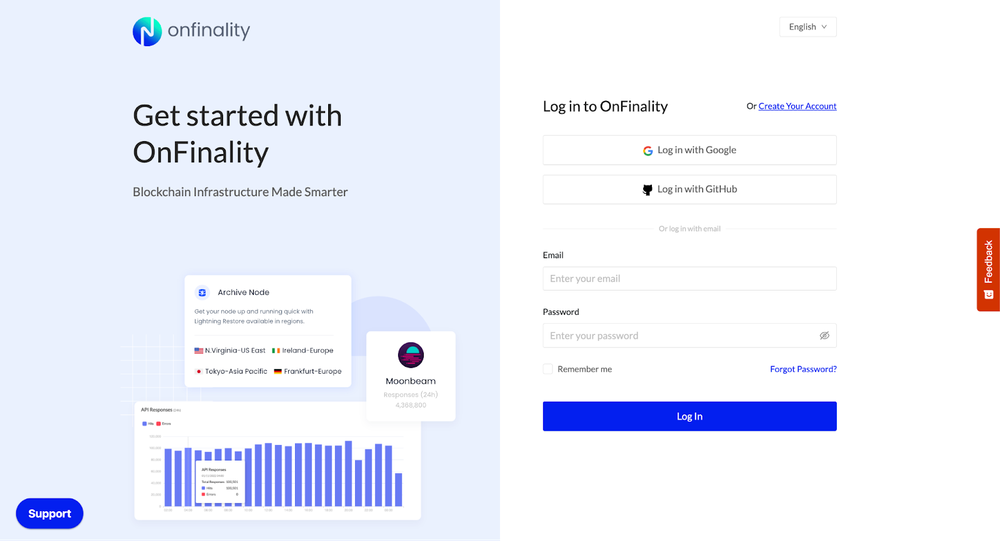

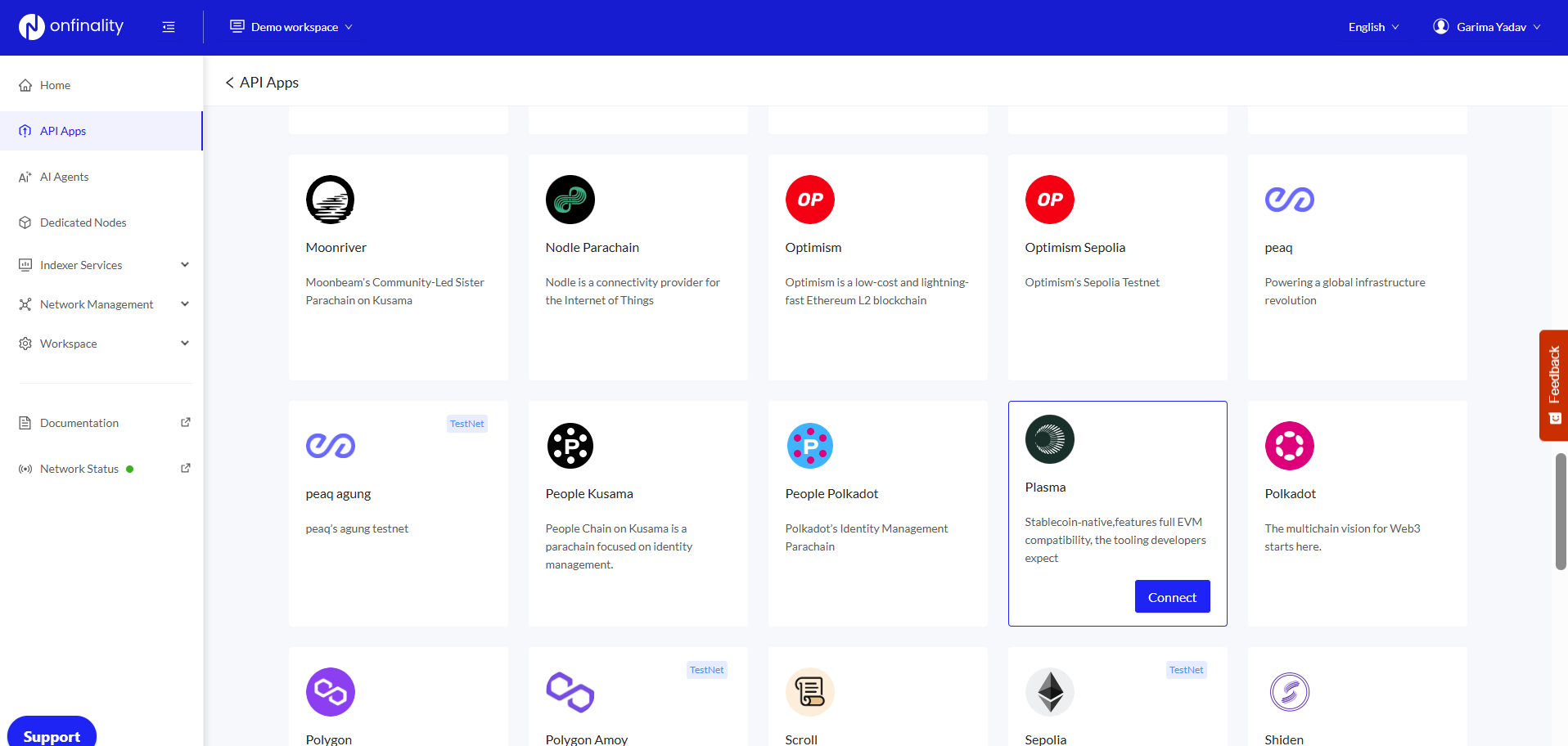

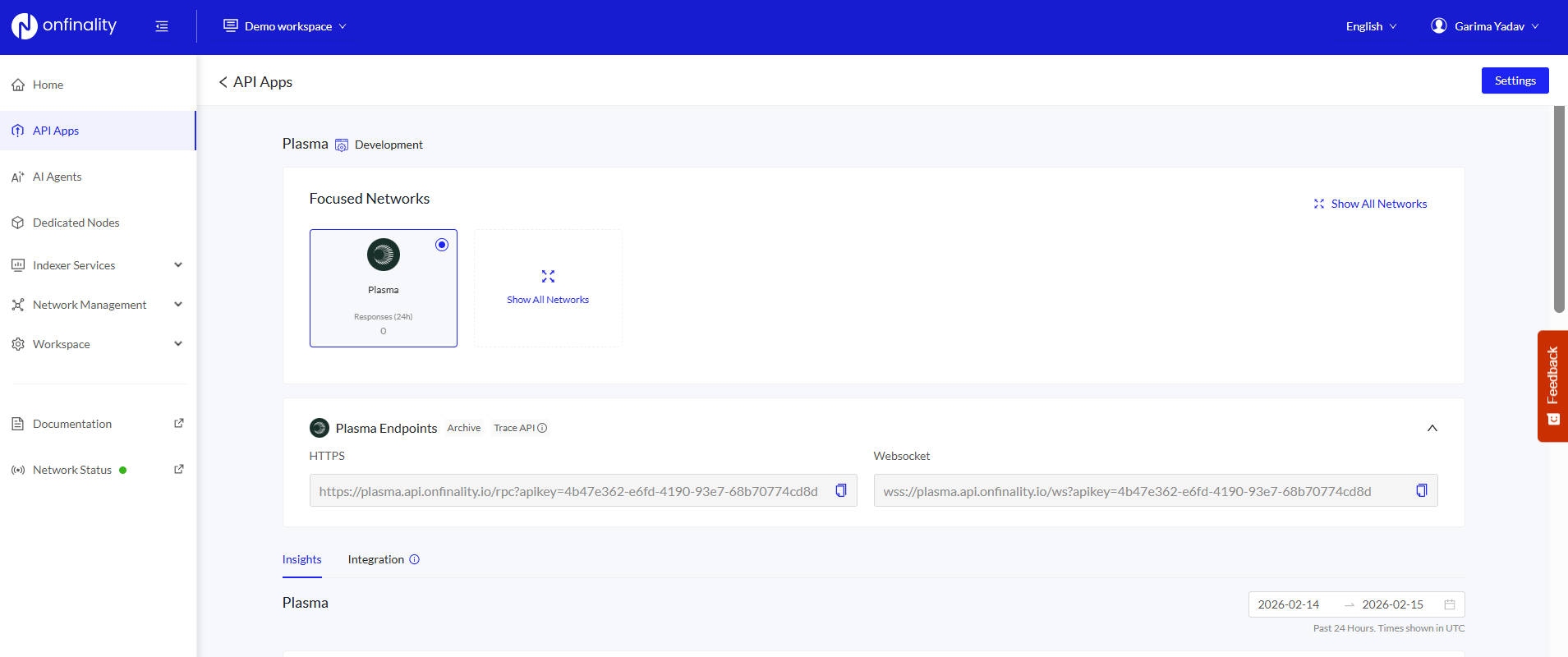

How to Access Plasma RPC on OnFinality

Developers can connect to Plasma using OnFinality’s Dashboard and RPC infrastructure.

For high-performance Plasma endpoints with SLA support and higher rate limits:

STEP 1: Log into the OnFinality Dashboard

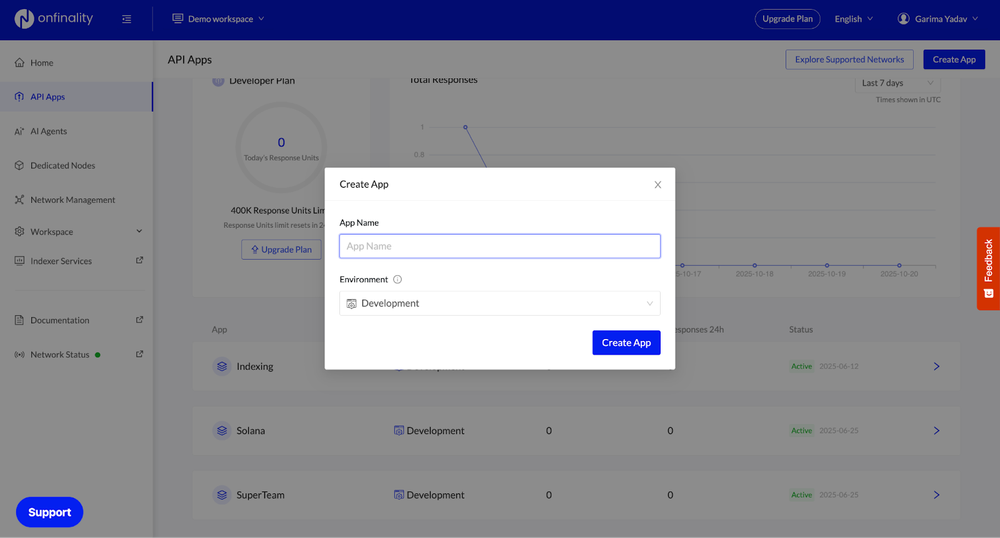

STEP 2: Create a new application

STEP 3: Select Plasma from the network list

STEP 4: Copy the Plasma HTTPS or WebSocket RPC endpoint

STEP 5: Integrate it into your web app, backend, or smart contract deployment workflow

Example: Test Plasma RPC

You can verify the RPC endpoint using the following CLI command:

curl --location 'https://plasma-mainnet.api.onfinality.io' \ --header 'content-type: application/json' \ --data '{"id":1,"jsonrpc":"2.0","method":"eth_blockNumber","params":[]}'

If the RPC is active, you will receive the latest block number in response.

Plasma Public RPC vs Dedicated RPC

OnFinality may provide public Plasma RPC endpoints for development and testing.

However, for production-grade applications, dedicated endpoints are recommended:

- Higher rate limits

- SLA-backed uptime

- Monitoring and analytics

- Reduced latency

- Enterprise-grade reliability

Stablecoin applications often require consistent performance, making reliable RPC infrastructure essential.

Frequently Asked Questions About Plasma

Is Plasma EVM compatible?

Yes, Plasma supports Ethereum Virtual Machine compatibility, allowing seamless contract deployment.

What makes Plasma different from other L2s?

Plasma is optimized specifically for stablecoin payments and financial infrastructure rather than general-purpose experimentation.

Who benefits most from Plasma?

Payment processors, fintech apps, DeFi protocols, treasury systems, and consumer apps handling large stablecoin volumes.

Can I use existing Ethereum tooling?

Yes. Most Ethereum tooling works out of the box due to EVM compatibility.

Summary

Plasma is a stablecoin-native, EVM-compatible Layer 1 built for payment-heavy blockchain applications. By focusing on stablecoin throughput, flexible gas mechanisms, and financial infrastructure, Plasma offers a streamlined experience for developers building payment systems and DeFi platforms.

With OnFinality supporting Plasma RPC infrastructure, developers gain reliable access, scalable endpoints, and production-ready performance.

Start building stablecoin-native applications today by connecting to Plasma via OnFinality.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

Strive and Semler Scientific to Merge in All-Stock Deal, Creating Bitcoin Treasury Powerhouse

Milyar Dolarları Yöneten Şirket, Onchain Verilerine Göre Bu Altcoini Topluyor Olabilir!