Solana Funds Draw $31M as Global Crypto Sees $173M in Outflows

Digital asset investment products extended their losing streak last week, yet Solana-linked funds moved against the broader tide. While global crypto products recorded $173 million in net outflows, Solana attracted $31 million in fresh capital. The divergence reflects selective investor positioning despite soft price action in $SOL. Market participants now weigh whether steady inflows can cushion a potential technical breakdown in the weeks ahead.

Regional Split Deepens as US Sees Heavy Redemptions

According to CoinShares, global crypto funds posted a fourth straight week of outflows. The four-week total now stands at $3.74 billion. The week opened with $575 million in inflows. However, sentiment reversed sharply as $853 million exited midweek amid price weakness. Consequently, total weekly flows turned negative.

Significantly, US-based products accounted for $403 million in outflows. In contrast, Europe and Canada reported net inflows. Germany led with $115 million, followed by Canada with $46.3 million. Switzerland added $36.8 million. This divergence suggests regional investors view current weakness differently.

Trading activity also slowed. Exchange-traded product volumes dropped to $27 billion from $63 billion the prior week. Moreover, weaker CPI data late in the week supported a modest $105 million rebound in flows.

Bitcoin faced the heaviest pressure, shedding $133 million in net outflows. Short Bitcoin products also recorded $15.4 million in outflows over two weeks. Historically, that pattern often appears near market bottoms. Ethereum lost $85.1 million, while Hyperliquid saw minor redemptions.

Solana Shows Resilience Despite Price Pressure

Besides Bitcoin and Ethereum weakness, selective altcoins drew demand. XRP led with $33.4 million in inflows. Solana followed closely with $31 million. Chainlink added $1.1 million. This rotation signals targeted accumulation rather than broad risk appetite.

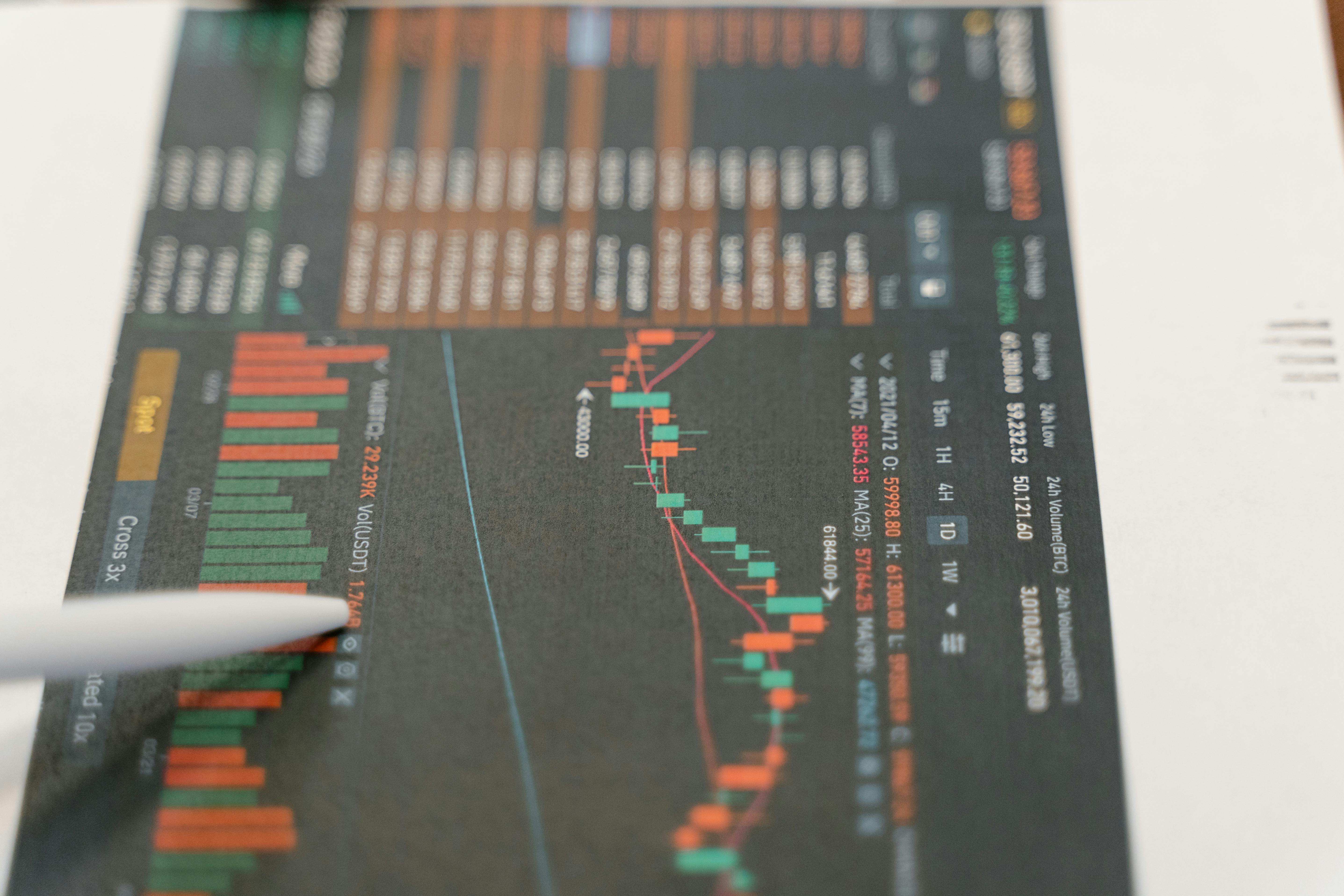

However, Solana’s price remains under pressure. SOL trades at $84.17 after a 3.63% daily decline. The token holds a $47.86 billion market capitalization with strong liquidity.

Umair Crypto noted that SOL remains trapped between $77 and $90. The range has held for 11 days. Both liquidity zones have been swept, which confirms balance. Price now trades below the range’s point of control. Hence, short-term pressure tilts slightly downward.

Range Holds, But Downside Risk Persists

Additionally, Umair Crypto suggested a rotation toward $81 or $82 remains possible. A marginal push toward $93 could occur if highs break again. However, $90 must flip into firm support to confirm strength. Without that shift, upside moves likely represent deviations.

Primary expectations favor continued consolidation. Moreover, if the range eventually breaks lower, analysts see $57 as a broader downside target. Until that expansion occurs, traders view SOL as range-bound rather than trending.

You May Also Like

Why Some XRP Users Are Calling for a Binance Boycott

Stunning $500K Forecast By 2030 From Ric Edelman