BlackRock Acquires Bitmine Stake: A Stronger Institutional Crypto Push

BlackRock has acquired a stake in Bitmine, a move that aligns with its more recent tokenisation strategy and infrastructure investments. The asset management giant BlackRock has significantly expanded its exposure to Ethereum infrastructure, increasing its holdings in crypto mining and staking firm Bitmine by 165.5% during the fourth quarter of 2025.

This move supports CEO Larry Fink’s ongoing belief that real-world asset tokenisation (RWAs) will shape the future of global financial markets.

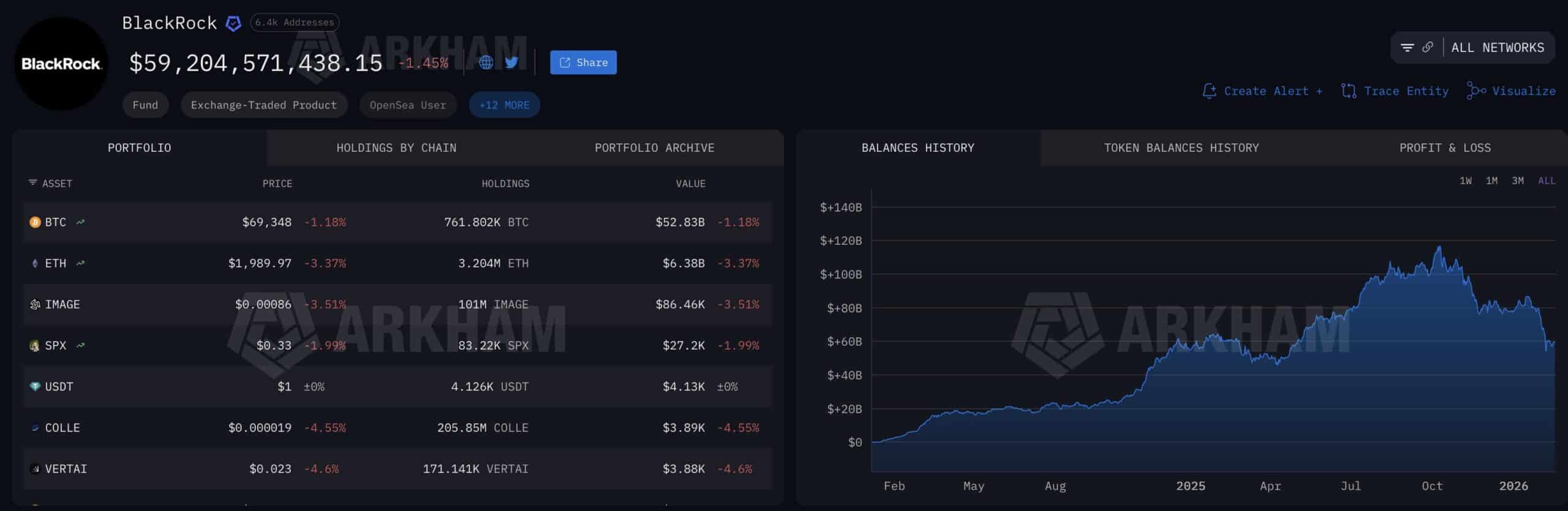

This acquisition deepens BlackRock’s institutional footprint in the crypto sector beyond its initial exchange-traded fund products. As of February 2026, the firm holds approximately $60 billion in crypto exposure, and now pivoting from pure asset holding to owning critical infrastructure layers.

BlackRock Holdings Source: Arkham

The shift comes despite periods of market volatility, during which analysts like Fundstrat’s Tom Lee defended Bitmine as a vital proxy for Ethereum’s long-term utility.

By targeting Bitmine, BlackRock appears to be betting on the operational layer of the ETH $1 968 24h volatility: 1.8% Market cap: $237.40 B Vol. 24h: $22.71 B network rather than solely the asset price.

DISCOVER: Best Solana Meme Coins By Market Cap 2026

BlackRock Acquires Bitmine Stake: Tokenization Strategy Drives Infrastructure Bets

The substantial increase in equity holdings signals a strategic alignment with BlackRock’s broader thesis on tokenization. CEO Larry Fink has frequently cited Ethereum as a primary ledger for this transition, and Bitmine, which pivoted substantially toward Ethereum staking and validator services, offers regulated exposure to yield-generating activities that traditional ETFs lack.

At the World Economic Forum in Davos, Fink said:

This aggressive accumulation mirrors wider institutional trends where smart money is securing positions in blockchain infrastructure. Cathie Wood’s ARK Invest recently scooped up BMNR shares, positioning various funds to capture value from blockchain validation revenue.

Unlike BlackRock’s previous commitment to pure-play Bitcoin miners like Marathon Digital, the Bitmine stake specifically targets the programmable finance layer. The move validates the narrative that, as Vitalik Buterin has noted regarding infrastructure, the value of blockchain networks is increasingly defined by their utility in automated and AI-driven financial systems.

EXPLORE: What is the Next Crypto to Explode in 2026?

Institutional Divergence in Crypto Assets: Bitcoin And Ethereum Are Serving Different Purposes

BlackRock’s maneuver suggests a growing decoupling of institutional strategies, where BTC $67 755 24h volatility: 1.7% Market cap: $1.35 T Vol. 24h: $37.29 B is treated as a reserve asset while Ethereum-linked equities are viewed as technology plays. This distinction is crucial as the ecosystem’s governance evolves, evidenced by recent shifts such as Tomasz Stanczak stepping down from the Ethereum Foundation.

As traditional finance seeks to integrate blockchain rails, reliable infrastructure providers like Bitmine are becoming critical acquisition targets for asset managers looking to control the “plumbing” of the next-generation financial system.

DISCOVER: 10 New Upcoming Binance Listings to Watch in February 2026

nextThe post BlackRock Acquires Bitmine Stake: A Stronger Institutional Crypto Push appeared first on Coinspeaker.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Unlocking Institutional OTC Trading For Tokenized Gold