Best Altcoins to Avoid in 2026 – The “Slow Rug” Cycle Is Real

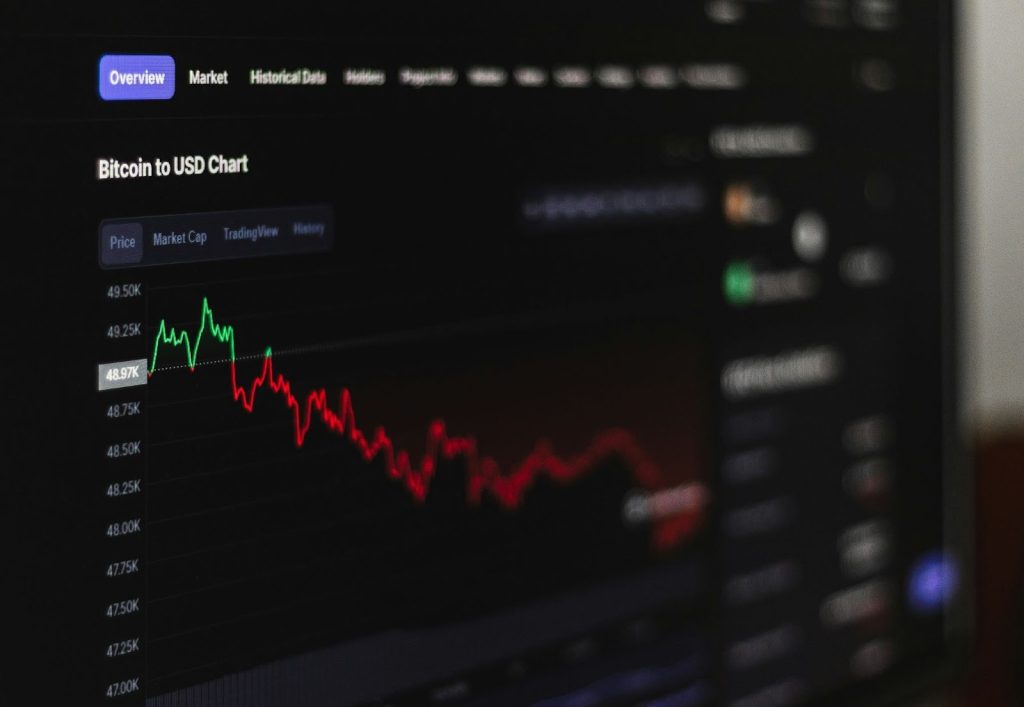

Crypto doesn’t always collapse in one dramatic headline. Sometimes the damage happens slowly. A project launches with huge hype, strong funding, and big promises, then over time it simply fades.

Development slows down, users move on, liquidity dries up, and the token keeps bleeding lower. That’s what many traders now call the “slow rug” cycle.

A tweet from Erequendi sparked debate this week by listing dozens of once-popular altcoins that, in his view, have been left behind. The bigger point wasn’t just about specific names.

It was about how common this pattern has become across the market, especially after every bull run creates far more projects than the space can actually sustain. Going into 2026, this is one of the biggest risks in altcoins.

Read Also: $2.5 Trillion Wiped in 30 Minutes: Why Gold and Silver Prices Suddenly Dipped Again

The Altcoin Market Has a Graveyard Problem

Every cycle produces new winners, but it also leaves behind a long graveyard of projects that never recover.

Many altcoins look unstoppable during the bull market. They trend everywhere, get listed quickly, and pull in retail money fast. But once the cycle cools off, most of them struggle to keep real users or real demand.

Some don’t crash instantly. They just slowly lose relevance. That’s what makes the slow rug so dangerous. There’s no single collapse moment. The token just drifts lower month after month as interest disappears.

However, this matters even more because altcoin performance comes in waves. The CMC Altcoin Season Index is one way to track that rotation. If 75% of the top 100 coins outperform Bitcoin over the last 90 days, the market is officially in Altcoin Season.

Stablecoins like USDT and DAI aren’t included, and asset-backed tokens such as WBTC, stETH, and cLINK are also excluded.

The index is useful because it shows when capital is flowing into alts broadly, but it also highlights the harsh truth: most altcoins don’t outperform for long, and many never return to their old highs.

Read Also: Top UK Bank Cuts 2026 Bitcoin and XRP Price Targets, Sees Tougher Path Ahead

The “Slow Rug” Isn’t Always a Scam

Not every struggling project is fraud. In many cases, the teams are real and the tech works.

The issue is that crypto moves fast, narratives rotate quickly, and infrastructure alone doesn’t guarantee long-term token demand.

Some projects fail because the token has no clear value capture. Others fade because competitors simply move faster. The end result looks the same: lower activity, weaker liquidity, and a token that keeps sliding.

Examples of the Slow Rug Setup in Real Time

This pattern has played out across multiple parts of the market.

For example, Layer 2 ecosystems like Starknet and zkSync have shipped serious technology, but their tokens have still faced heavy pressure because holders often don’t see direct value accrual. The network may grow, yet the token struggles to benefit.

Older cycle giants like Algorand, EOS, and Tezos show another side of the problem. These were once major names, but over time developer attention and liquidity rotated elsewhere, leaving prices far below their peaks.

Even newer Layer 1s such as Aptos and NEAR continue dealing with the same challenge: strong infrastructure is not enough if adoption, incentives, and demand don’t line up in a sustainable way.

Then there are extreme cases like Luna, which became a reminder that once trust breaks in crypto, recovery becomes nearly impossible.

The takeaway isn’t that every struggling token is doomed. It’s that hype fades quickly, and without clear utility or lasting demand, even well-known projects can enter the slow rug cycle.

Read Also: How High Could Kaspa (KAS) Price Climb by 2030?

Red Flags to Watch in 2026

The slow rug cycle usually leaves clues.

Projects become risky when the activity of the project keeps declining, the pace of development slows down, token unlocks remain in the form of tokens, and governance fails to provide actual value to the holders.

If the entire ecosystem is dependent on emissions, short-term farming, or narrative hype, the negative side of it may last for years.

The year 2026 will see attention shift even faster than the previous cycles. Projects that stall for too long can get left behind permanently.

Does Crypto Really Need This Many Altcoins?

That’s the uncomfortable question raised in the tweet.

Crypto probably doesn’t need hundreds of nearly identical chains, rollups, and tokens all fighting for the same users. Most won’t survive long-term.

The next altcoin season will still create massive winners, but it will also expose how many projects were built for hype instead of staying power.

The slow rug cycle is one of the most common ways people lose money in crypto. Not through one-day collapses, but through years of holding tokens that never regain attention.

Altcoin season will come again, but 2026 will also be a sorting phase. The projects that keep shipping, keep users, and build real demand will stand out. The rest will fade quietly into the background, like so many cycles before.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Best Altcoins to Avoid in 2026 – The “Slow Rug” Cycle Is Real appeared first on CaptainAltcoin.

You May Also Like

We should be prepared for “short-term disruptions” in the labor market from AI

ZKP’s Presale Stage 2 Countdown Begins: Smart Buyers Rush Before Supply Cuts While Monero & Cardano Face Market Shifts