Ripple CEO Rejects XRP Panic As Market Slumps And Utility Case Expands

TL;DR

- XRP fell despite Ripple reporting strong 2025 performance and expanding institutional demand.

-

XRP gained over 17% against ETH this year as Ethereum dropped faster in the downturn.

-

Ripple spent about $3B on acquisitions since 2023 to expand treasury and liquidity services.

-

XRP needs a 173% rise to reach $3.83 to match Ethereum’s current market valuation.

XRP continues to trade lower as the broader market faces heavy selling, yet Ripple maintains its long-term strategy remains on track. Ripple CEO Brad Garlinghouse said price swings should not distract from the company’s progress. He noted that regulatory delays earlier in the year added pressure across major assets.

Garlinghouse said the firm entered 2026 from a strong position after what he described as a positive 2025. He also said that short-term market stress will not change how Ripple builds its payment and liquidity products.

He added that the lack of regulatory clarity “did not help” after efforts stalled in late January. Still, he said the company sees growing interest from institutions that want faster settlement systems and better liquidity access.

XRP Performance and Its Position Against Ethereum

XRP has dropped more than 20% recently, yet it remains one of the assets showing relative strength against peers. Data shows XRP is down 24% this year, while Ethereum has fallen 35% during the same period. XRP has also gained more than 17% against Ethereum since January.

The asset’s market cap stands at $85.8 billion. Ethereum holds $233 billion in market cap. To match Ethereum’s valuation, XRP would need to rise 173% to reach $3.83 per token based on current supply and pricing.

The XRP-to-ETH ratio has moved from 0.0006199 ETH to 0.0007280 ETH this year. Market analysts say this shift shows traders are rotating into assets that have held support levels better during the downturn.

Garlinghouse said,

Ripple Expands Its Business Through Acquisitions

Ripple has spent about $3 billion on acquisitions since 2023. These deals pushed the company deeper into custody services, treasury management and prime brokerage. One of the company’s major purchases became Ripple Treasury, which processed $13 trillion in payments in 2025.

None of those flows used crypto rails, and Ripple sees that as a large opening for future use cases. Garlinghouse said more than 1,000 corporate clients use the system today. He said many now ask how blockchain can release capital held in foreign accounts.

Ripple said its long-term plan is to connect traditional finance rails with blockchain-based tools. Garlinghouse explained that the firm continues to build “bridges” between these two areas.

Analysts and Traders Share Bullish Long-Term Views as XRP Forms New Levels

Despite recent declines, some market watchers remain optimistic. CryptoBull, a well-known trader, said he tends to become more confident when XRP forms new lows. He said he was quiet at the peak near $3.65 months ago, yet he stayed bullish when the price traded around $0.11 in earlier cycles. He said he expects the coming months to bring strong moves.

Source: X

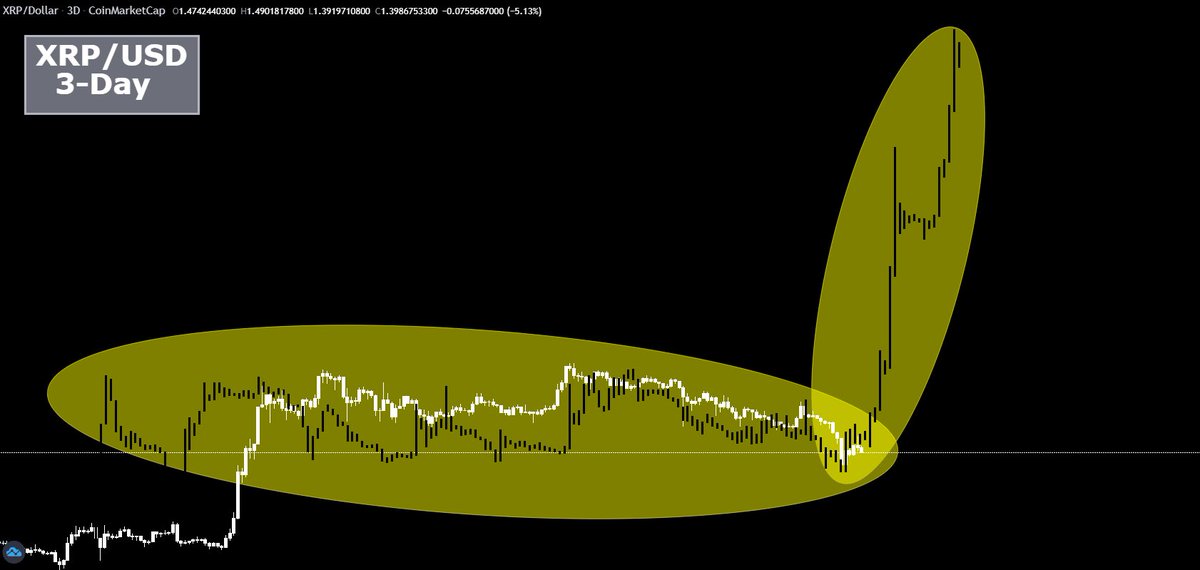

He also said the current structure resembles a 2017 fractal on the three-day chart. He suggested the pattern points to possible levels near $4 on March 2 and near $9 on March 11. These projections remain speculative and depend on market liquidity, yet they show the strong interest within the XRP community.

XRP traders have also pointed to the asset’s rising strength against Ethereum. They see this as another area that may support future interest when the market begins to stabilize.

The post Ripple CEO Rejects XRP Panic As Market Slumps And Utility Case Expands appeared first on CoinCentral.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

SEC approves generic listing standards, paving way for rapid crypto ETF launches