Tom Lee’s Bitmine Buys 10,000 ETH Worth $19.49M From Kraken

Highlights:

- Tom Lee’s BitMine has expanded its Ethereum holdings with fresh investments worth $19.49 million for 10,000 tokens.

- The company has purchased 45,000 ETH within a 2-day interval, underscoring strong faith in ETH.

- Tom Lee said BitMine will continue buying Ethereum amid the token’s persistent price dip.

BitMine Immersion Technologies has yet again completed another massive Ethereum (ETH) purchase. Lookonchain, a leading cryptocurrency transaction tracker, reported the latest acquisition in a recent tweet, dated February 20, 2025. According to the X post, BitMine bought an additional 10,000 ETH worth roughly $19.49 million from Kraken, a United States-based exchange.

This purchase comes a few hours after the company had acquired 15,000 ETH, valued at approximately $29.57 million from Falcon X. On February 18, BitMine purchased another 20,000 ETH for $39.8 million from BitGo. Overall, the investment firm spent $88.86 million, accumulating 45,000 ETH within 48 hours.

Tom Lee’s BitMine Intensifies Purchase Amid Ethereum’s Price Dip

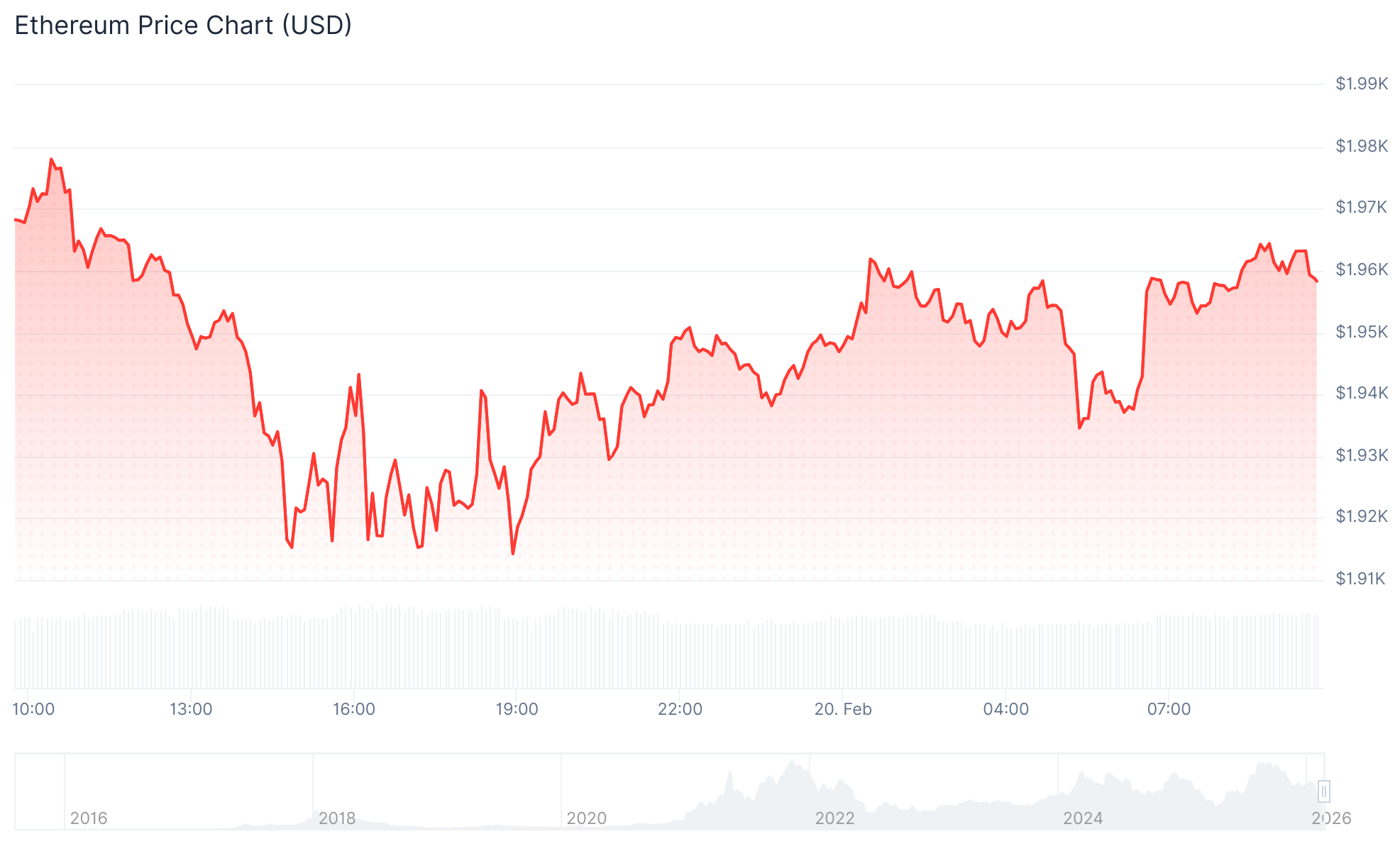

At the time of writing, the crypto market has spiked 0.2% over the past 24 hours, with trading volume of about $86.45 billion and a market capitalization of roughly $2.382 trillion. Bitcoin’s dominance has increased slightly to about 56.5%, while ETH’s dominance dropped to 9.84%. On its part, ETH has declined by 1.4% in the past 24 hours. It is changing hands at roughly $1,958, with a market cap of $234.2 billion and a trading volume of $17.44 billion. Over the past week, month, and year, ETH has dropped by 0.2%, 32.8%, and 29.3%, respectively.

Ethereum Price Chart: CoinGecko

Ethereum Price Chart: CoinGecko

Coincodex’s data shows that supply inflation is low at 0.16%, with a very high volatility at 17.5%. Ethereum’s “Fear & Greed Index” sits at extreme fear while bearish sentiment persists. Despite its poor market outlook, Ethereum has outperformed Bitcoin. However, 93% of the top-ranking cryptocurrencies have outperformed Ethereum. Meanwhile, Ethereum is trading below its 200-day Simple Moving Average (SMA) with only 13 green days in the past 30 days.

BitMine Now Holds More than 3% of ETH Supply

On February 17, BitMine released a publication disclosing its assets, led by a massive Ethereum treasury. According to the press release, the company currently holds crypto, cash, and other strategic investments worth around $9.6 billion. A large part of this valuation comes from cryptocurrencies, such as Ethereum and Bitcoin (BTC).

BitMine owns over 4 million ETH and 193 BTC. Out of the company’s total ETH holdings, 3,040,483 ETH, worth about $6.1 billion at current prices, are staked. Meanwhile, annualized staking revenue is $176 million, while estimated annual staking revenue at full scale is approximately $252 million.

A significant portion of BitMine’s valuation is in the form of cash, while the remaining is concentrated in minority stakes. For example, BitMine holds stakes worth $200 million and $17 million from Beast Industries and Eightco Holdings, respectively. Moreover, BitMine now controls approximately 3.62% of Ethereum’s total supply.

The company remains committed to meeting its public goal called “Alchemy of 5%.” This goal entails owning 5% of all ETH in circulation. BitMine has already reached over 72% of the set target within seven months. Notably, the company purchased 45,759 ETH in the week that started on February 9, 2025.

Tom Lee Highlights Why BitMine is Focused on Ethereum

BitMine Chairman Tom Lee said BitMine will continue to buy Ethereum amid the asset’s unstable price movements. He believes the current market mood is weak and similar to past market cycles. However, Ethereum has all it takes to become a sustainable store of value in the long term.

During his keynote speech at Consensus Hong Kong, the chairman highlighted three trends as factors driving long-term confidence in Ethereum. The first was Wall Street tokenization and privacy solutions. The second factor was Artificial Intelligence (AI) systems using Ethereum for payments and verification. Finally, creators who are adopting proof-of-human systems on Ethereum Layer 2 networks are also driving long-term confidence in the asset.

The BitMine Chairman added:

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Supreme Court Strikes Down Most of Donald Trump Tariffs

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC