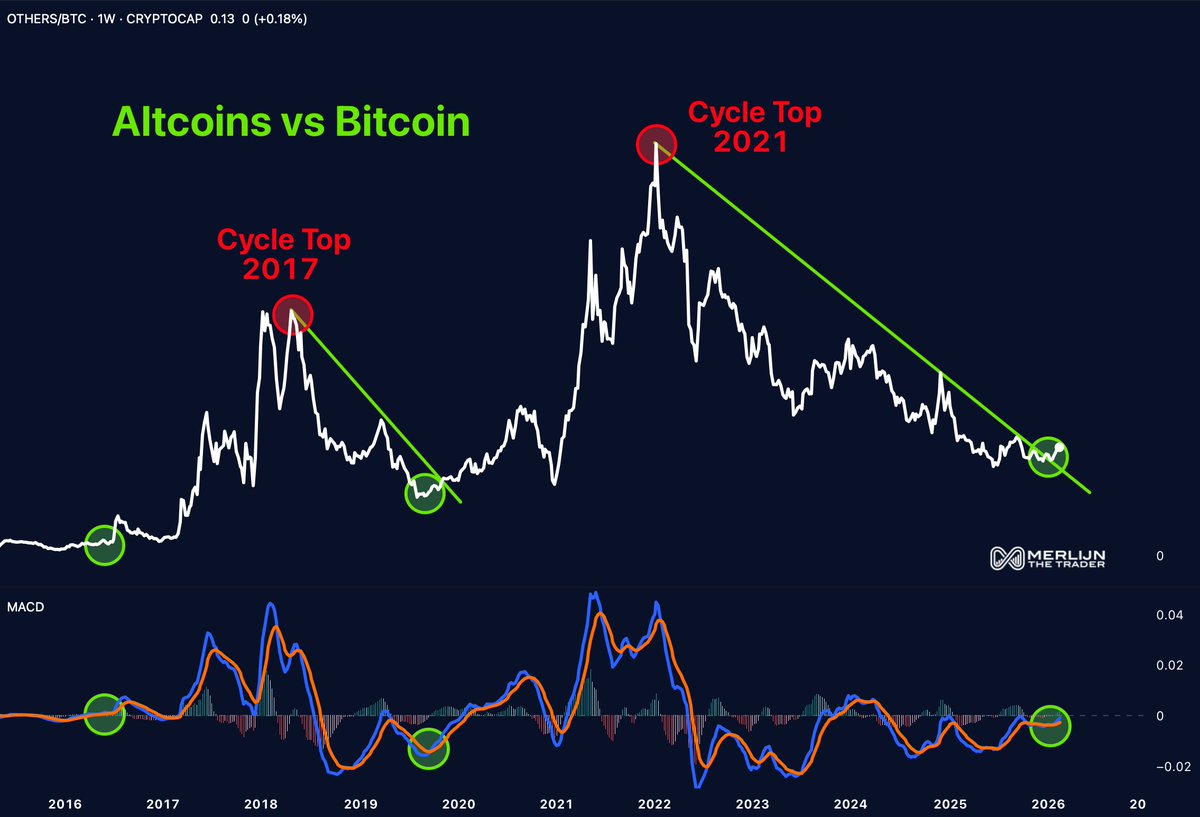

Altcoins vs Bitcoin: Is a Rotation Already Starting?

The ALT/BTC ratio, which measures altcoin performance relative to Bitcoin, has spent the past several years in a persistent downtrend.

Recently, however, the structure has shifted from clear decline to consolidation. Market observers are now watching closely for signs that capital rotation may be beginning.

According to a recent tweet from Merlijn The Trader, the long-term downtrend in ALT/BTC may be transitioning into an early breakout phase. While the broader structure has not fully reversed, the recent consolidation suggests that selling pressure could be stabilizing.

Source: https://x.com/MerlijnTrader/status/2024906900152680618

Source: https://x.com/MerlijnTrader/status/2024906900152680618

Not a Broad Altcoin Rally

Merlijn emphasizes that this environment is unlikely to resemble previous “everything pumps” alt seasons. Instead of indiscriminate rallies, capital may rotate selectively into specific segments of the market.

He highlights three key areas that could attract flows:

- Utility-driven projects

- Deep liquidity assets

- Long-term survivors

In more mature markets, fundamentals and sustainability tend to matter more than hype cycles.

Selective Rotation, Not Speculation

The implication is clear: choosing the wrong assets in this phase could result in prolonged underperformance, or what traders often call “dead money.” On the other hand, identifying projects with real adoption, strong liquidity, and resilience through prior cycles could lead to relative outperformance against Bitcoin.

The shift, if confirmed, would mark a structural change in how altcoin rallies develop. Rather than broad speculative spikes, the next phase may reward disciplined positioning and long-term viability over short-term narratives.

For now, the ALT/BTC chart suggests that something may be building, but confirmation will depend on whether consolidation evolves into a sustained breakout.

The post Altcoins vs Bitcoin: Is a Rotation Already Starting? appeared first on ETHNews.

You May Also Like

the “ambient gambling” shift coming to brokerage accounts

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”