Meme Coin Market Climbs 23.9% Since Early July, Adding $14 Billion

Over the past few weeks, cryptocurrencies have experienced significant fluctuations, yet the meme coin sector has grown considerably, climbing by $14.15 billion over the last 51 days.

Meme Coins Still Carving Out a Slice of Crypto

The five largest meme coins by market value are topped by dogecoin (DOGE) at $33.26 billion, with shiba inu ( SHIB) next at $7.35 billion. Pepe (PEPE) sits in third at $4.20 billion, trailed by pudgy penguins (PENGU) at $1.87 billion and official trump (TRUMP) at $1.69 billion. Together, those five meme coins represent $48.40 billion, making up 66.31% of the $73.02 billion meme coin market.

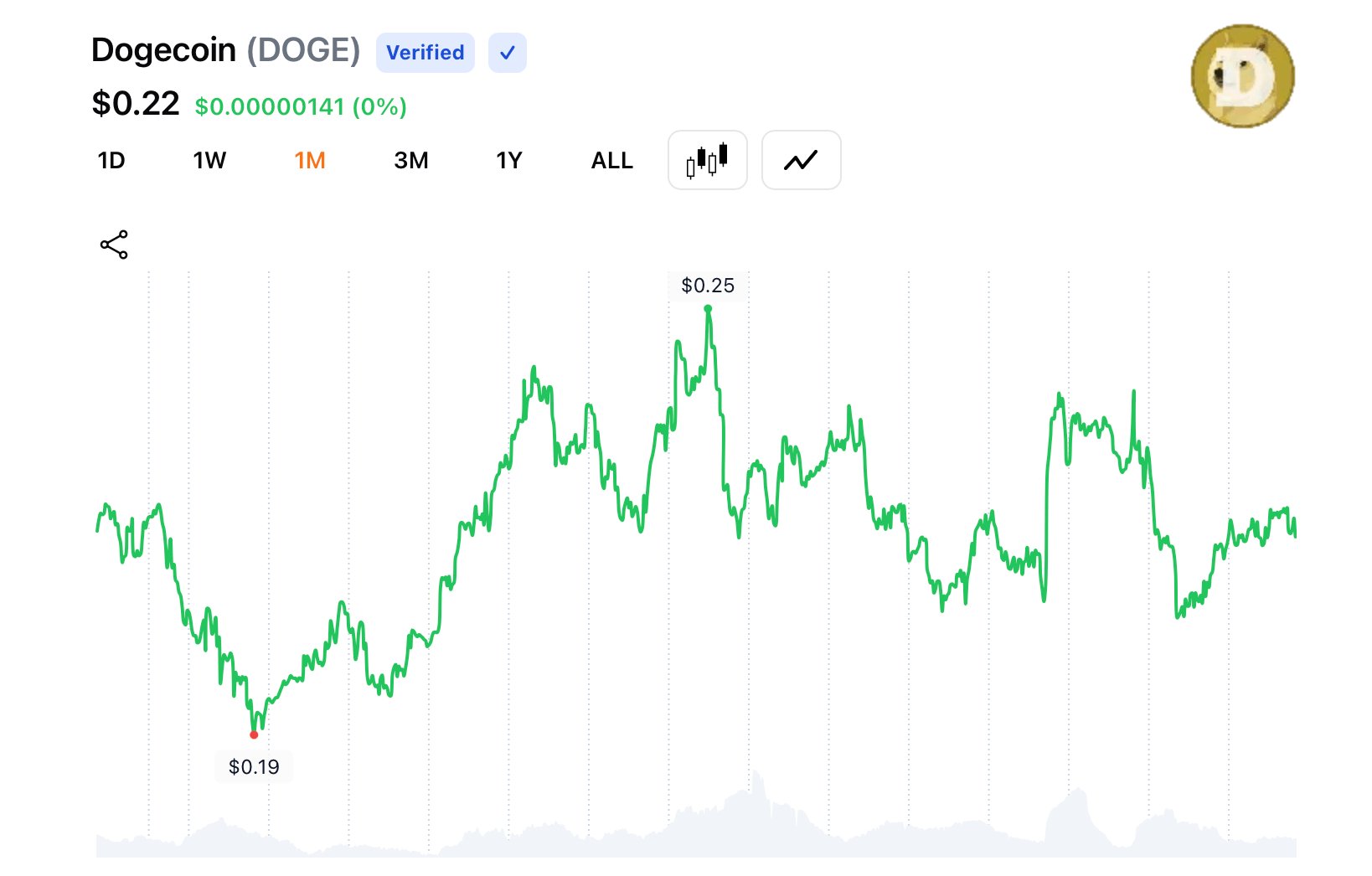

Dogecoin (DOGE) 30-day view on Aug. 28, 2025.

Dogecoin (DOGE) 30-day view on Aug. 28, 2025.

This week proved uneven for many meme tokens, with DOGE edging up 1.4% and SHIB adding 0.8%. In contrast, a wave of lesser-known coins posted double-digit jumps, including WOLF, USDUC, AGENTFUN, and LAUNCHCOIN, which gained between 67.1% and 123%. Corgiai (CORGIAI) also climbed 49% over the week.

SLERF gained 15.4%, MEME rose 13.3%, and BOME advanced 11.7%. Since July 8, meme coins have added $14.15 billion in value, climbing 23.96% against the U.S. dollar. Today, DOGE dominated daily trading with more than $2.12 billion in volume, far surpassing its peers out of the $6.2 billion aggregate.

PEPE followed DOGE with $487.2 million, while TRUMP and PENGU recorded $296.2 million and $275.8 million. WIF and PUMP each topped $214 million in turnover, with BONK and SHIB close behind at $207.7 million and $199.4 million. Further down the ranks, FARTCOIN posted $179 million, and PNUT closed the list with $92.7 million in daily trades.

The climb over the past 51 days shows how meme tokens continue to attract sizable liquidity, with both established leaders and newer entrants pulling in heavy daily trading. This steady demand reflects strong investor interest, though the sector accounts for just 1.887% of the $3.87 trillion crypto market.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud