The Week Ahead: Bitcoin Investors Eye Jobs Report for Rate Cut Signals

TLDR

- Bitcoin closed August with a 6.47% loss despite hitting a record high of $124,545.60 during the month

- Key economic data this week includes Thursday’s jobless claims and Friday’s August jobs report, which could influence Fed rate cut decisions

- A weaker jobs report might actually benefit Bitcoin by increasing expectations for Fed rate cuts and looser monetary policy

- Broadcom reports earnings Thursday following record AI semiconductor revenue, while Salesforce reports Wednesday with focus on AI initiatives

- September is historically Bitcoin’s weakest seasonal month, with experts recommending caution despite potential Fed policy shifts

Bitcoin traders are watching closely this week as critical economic data could determine the Federal Reserve’s next move on interest rates. The cryptocurrency ended August down 6.47% despite reaching an all-time high of $124,545.60 earlier in the month.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The Fed faces a difficult balance between controlling inflation and supporting employment. Chair Jerome Powell has indicated that labor market weakness could justify rate cuts at September’s meeting.

Thursday brings initial jobless claims data, with economists expecting 230,000 new unemployment benefit applications. This matches the previous week’s 229,000 figure.

Any reading above the forecast would signal further labor market softening. Such weakness could pressure the Fed toward cutting interest rates.

The same day delivers the final revision of U.S. productivity and unit labor costs for the second quarter. Preliminary data showed productivity growth of 2.4% quarter-over-quarter.

Unit labor costs came in at 1.6%, down sharply from the first quarter’s 6.9% reading. Revisions to these numbers could affect inflation expectations.

Jobs Report Could Determine Bitcoin Direction

Friday’s unemployment rate and nonfarm payrolls report represents the week’s most important event. Forecasts predict unemployment rising to 4.3% from July’s 4.2%.

Source: Forex Factory

Source: Forex Factory

Economists expect 75,000 new jobs, up slightly from July’s 73,000. Wage growth is projected at 0.3% month-over-month.

Xu Han from HashKey Capital expects weaker numbers than the consensus. He forecasts payrolls between 40,000 and 60,000 jobs, with unemployment likely reaching 4.3%.

Multiple rate cuts could benefit Bitcoin by increasing market liquidity. Lower interest rates typically make risk assets more attractive to investors.

Technology Earnings Add Market Complexity

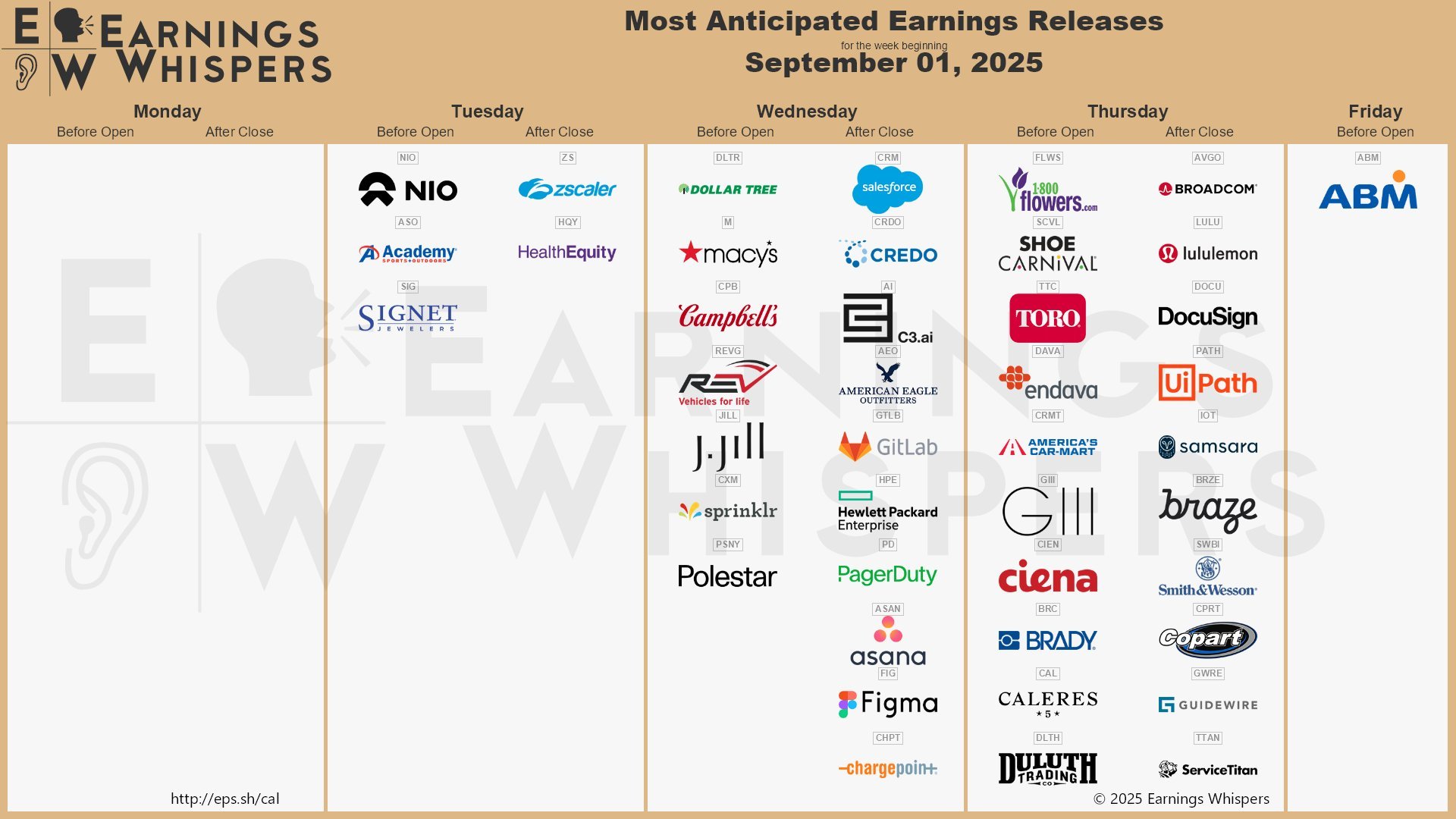

Corporate earnings will compete for attention with economic data this week. Broadcom reports Thursday after posting record quarterly revenue from AI semiconductor sales.

Source: Earnings Whispers

Source: Earnings Whispers

The chipmaker’s results will show whether artificial intelligence demand continues supporting the semiconductor sector. Broadcom follows Nvidia’s recent earnings, which highlighted ongoing AI chip demand.

Salesforce reports Wednesday with focus on its artificial intelligence strategy. The cloud software company has been integrating AI capabilities across its customer management platform.

Recent acquisitions have strengthened Salesforce’s AI offerings. The earnings will reveal whether enterprise customers are adopting these new tools.

Bitcoin currently trades at $107,500 according to CoinGecko data. The cryptocurrency faces headwinds from September’s historically weak seasonal performance.

Experts recommend focusing on medium-term holder cost basis levels given Bitcoin’s fragile trading position. The combination of economic uncertainty and seasonal weakness creates a challenging environment for the cryptocurrency.

The post The Week Ahead: Bitcoin Investors Eye Jobs Report for Rate Cut Signals appeared first on CoinCentral.

You May Also Like

Gold continues to hit new highs. How to invest in gold in the crypto market?

DOGE ETF News & Could Layer Brett See an ETF Approval in Years to come?