Bitcoin’s September Curse Meets Gold’s Glittering Breakout

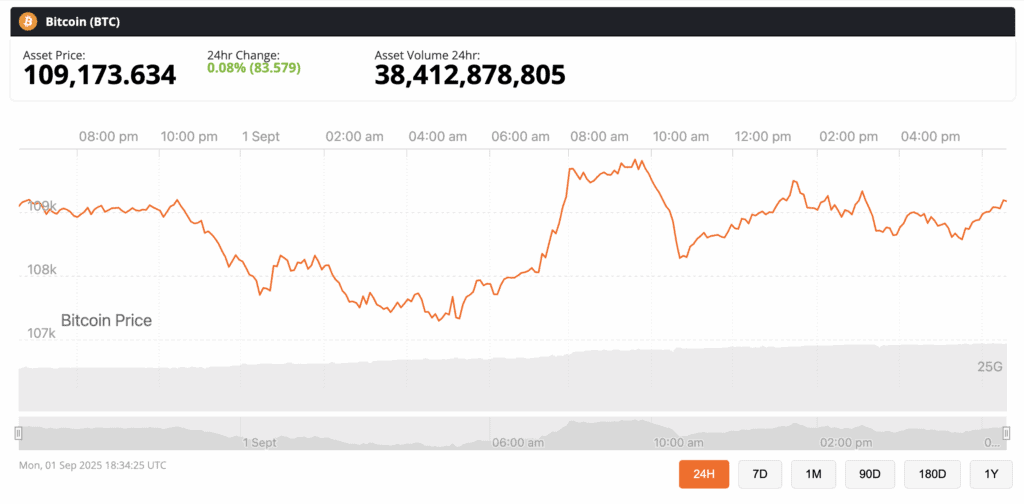

Bitcoin entered September limping, dipping to $107,270 before bouncing near $110,000. That’s classic low-liquidity holiday chop, but the bigger story is statistical: over the past 12 years, Bitcoin’s average September return sits at -3.5%. Even in bull markets, September tends to be a wet blanket.

And this year’s setup doesn’t inspire much confidence. ETF flows have flipped red again, with August chalking up $750 million in outflows — the second-worst month on record. Institutional buying, once the darling of the 2024–2025 bull run, has slowed to its weakest pace since April. Traders are now openly debating whether Bitcoin needs to retest $100,000 support, with some even eyeing a liquidity sweep down to $94,000.

Bitcoin remains uncertain at $1, source: BNC

If there’s a psychological level in markets right now, it’s six figures — and if that cracks, sentiment will take a hit.

Bitcoin seasonality suggests September could be a red month

Gold: “Boomer Rock” in Breakout Mode

While Bitcoin sulks, gold is staging another charge. Spot gold hit $3,489/oz this week, putting it within inches of April’s all-time high. The yellow metal has history on its side: September is gold’s second-strongest month of the year across the past half-century. Inflation jitters, Fed uncertainty, and trade war noise are providing the perfect tailwind.

Peter Schiff — Bitcoin’s eternal nemesis — couldn’t resist a jab, declaring that gold’s breakout is “very bearish for Bitcoin.” Schiff may be biased, but the data doesn’t lie: gold is rising at the exact moment Bitcoin is stumbling. If the digital gold narrative were airtight, BTC should be tracking higher alongside bullion. Instead, the correlation is breaking down.

Macro Crosswinds: Fed Cuts vs. Trade Chaos

The macro backdrop adds spice. The U.S. is tangled in tariff confusion after a federal appeals court challenged Trump’s trade moves, while the Fed looms with a September 17 meeting that markets expect will deliver the first rate cut of the cycle. Liquidity should, in theory, help Bitcoin — but if investors are spooked and capital is rotating into gold, crypto may miss the initial bid.

Remember: gold benefits from rate cuts because it yields nothing. Bitcoin should benefit for the same reason, but ETF outflows suggest that “should” is doing a lot of heavy lifting here.

Breaking the Pattern?

Here’s the contrarian take: seasonality is real but not destiny. Yes, Bitcoin has been red in September more often than not. But every time the market insists the four-year cycle is broken, BTC eventually makes new highs anyway. Some analysts argue that institutional adoption — despite current ETF outflows — has permanently changed Bitcoin’s rhythm. If so, the dreaded September curse could be blunted this cycle.

Still, the path of least resistance in the near term is lower. Bitcoin bulls need a narrative shift — and fast — to avoid a slide toward that $100,000 line in the sand.

The Bottom Line

This September is shaping up as a battle of narratives: gold reclaiming its throne as the timeless store of value, and Bitcoin struggling with its reputation as “digital gold.” One is breaking out, the other is breaking down. For now, the shiny rock is winning.

But here’s the thing: Bitcoin doesn’t need to outshine gold every month. It just needs to survive September without too much blood on the floor. If BTC can hold six figures, the Fed’s liquidity wave could turn October into a comeback story. If not, Schiff might actually have something to gloat about for once.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

XAG/USD Plummets To $76.00 As Anxious Investors Await Critical FOMC Minutes