Chainalysis 2025 Global Index: India and U.S. Top Crypto Adoption Rankings

The sixth annual Chainalysis Global Crypto Adoption Index reveals a transformative year for digital assets, with India and the United States leading the world in overall adoption.

Unlike earlier years, where crypto activity leaned heavily toward grassroots usage in emerging markets, 2025 showcases a more balanced picture: retail adoption remains strong, but institutional flows are now a critical driver of growth.

The methodology remains rigorous. Chainalysis evaluates 151 countries using four sub-indices: on-chain value received by centralized services; retail-sized value received by those services; on-chain activity in DeFi protocols; and institutional-sized transfers.

Each component is weighted by GDP per capita on a purchasing-power-parity basis, ensuring the rankings reflect economic context rather than raw transaction volume. This comprehensive approach highlights not just where crypto is popular, but where it is meaningfully integrated into financial systems.

Shifting Methodology for a Maturing Market

In 2025, Chainalysis introduced important methodological changes. First, the retail DeFi sub-index was removed, as internal data showed that while DeFi transaction volumes remain significant, grassroots engagement there is far smaller than on centralized platforms. By excluding retail DeFi as a standalone category, the index avoids overrepresenting a relatively niche behavior.

Second, an institutional activity sub-index was added, reflecting the surge of large-scale transactions driven by traditional finance. Transfers above $1 million are now captured in the rankings, providing a clearer view of how hedge funds, custodians, ETFs, and banks are shaping the landscape.

This shift is timely: with multiple U.S. spot Bitcoin ETFs approved and greater regulatory clarity across key jurisdictions, institutions are no longer testing the waters—they are actively participating.

Together, these changes create a more accurate lens. The index continues to focus on grassroots adoption but now incorporates top-down institutional flows, showing how deeply crypto has penetrated mainstream finance.

India, the U.S., and the Rise of APAC

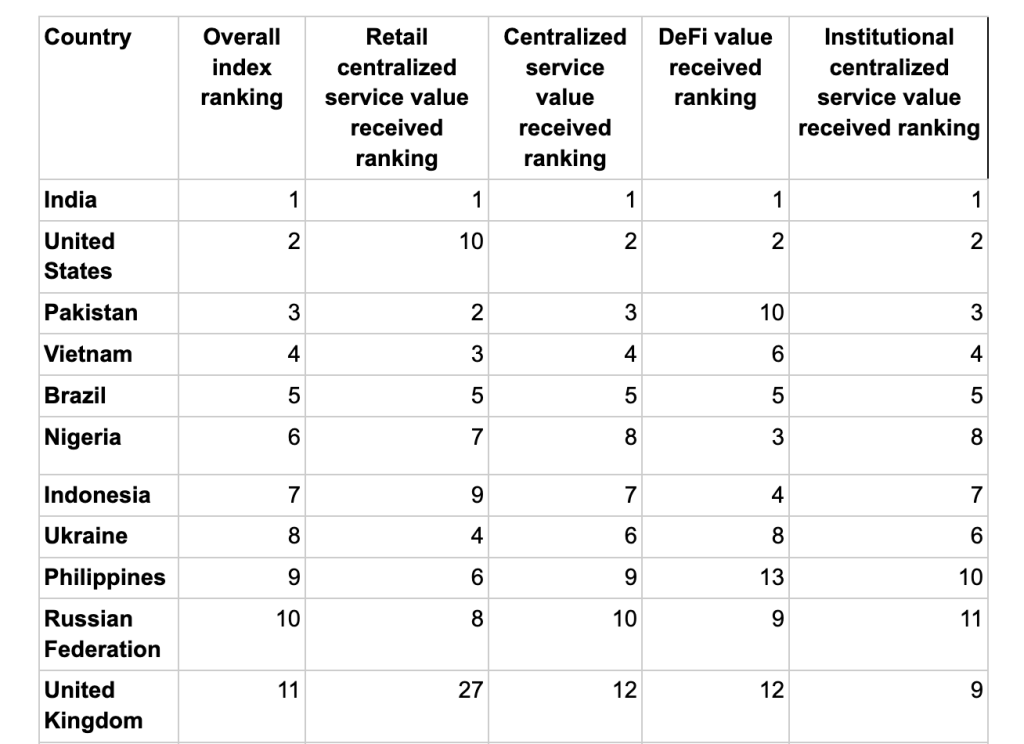

The 2025 Index crowns India as the number one country for crypto adoption, ranking first across all four sub-indices. India’s dominance reflects both widespread grassroots use and growing integration with financial services.

The United States ranks second overall, bolstered by strong institutional participation and the legitimizing effect of regulatory progress. Beyond these leaders, Pakistan (3rd), Vietnam (4th), and Brazil (5th) round out the top five, reflecting a blend of remittance-driven retail usage and rising institutional interest.

Notably, APAC has emerged as the fastest-growing region, with on-chain activity rising 69% year-over-year to $2.36 trillion. Latin America follows with 63% growth, showing the region’s reliance on stablecoins for remittances and inflation hedging.

When adjusting for population size, Eastern Europe stands out. Ukraine, Moldova, and Georgia top the population-adjusted index, reflecting extraordinary levels of activity relative to population. Factors such as war, inflation, and banking restrictions have accelerated crypto’s role as both a hedge and a cross-border transaction tool.

Stablecoins and Bitcoin Dominate On-Ramps

Stablecoins remain at the heart of global crypto adoption. Between June 2024 and June 2025, USDT processed more than $1 trillion per month, while USDC peaked at $3.29 trillion. New entrants like EURC and PYUSD are also growing rapidly, with EURC volumes surging nearly 89% month-over-month as MiCA-compliant euro stablecoins gain traction in Europe.

At the same time, Bitcoin continues to serve as the primary fiat on-ramp, accounting for over $4.6 trillion in inflows—more than double any other category. The United States leads by volume, with South Korea and the European Union trailing behind. These flows confirm that while altcoins and DeFi tokens are important, Bitcoin and stablecoins remain the central gateways into crypto.

A Truly Global Wave

Perhaps the most striking finding of the 2025 Index is that adoption is no longer confined to one region or income level. High-income countries are accelerating institutional rails, while lower- and middle-income nations continue to rely on crypto for remittances, dollar access, and mobile-first finance. This synchronicity suggests crypto adoption is now broad-based and durable, not episodic.

The challenges ahead remain clear: fragmented regulations, fragile infrastructure in low-income countries, and the need for secure on-ramps. Yet the trajectory is undeniable.

With India and the United States setting the pace, and the Global South demonstrating how crypto solves real-world problems, the 2025 Global Adoption Index shows one truth: crypto is no longer an experiment. It is becoming a core feature of the global financial system.

You May Also Like

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

Bitmine Immersion Technologies (BMNR) stock :soars 5% as $13.4B Crypto Treasury Propels Ethereum Supercycle Vision