Is Jack Ma in the game? Yunfeng Financial invests $44 million in ETH and partners with Ant Financial to develop RWA.

By Asher, Odaily Planet Daily

Yesterday, Yunfeng Financial, in which Jack Ma indirectly holds a stake, announced that its board of directors has approved the purchase of ETH on the open market as a reserve asset. As of the date of the announcement, the group had purchased a total of 10,000 ETH on the open market, with a total investment cost (including fees and expenses) of US$44 million.

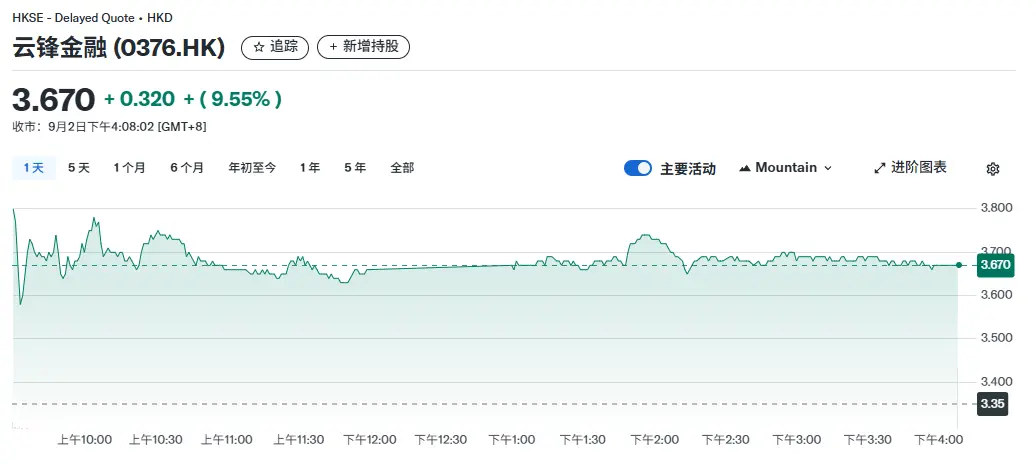

Furthermore, the group's use of ETH as a reserve asset aligns with its development in cutting-edge areas such as Web 3, and can optimize its asset structure and reduce its reliance on traditional currencies. Yunfeng Financial (0376.HK) saw its stock price rise nearly 10% on the day following this news.

Yunfeng Financial's stock price

Jack Ma and Yunfeng Financial

Yunfeng Financial has always been regarded as a "Jack Ma concept stock."

Yunfeng Financial's controlling shareholder is Yunfeng Capital, co-founded in 2010 by Jack Ma and Juzhong Media founder Yu Feng. The name "Yun" is taken from Jack Ma, and the name "Feng" is taken from Yu Feng. According to public data, Alibaba founder Jack Ma indirectly holds approximately 11.15% of Yunfeng Financial's shares through Yunfeng Capital, a 29.85% stake in Yunfeng Financial Holdings Co., Ltd., and a 40% non-voting stake in Shanghai Yunfeng Capital.

Jack Ma and Yu Feng

Yunfeng Financial's predecessor can be traced back to Wansheng International Securities, founded in 1982 and listed on the Hong Kong Stock Exchange in 1987, gradually growing into a leading local brokerage firm in Hong Kong. In 2015, Yunfeng Capital, led by Jack Ma and Yu Feng, invested HK$3.9 billion to take a controlling stake, driving the company's transformation. Subsequently, Yunfeng Financial acquired a 60% stake in MassMutual Asia in 2018, integrating securities, insurance, and asset management licenses to gradually build a closed "finance + technology" ecosystem.

Yunfeng Financial's purchase of Ethereum is just the beginning

Yunfeng Financial announced yesterday that it has added Ethereum to its strategic reserve assets. This move marks the beginning of the group's expansion into digital assets and Web 3. Going forward, the company will continue to promote the strategic integration of crypto assets and digital financial innovation, and explore the inclusion of mainstream tokens such as BTC and SOL in its reserves.

At the same time, the group plans to deeply integrate digital assets with its own business, explore the tokenization of RWA (real-world assets) and the potential application of blockchain technology in core businesses such as insurance and asset management, and build a "finance + technology" ecological closed loop for the company.

Yunfeng Financial will flexibly adjust the size of its digital asset reserves based on market developments, the regulatory environment, and its financial situation. The group emphasized that it will continue to accelerate its Web 3 deployment and promote Fintech innovation to enhance customer service experience and financial autonomy.

Strategically invested in the public blockchain Pharos and jointly developed the RWA sector with Ant Financial

On September 1st, Yunfeng Financial announced a strategic partnership with Ant Financial and a strategic investment in the Pharos public blockchain. This partnership aims to accelerate the integration and innovation of Web 3 and traditional finance, jointly developing RWA (real-world asset) tokenization and Web 3 initiatives through the Pharos public blockchain platform.

Pharos Project Introduction

Pharos is a new generation Layer 1 public chain focusing on RWA.

In terms of performance, the network features a modular design and high parallelism. The current testnet reaches 30,000 TPS, far exceeding other EVM and parallel networks. Pharos also utilizes an innovative GPU-like architecture, increasing storage efficiency by 80% and enabling support for billions of users. The Pharos core team includes not only Web 2 experts from Ant Financial and Alibaba Blockchain, but also veterans of the Web 3 industry.

In terms of financing, on November 8, 2024, Pharos completed an $8 million seed round of financing, led by Faction and Hack VC, with participation from SNZ Holding, Hash Global, MH Ventures, Dispersion Capital, Generative Ventures, and Chorus One.

Testnet Season 2 tasks in progress

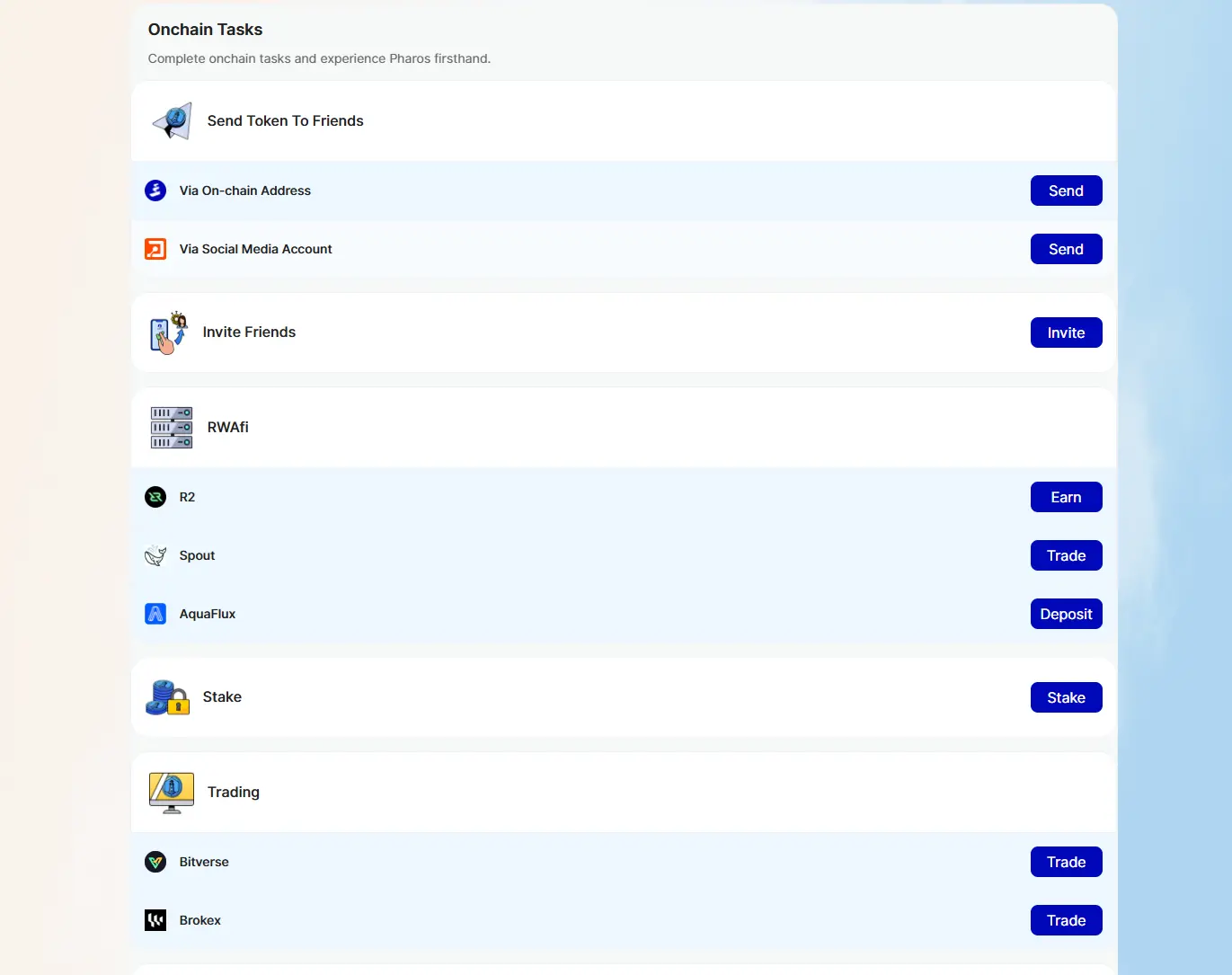

Currently, the second season of the Pharos Open Testnet is available for early user experience. The specific interactive operations are as follows:

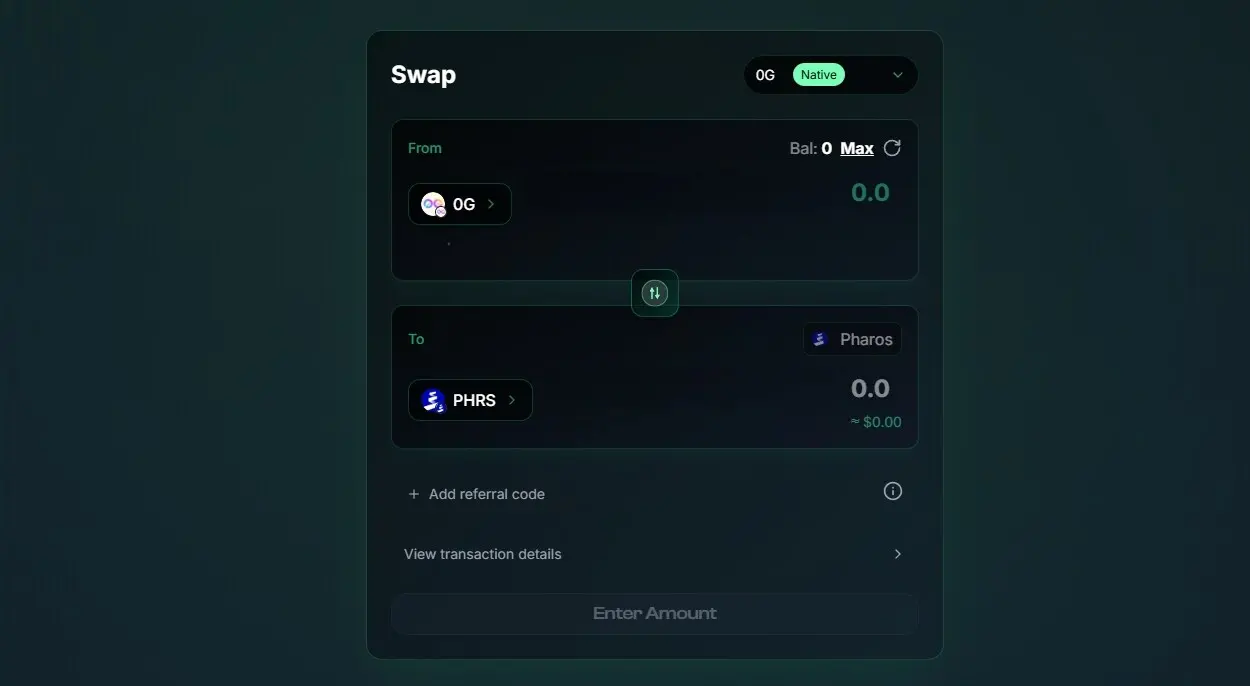

STEP 1. Get test coins. You can choose to get 0G test coins first and then exchange them for PHRS test coins.

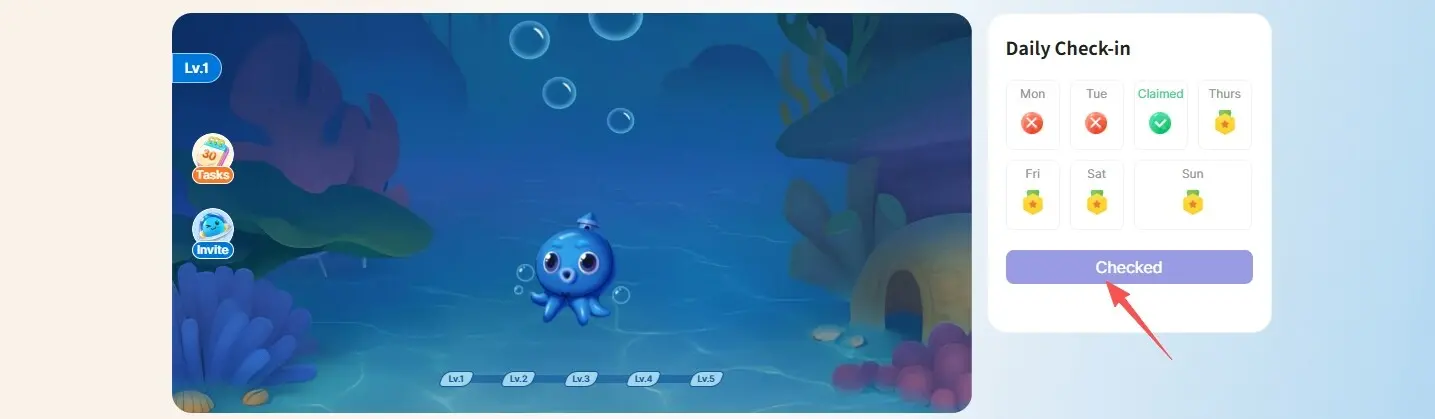

STEP 2. Go to the Season 2 interactive website, connect your wallet, and complete your daily sign-in.

STEP 3. Complete on-chain interaction and social tasks as required.

summary

Yunfeng Financial, in which Jack Ma indirectly holds shares, has strategically positioned itself in Ethereum, demonstrating not only its belief in emerging technologies but also its forward-looking exploration of financial architecture.

From an overall strategic perspective, Yunfeng Financial has taken a key step in optimizing the company's reserves and reducing its dependence on traditional fiat currencies by increasing its investment in digital assets. On the other hand, it is also trying to deeply integrate traditional financial services with Web 3 technology, especially exploring the application scenarios of blockchain in the fields of insurance and securities.

Leveraging Hong Kong's advantages in digital asset regulation, Yunfeng Financial is poised to become a crucial bridge between traditional finance and the crypto ecosystem. Perhaps, for Jack Ma, Yunfeng Financial's purchase of 10,000 ETH is just the beginning of his Web 3 strategy—the true digital financial landscape has only just begun to unfold.

You May Also Like

Sunmi Cuts Clutter and Boosts Speed with New All-in-One Mobile Terminal & Scanner-Printer

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC