Ethereum (ETH) Price: Massive Whale Buying Spree Coincides with Historic Staking Queue Surge

TLDR

- Ethereum’s staking entry queue reached a two-year high with 860,369 ETH ($3.7 billion) waiting to be staked, driven by institutional demand and network confidence

- Whale purchases of 260,000 ETH in 24 hours show strong institutional accumulation despite recent price decline

- Technical analysts project potential price targets of $8,500 to $22,000 based on ascending triangle breakout patterns

- Corporate treasury funds now hold 4.7 million ETH worth $20.4 billion, representing nearly 4% of total supply

- Exit queue dropped 20% from its August peak, reducing selling pressure as more investors choose to stake rather than withdraw

Ethereum’s staking infrastructure is experiencing unprecedented institutional demand. The staking entry queue reached 860,369 ETH on Tuesday, marking the highest level since September 2023.

This represents approximately $3.7 billion worth of Ether waiting to enter the staking ecosystem. The surge comes as institutional traders and crypto treasury firms seek staking rewards for their holdings.

Everstake, a leading staking protocol, described the development as striking. The firm noted that such large queues haven’t been seen since 2023 when the Shanghai upgrade first enabled withdrawals.

Ethereum (ETH) Price

Ethereum (ETH) Price

The growth reflects multiple market factors working together. Network confidence has increased as more participants trust Ethereum’s long-term prospects. Rising Ether prices combined with historically low gas fees make staking more attractive for users.

Institutional interest represents a key driver behind the queue expansion. More companies and investment funds are entering Ethereum staking with larger capital allocations.

Whale Activity Drives Market Momentum

Recent whale activity supports the institutional accumulation trend. Crypto analyst Ali Martinez reported that whales purchased approximately 260,000 ETH within a 24-hour period.

These large-scale purchases indicate growing demand from major investors. Such buying patterns often precede price movements as institutional capital enters the market.

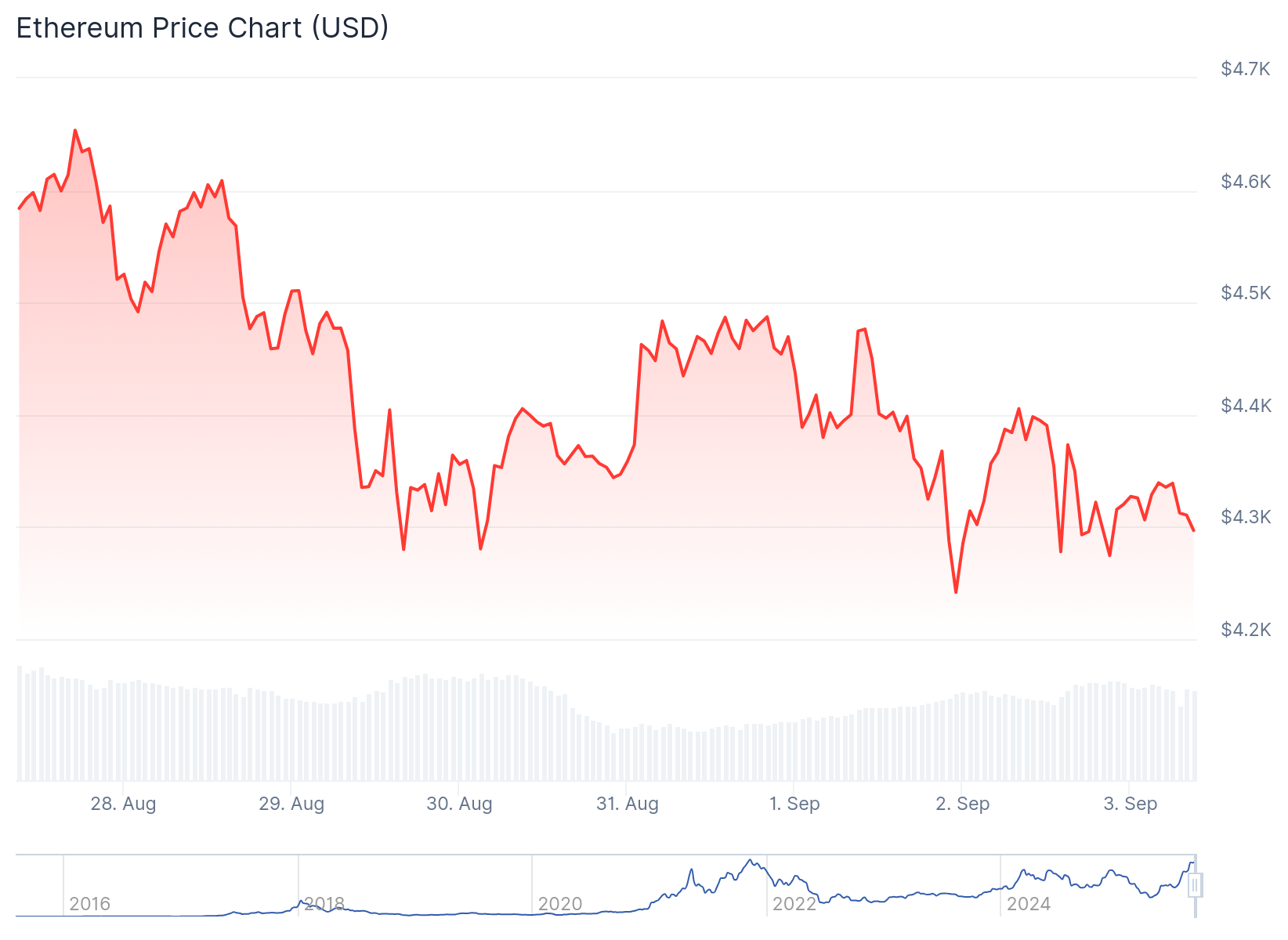

Current trading data shows Ethereum at $4,381.78 with a market capitalization of $530.55 billion. The 24-hour trading volume reached $62.24 billion despite a slight 0.66% price decline.

Corporate treasury adoption continues expanding. Strategic Ether Reserve data shows treasury funds now control 4.7 million ETH worth approximately $20.4 billion.

This represents nearly 4% of Ethereum’s total supply held by over 70 participating entities. Most treasury holders plan to stake their holdings for additional yield generation.

Technical Patterns Point to Potential Breakout

Technical analysis suggests Ethereum may be approaching a breakout from key chart patterns. Analyst EGRAG CRYPTO identified potential price targets ranging from $8,500 to $22,000.

These projections depend on a successful breakout from an ascending triangle formation. The pattern could confirm strong upward momentum if validated by increased trading volume.

Fibonacci-based cycle analysis provides additional context for these targets. Previous cycles reached specific Fibonacci levels, with the current cycle potentially targeting levels between 1.272 and 1.618.

Logarithmic analysis points to a $22,000 price target, while non-logarithmic calculations suggest $8,500. The mid-range target sits at $15,250 based on averaging these projections.

The Relative Strength Index stands at 52.69, positioning ETH in neutral territory. Neither intense buying nor selling pressure dominates current trading conditions.

MACD indicators show a bearish crossover with the histogram at negative 51.95. However, the narrowing gap between signal lines suggests potential reversal if buying volume increases.

Meanwhile, the staking exit queue has declined 20% from its August peak of over 1 million ETH. The reduction in withdrawal requests indicates fewer validators are choosing to unstake their holdings.

Total staked ETH reached 35.7 million tokens worth approximately $162 billion. This represents 31% of Ethereum’s total supply locked in staking contracts according to Ultrasound.Money data.

The post Ethereum (ETH) Price: Massive Whale Buying Spree Coincides with Historic Staking Queue Surge appeared first on CoinCentral.

You May Also Like

Sunmi Cuts Clutter and Boosts Speed with New All-in-One Mobile Terminal & Scanner-Printer

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC