XRP ETF News: 15 Applications Sit on SEC’s Desk – October is the Key

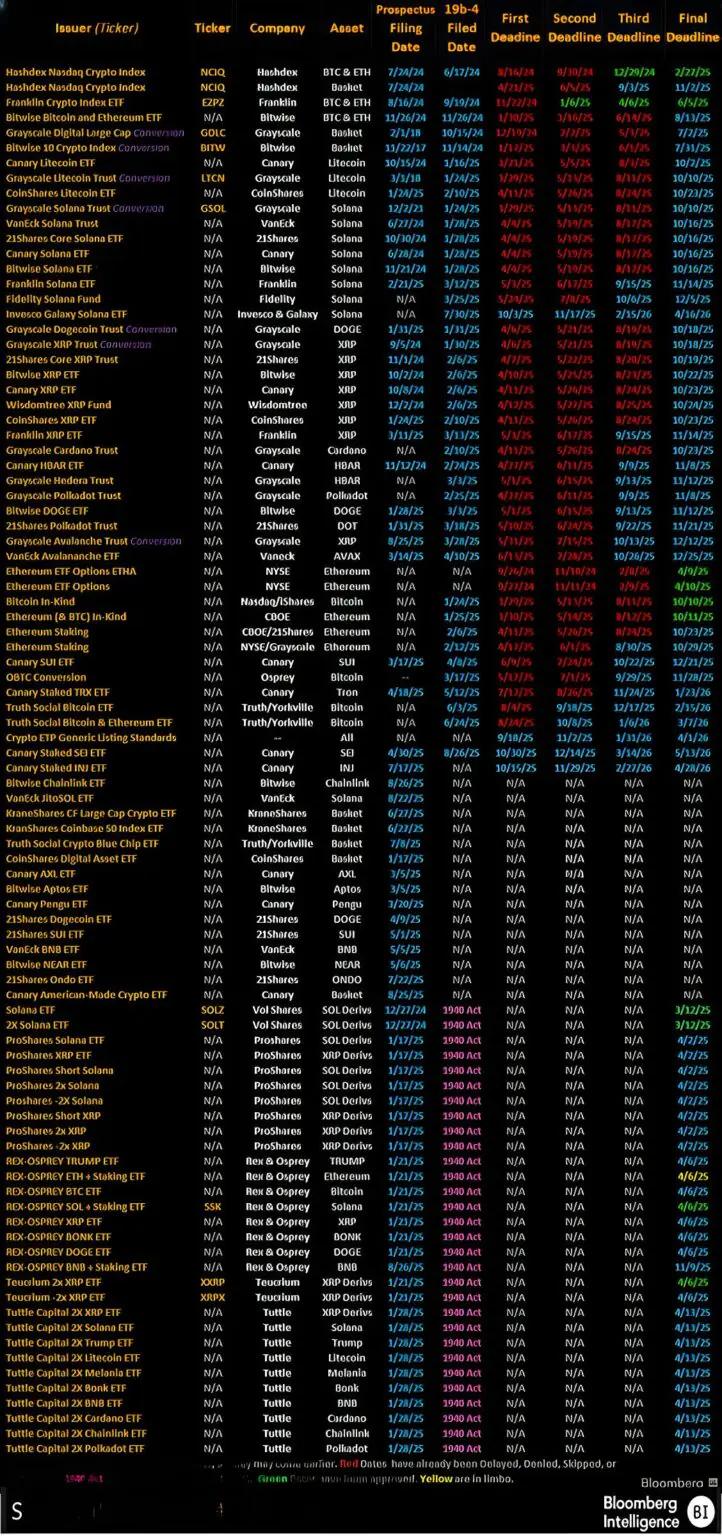

This surge of filings positions XRP alongside Bitcoin and Ethereum as a cryptocurrency attracting serious attention from major financial firms. The final decisions on many of these proposals are slated for late 2025, with a critical cluster of deadlines expected in October.

A Diverse Field of Issuers

The applicants for these XRP ETFs represent a wide mix of established financial powerhouses and innovative crypto-native firms. Companies like Grayscale, 21Shares, Bitwise, Franklin Templeton, WisdomTree, Canary Capital, and CoinShares have all filed for spot XRP products. Spot ETFs would directly hold and track the price of XRP. In addition, other firms, including ProShares, Rex & Osprey, Teucrium, and Tuttle Capital, have submitted proposals for more complex, leveraged, inverse, and derivative-based XRP ETFs. This variety of offerings suggests issuers see strong demand from investors who want both straightforward and more sophisticated exposure to the asset.

Key Filings and Review Deadlines

While the SEC has a number of filings to review, several are drawing significant attention from the market. The 21Shares Core XRP Trust and the Bitwise XRP ETF are among the most closely watched. The final wave of SEC decisions is anticipated in October-December 2025, with several key rulings for firms like Grayscale, 21Shares, Bitwise, and WisdomTree all clustered within the same week in October. The high concentration of deadlines has fueled market speculation and heightened expectations for a potential approval.

Price Speculation: A Catalyst for a New Market Cycle?

The potential approval of a spot XRP ETF could serve as a powerful catalyst for the token’s price, potentially triggering a new market cycle for the broader altcoin market. The logic is straightforward: an approved ETF provides a regulated and accessible gateway for institutional and retail investors to gain exposure to XRP without needing to hold the asset directly. This could lead to a significant influx of capital, creating upward pressure on XRP’s price due to increased demand and constrained supply.

READ MORE:

Bitcoin’s Biggest Holders Aren’t ETFs – It’s the Whales Selling

The market has seen a similar dynamic with Bitcoin’s spot ETF approval. While the price action wasn’t always immediate, the approval led to massive cash inflows and a subsequent rally. Analysts have forecasted that an XRP ETF could attract billions of dollars in inflows within the first month alone. While Bitcoin’s ETF inflows were even larger, such a significant capital injection into a single altcoin could have a “ripple effect” across the entire crypto ecosystem.

An XRP ETF approval could also be the trigger for a new “altcoin season.” Historically, Bitcoin rallies first, pulling new liquidity into the market and stabilizing sentiment. This is then followed by a rotation of capital into smaller, riskier assets—the altcoins. An XRP ETF approval would be a major sign of regulatory maturity and institutional acceptance for altcoins as an asset class. This could give investors the confidence to allocate capital to other projects, particularly those with strong fundamentals and pending ETF applications of their own.

Conclusion

This regulatory development, combined with other favorable macroeconomic conditions, could mark a turning point where institutional money and retail interest converge on altcoins. An XRP ETF approval would validate a new class of digital assets, potentially paving the way for ETFs for other tokens like Solana (SOL), Cardano (ADA), and Dogecoin (DOGE), which are also awaiting SEC decisions. This could usher in a new, more sustainable, and institutional-driven altcoin season.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post XRP ETF News: 15 Applications Sit on SEC’s Desk – October is the Key appeared first on Coindoo.

You May Also Like

Sunmi Cuts Clutter and Boosts Speed with New All-in-One Mobile Terminal & Scanner-Printer

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC