Michael Novogratz: AI will dominate stablecoin use

Galaxy Digital CEO Michael Novogratz believes AI agents will be the biggest users of stablecoins, as AI and crypto become much more interconnected overtime.

- Galaxy Digital CEO Michael Novogratz predicts AI Agents will be the biggest users of stablecoins.

- China is bound to play catch-up with the United States in terms of stablecoin dominance.

In an interview with Bloomberg TV, Michael Novogratz predicted what the stablecoin market would be like in the near future. The founder and CEO of Galaxy Digital believes that the adoption of stablecoins is “just getting started” and the crypto market will soon see a major acceleration in the sector.

“So sometime in the distant future, I don’t know if it’s one year or five years, you’re gonna see an explosion of stablecoin transactions,” said Michael Novogratz at the Goldman Sachs Asia Leaders Conference in Hong Kong on September 3.

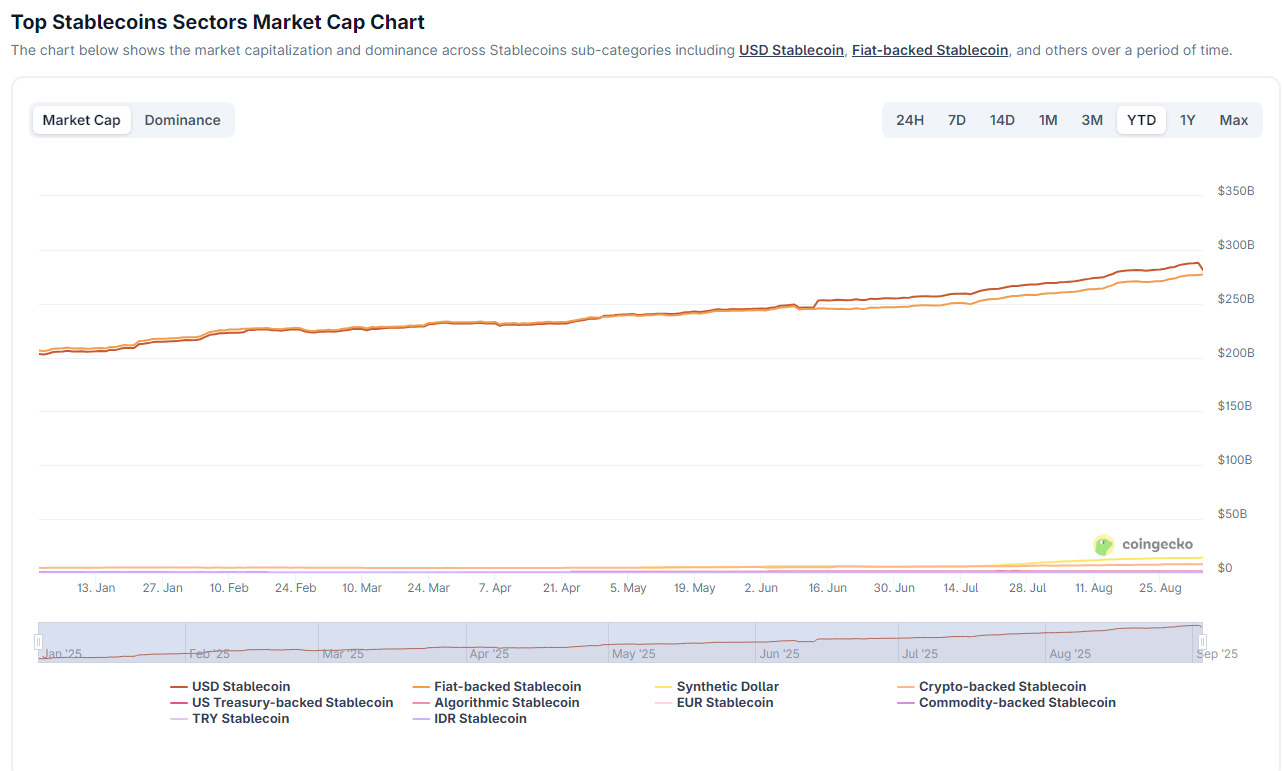

The big kicker that will catapult stablecoin usage from $280 billion today to $2 trillion, as predicted by firms like McKinsey and Standard Chartered, will be the role of AI agents in executing everyday transactions facilitated by stablecoins.

“In the not so distance future, the biggest user of stablecoins is going to be AI. You’re going to pick up your phone and say buy my groceries and your grocery agent who knows what you like to eat knows if you’re on a diet, it’s gonna know which groceries to buy and from where,” said Michael Novogratz.

“And they’re not gonna send a wire instruction or a Venmo, they’re gonna send a digital currency over a crypto rail,” he added.

Even today, stablecoins have already seen a major wave in global adoption following the GENIUS Act passing in the United States and the Stablecoin Ordinance in Hong Kong. The stablecoin market cap has reached as high as $287 billion, nearing $300 million. Major consulting firms have predicted that this number will skyrocket in the next three years, reaching the trillions.

On the other hand, the AI agents sector has also seen major developments with more collaborative initiatives between AI agent platforms and crypto firms. Earlier this year, two AI agent projects, Flagship and Virtuals, banded together to launch the FYI token.

At press time, the AI Agents sector has continued to dominate AI and crypto, with more than 46% of the total market cap coming in from AI Agents. According to data from CoinGecko, the AI Agents sector has seen a 3.8% boost in the past 24 hours, a breath of fresh air compared to the downward trend it experienced last month.

Michael Novogratz’s view on yuan-backed versus dollar-backed stablecoins

According to Michael Novogratz, the competition between China and the U.S. to expand the usage of their currency into the global economic landscape is shifting towards stablecoins. As today’s stablecoin market consists mostly of dollar-backed stablecoins like USDT (USDT), USDC (USDC) and PYUSD (PYUSD), China is tempted to develop their own stablecoin pegged to the remnibi to challenge the dollar’s domination.

Michael Novogratz believes its “just a matter of time” before China catches up and emerges with their own yuan-backed stablecoin.

“The US is now the world leader. Since it’s the biggest economy, pretty much everyone’s trying to match what the US is doing. It’s crazy how fast that shift happened,” said Novogratz.

Most recently, China’s National Petroleum Corporation has considered registering for a Hong Kong stablecoin license so it can start developing a yuan-backed stablecoin, which could be beneficial for cross-border settlements.

At the moment, China has been accelerating its efforts to delve into stablecoins as a way to combat the dollar. Officials are reportedly seeking input from experts on how to best go about implementing stablecoins pegged to the renminbi. Japan and South Korea have also made similar moves to advance their own local currency-pegged stablecoins.

You May Also Like

Sunmi Cuts Clutter and Boosts Speed with New All-in-One Mobile Terminal & Scanner-Printer

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC