Bitcoin Hyper Emerges as Best Crypto Presale With Over $14 Million Raised for Bitcoin Layer 2

The Bitcoin price continues to establish strong support above the $110,000 level, with cooling US labor market data and dovish comments from the Fed fueling expectations for an interest rate cut at the September 16-17 FOMC meeting, and therefore boosting sentiment around risk assets.

As a result, analysts anticipate significant gains for Bitcoin in the coming months, with market consensus pointing toward another new all-time high early in Q4. But while top analysts focus on the next Bitcoin highs, many savvy traders are turning their attention to its new Layer 2 (L2) blockchain, Bitcoin Hyper (HYPER).

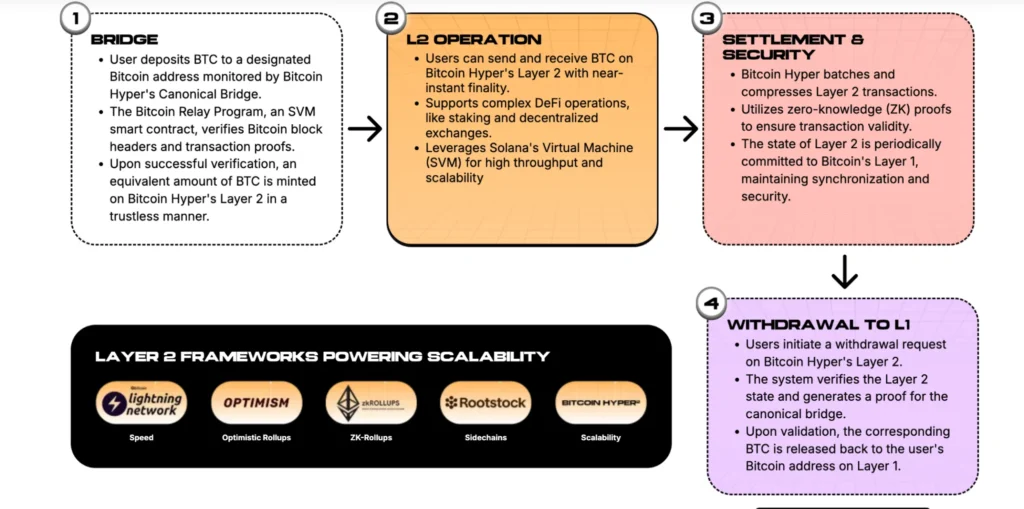

The project is developing the world’s first ZK-rollup-powered Bitcoin scaling solution, offering the benefits of low fees, high speeds, and smart contract support – all without compromising security.

HYPER is currently in a presale, having raised an impressive $14 million so far, highlighting strong community support and potential for substantial price increases once it begins trading on exchanges. Investors can currently purchase HYPER at a discounted price of $0.012865 in its ongoing presale round.

Analyst Tips BTC to $190K

Bitcoin recently broke a descending channel pattern and then retested its resistance as support – a move the trader Crypto Elites believes will lead to the next leg up. According to the analyst, Bitcoin has a peak target for 2025 of $190,000, representing a 71% increase from its current price.

He’s far from the only one expecting strong gains this year: Fundstrat’s Tom Lee predicts BTC could reach $250,000, Bitwise’s Matt Hougan predicts $200,000, and Standard Chartered analysts are targeting $200,000.

And with the market now factoring in a 99.4% chance of a rate cut at September’s FOMC – along with the M2 money supply continuing to grow – macroeconomic factors are aligning for Bitcoin to reach these levels.

If Bitcoin indeed climbs to $190,000 or higher, it could create opportunities for related tokens like Bitcoin Hyper to surge, except with room for much bigger returns. Bitcoin Hyper’s early stage means investors can get in on the ground floor, and its position as a low-cap BTC alternative means it could attract a lot of capital rotations as Bitcoin rallies, potentially leading to huge gains.

Analyst Umar Khan is among several experts who suggest that HYPER could deliver 100x returns once it lists on exchanges. This would turn a $1,000 investment into $100,000, or a $10,000 investment into $1 million.

Bitcoin Hyper Swaps Passive Holding for Active Yield Generation

Imagine a future where your Bitcoin not only appreciates in value but becomes the universal currency for a scalable network supporting micropayments, DeFi operations, meme coin transactions, NFTs, gaming, and much more.

You could earn yield on your Bitcoin, lend it, borrow it, leverage it, send it, earn it, or speculate on other assets with it. This is what the Bitcoin Hyper L2 will enable. It doesn’t just make Bitcoin faster and cheaper; it unlocks a new economy that’s powered by the $2 trillion crypto asset.

Bitcoin holders can easily transfer their BTC to the L2 network using Bitcoin Hyper’s trustless canonical bridge. Additionally, the L2 is interoperable with Solana, as it utilizes the Solana Virtual Machine (SVM) for execution. This also allows Solana developers to port their apps and tokens to the network – positioning HYPER at the intersection of Solana and Bitcoin, two of the hottest cryptocurrency ecosystems.

And while the project is currently in presale and the L2 has yet to launch, investors already have an opportunity to earn through the Bitcoin Hyper staking mechanism. It’s live in the presale and currently offers a 78% APY, although this will decrease as the staking pool grows.

Don’t Miss the HYPER Presale Discount – Under 2 Days Left

Every few months, a new project emerges and makes a significant impact on the market. Pump.fun is the latest example of something that truly changed how the market moves – but Bitcoin Hyper could be about to make a far more noticeable difference.

If it succeeds in its mission, Bitcoin Hyper could attract more users to Bitcoin, create real BTC utility, and ultimately solidify the Bitcoin network as the ultimate blockchain for all forms of digital transactions.

And with the Bitcoin Hyper project currently available for purchase in its presale, investors have a rare chance to get in early and capitalize on its full growth potential. However, the presale price will increase throughout the campaign, with the next increase scheduled to occur in less than two days. This means potential investors should not delay when researching this project and getting involved.

Visit Bitcoin Hyper Presale

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Strive Finalizes Semler Deal, Expands Its Corporate Bitcoin Treasury

Why 2026 Is The Year That Caribbean Mixology Will Finally Get Its Time In The Sun