Bitcoin White Paper Celebrates 17 Years as BTC Encounters First 7-Year Red October

- Bitcoin white paper was published 17 years ago by Satoshi Nakamoto, introducing decentralized digital currency.

- Bitcoin has grown from an experimental project into a $2 trillion global asset, ranking among the top financial assets worldwide.

- Despite historic growth, Bitcoin faces its first red October in seven years, with a monthly decline of over 3.5%.

- Market corrections are perceived by analysts as necessary for sustainable growth, with recent declines seen as controlled deleveraging.

- Regulatory developments and institutional interest continue to shape the future of cryptocurrency markets.

For 17 years, Bitcoin has transitioned from a niche technological innovation to a cornerstone of the global financial landscape. Celebrating the anniversary of the white paper published by creator Satoshi Nakamoto on October 31, 2008, the cryptocurrency’s journey underscores its profound influence on the financial industry. The white paper outlined a decentralized, peer-to-peer electronic cash system capable of eliminating double-spending issues through proof-of-work consensus, laying the groundwork for what would become a multi-trillion-dollar market.

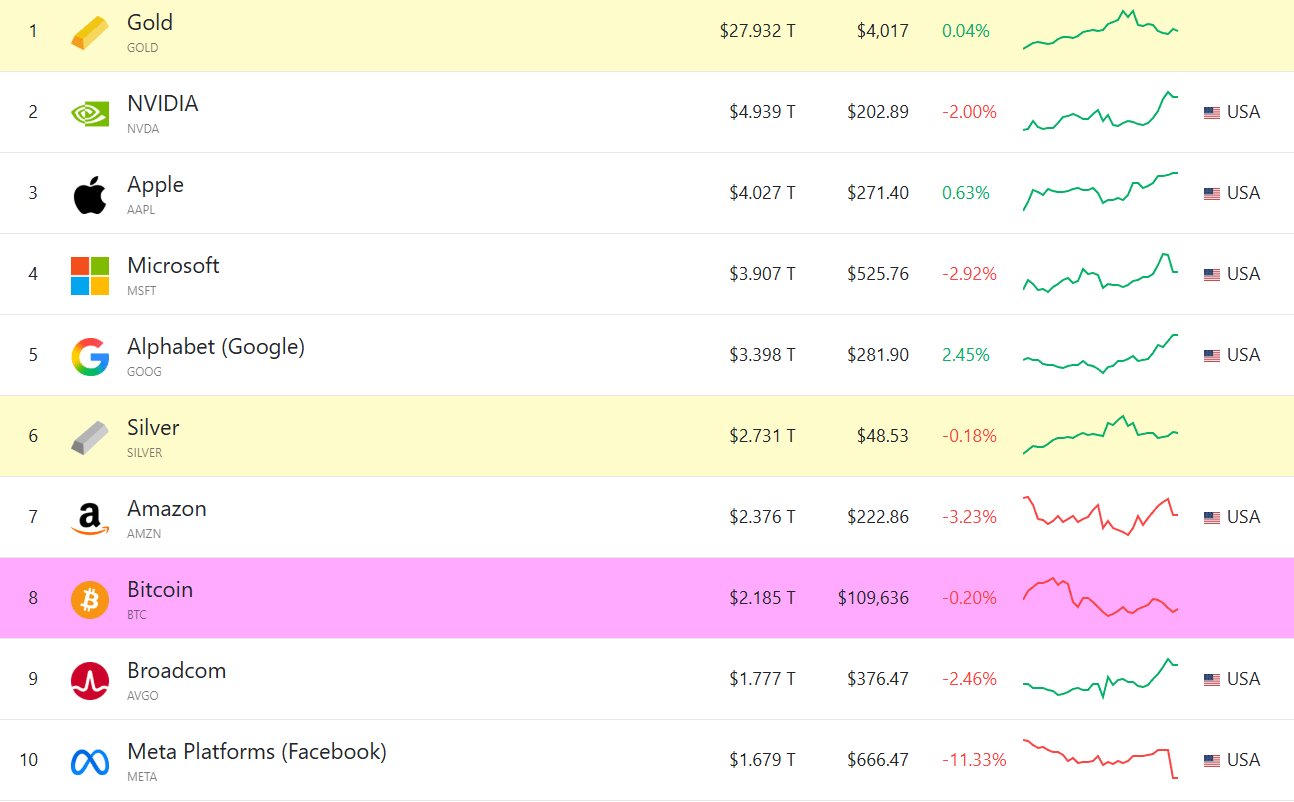

Just three months after releasing the white paper, Nakamoto mined the first Bitcoin block, known as the genesis block, awarding 50 BTC and establishing the foundation of the world’s largest decentralized network. Today, Bitcoin’s market capitalization surpasses $2 trillion, positioning it as the eighth-most-valuable asset globally, trailing only silver and Amazon, according to data from CompaniesMarketCap.

Top global assets by value. Source: CompaniesMarketCap

Top global assets by value. Source: CompaniesMarketCap

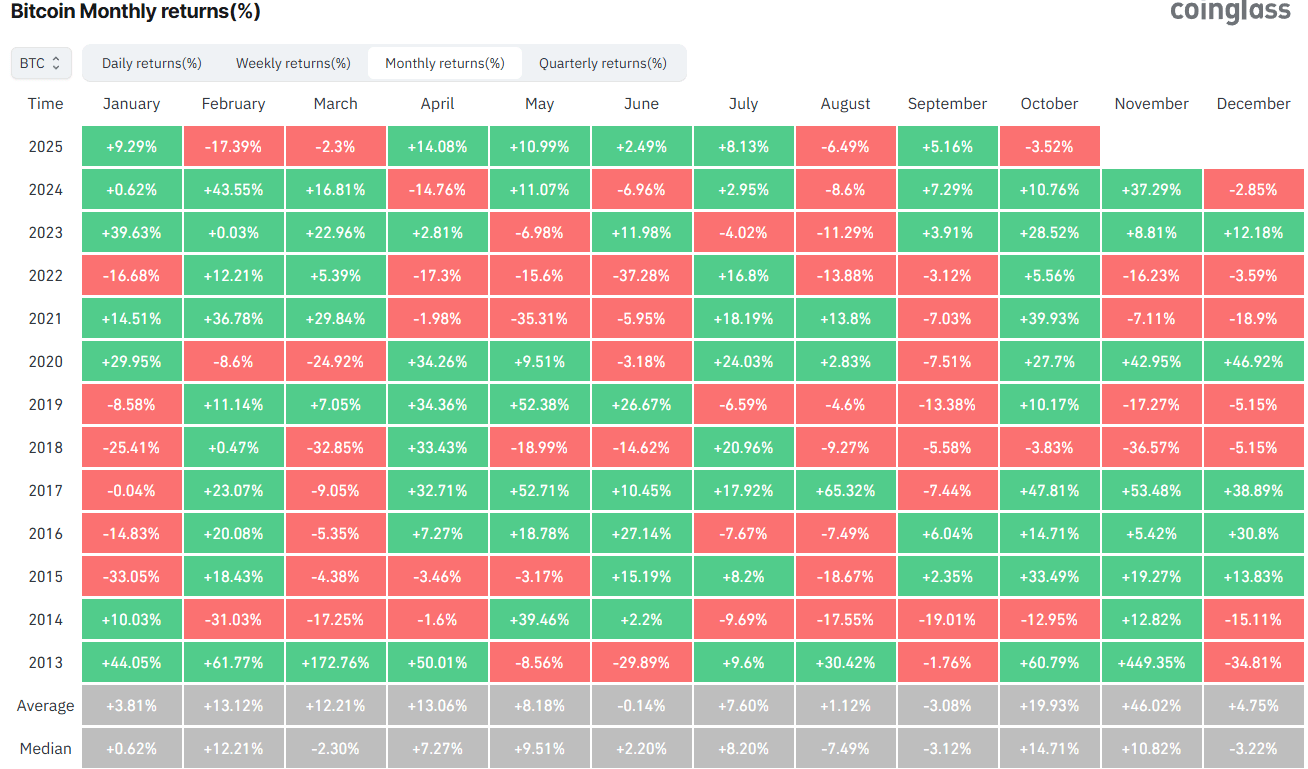

Despite milestones, Bitcoin is experiencing its first October with losses in seven years. The leading cryptocurrency has fallen over 3.5% this month, breaking its six-year streak of positive October performances, often dubbed “Uptober,” which historically yields an average return of nearly 20%. The last time Bitcoin faced a monthly decline was in 2018 when it fell 3.8%, underscoring the volatile nature of crypto markets.

Bitcoin monthly returns. Source: CoinGlass

Bitcoin monthly returns. Source: CoinGlass

The recent market correction, which saw Bitcoin’s price dip to a four-month low of $104,000 during a broader crypto market crash exceeding $19 billion, is being viewed by analysts as a necessary adjustment. This “controlled deleveraging” aims to remove excess leverage, fostering a more sustainable environment for future growth as the market prepares for the next rally.

Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin

This article was originally published as Bitcoin White Paper Celebrates 17 Years as BTC Encounters First 7-Year Red October on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

SUI Surges From Consolidation, Buyers Regain Control Above $1.78

Shibarium releases security incident update: Specific bridge operations have been restricted, limiting the attacker's short-term BONE token staking