XRP consolidates as losses linger ahead of October

- XRP trades sideways between the 100-day EMA support and the 50-day EMA resistance.

- XRP upholds marginal profits in September, but downside risks persist amid widespread volatility.

- XRP Open Interest weighted funding rate steadies, suggesting a gradual shift in sentiment as traders pile into long positions.

Ripple (XRP) trades sideways in a narrow range between support at $2.83 and resistance at $2.92 on Tuesday. Interest in the cross-border token has remained significantly suppressed over the past few weeks, reflecting the general sentiment that September is a bearish month for crypto.

However, based on CryptoRank's data, XRP is on course to end September with marginal profits of about 2.76%. The table below shows that XRP has posted profits in three consecutive Septembers, with the highest gains of 46% in 2022.

XRP monthly returns | Source: CoinGlass

As for October, returns have been erratic, highlighting the lack of a clear trend. Hence, investors should approach October with an open mind, and focus promptly on technical, fundamentals and macroeconomic data.

XRP derivatives market offers mixed signals

Retail interest in XRP stabilized at lower levels on Tuesday, following a week of volatility that triggered significant liquidations as the XRP price declined to $2.70.

According to CoinGlass data, Open Interest (OI), representing the notional value of outstanding futures contracts, averages at $7.58 billion at the time of writing, down from $8.96 billion on September 19.

If open interest stabilizes and trends upward, it would indicate that traders have a strong conviction in XRP's ability to reach higher levels above $3.00.

Conversely, declining or suppressed OI implies that investors are losing confidence in the cross-border money remittance token and its ecosystem, likely holding the price from rising above the narrow range.

XRP Futures Open Interest | Source: CoinGlass

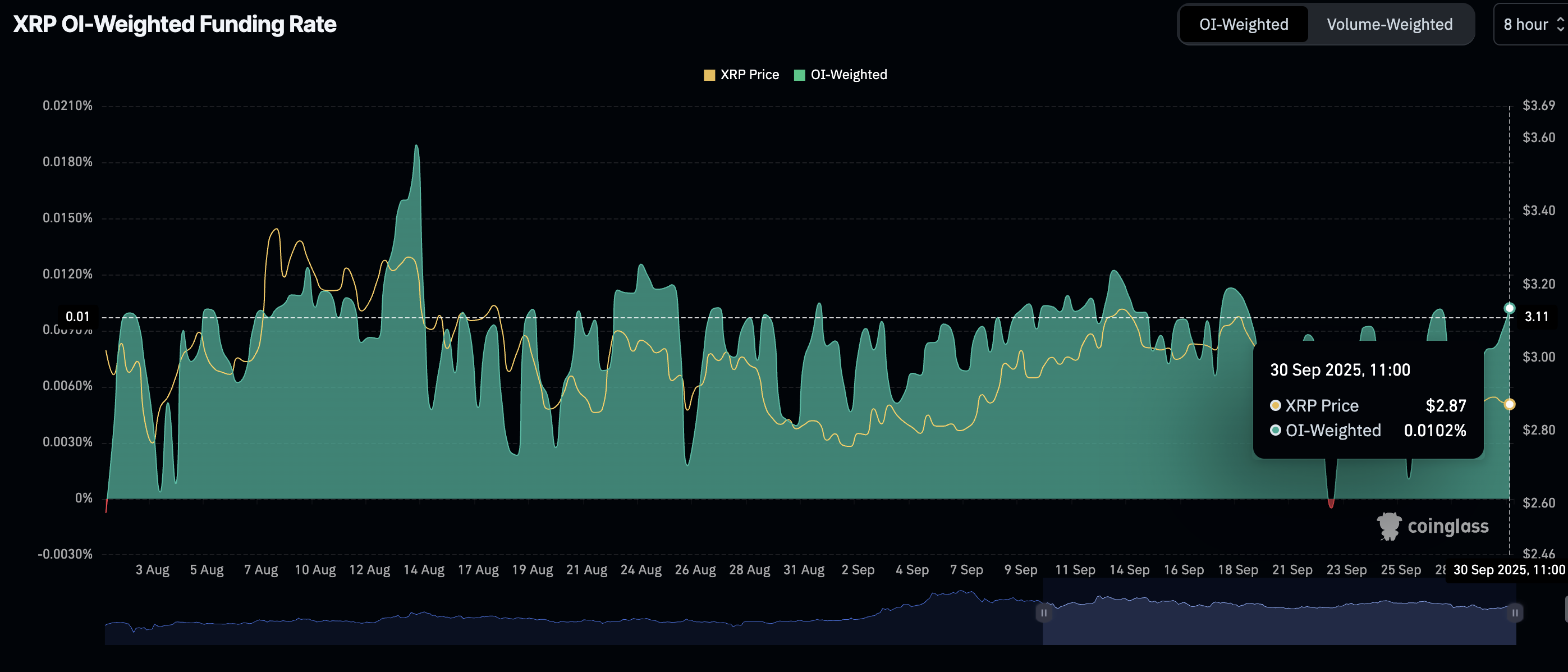

As the price of XRP consolidates, traders are increasingly piling into long positions, as evidenced by the OI-Weighted Funding Rate sharply rising to 0.0102%. This is an aggregated metric of XRP perpetual futures contracts across multiple exchanges, calculating the weighted average of funding rates.

XRP OI-Weighted Funding Rate | Source: CoinGlass

High positive rates indicate that traders are aggressively piling into long positions. Initially, this is a positive signal; however, at extreme levels above 0.1%, it can serve as a warning to reduce risk exposure. For now, XRP OI-Weighted Funding Rate is within the health band, encouraging more traders to increase their exposure, anticipating a price breakout above the critical $3.00 level.

Technical outlook: Can XRP defend support and nurture a short-term breakout?

XRP delicately holds onto the 50-day Exponential Moving Average (EMA) at $2.83, reflecting an increase in downside risks. The Relative Strength Index (RSI) crossover below the signal line on the daily chart suggests that bearish momentum is building. With the RSI holding in the bearish region, it would be difficult for bulls to push past the 50-day EMA resistance.

Investors may consider de-risking further, especially with the Moving Average Convergence Divergence (MACD) having sustained a sell signal since September 22. Risk-off sentiment will prevail if the blue line remains below the red signal line.

XRP/USDT daily chart

Losing ground below the 100-day EMA at $2.83 could accelerate the decline toward the demand zone at $2.70, which would encourage risk-on sentiment. The 200-day EMA at $2.61 and the round-number support at $2.50 would also serve as tentative support levels.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!