$50K or $120K by Christmas? Here’s What 4 AIs Expect for Bitcoin

November was not a good month for the Bitcoin (BTC) bulls, since the asset’s price tumbled by approximately 17%.

Instead of bringing some hope, December delivered even more pain, and now the big question is whether the valuation will collapse to $50,000 or stage a resurgence to $120,000 by Christmas. To gain a clearer perspective, we decided to ask four of the most popular AI-powered chatbots for their take on the matter.

What’s More Likely?

ChatGPT suggested that a sharp decline to $50K before December 25 is possible but would require a major negative catalyst. Such events would be a meltdown of a popular crypto exchange (similar to what happened with FTX in 2022) or a new military conflict across the globe.

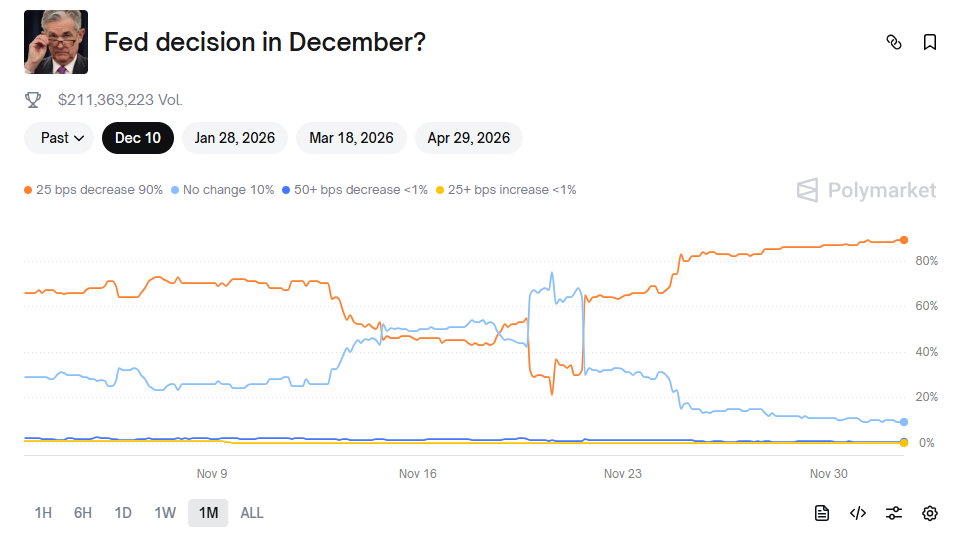

The chatbot assumed that an unexpected Federal Reserve interest rate hike could also have the same effect. America’s central bank will decide on December 10 whether to cut, raise, or keep the benchmark unchanged, and as of this writing, the odds of a 0.25% decrease stand at 90%.

Fed Decision in December, Source: Polymarket

Fed Decision in December, Source: Polymarket

ChatGPT sees a slightly bigger chance of a pump to $120K before Christmas. Nonetheless, such a price explosion would depend heavily on factors like renewed institutional inflows into spot BTC ETFs, a massive buying spree by whales, and overall macro optimism.

In conclusion, the chatbot estimated that the most likely scenario for the leading digital asset is to hover between $70,000 and $95,000 through December.

Grok took a far more bullish stance, insisting that a collapse to $50,000 before Christmas is simply off the table for BTC.

Other Opinions

Perplexity also leaned toward the bullish target. It claimed BTC is more likely to test $120,000 than plummet to $50,000 based on technical setups and macro tailwinds outweighing short-term consolidation risks.

For its part, Google’s Gemini said both levels represent “extreme ends of the spectrum” with strong arguments for both. At the same time, the chatbot estimated that a return to $50K is less probable than a jump to $120K despite the current bearish sentiment.

The post $50K or $120K by Christmas? Here’s What 4 AIs Expect for Bitcoin appeared first on CryptoPotato.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Large-Scale Bitcoin Outflow: Matrixport Removes $352.5M From Binance