The crypto market plummeted, and more than 300,000 people were liquidated: the core reasons you need to know

Author: Alea Research

Compiled by: Tim, PANews

In yesterday's report , we explored several structural changes that have occurred in the cryptocurrency market over the past few months. Today, before the US market opens, the total market value of the crypto space has fallen by nearly 9%, and Bitcoin has fallen by more than 7% in the past 24 hours. Although Bitcoin rebounded to the $89,000 mark after hitting a new low above $87,000, the current trend has shown signs of fatigue.

In today’s report, we will once again take a look at market trends, try to clarify the causes of the current downward trend in cryptocurrencies, and determine what conditions are necessary for the market to regain bullish sentiment.

Current Macro and Crypto Environment

Over the past year, the overall trend of the crypto market has been highly correlated with Bitcoin. Starting from the second quarter of 2024, Bitcoin and altcoins entered a period of sideways fluctuations for about half a year. With the arrival of the catalyst of the US election in November, the entire crypto market rose almost across the board. However, this situation has taken a sharp turn for the worse recently, as evidenced by the rapid divergence of the trends of Bitcoin and altcoins.

There is no clear trigger for this sell-off in the cryptocurrency sector. We have discussed the Libra token crash and the recent Bybit attack in detail in our member newsletters and emails. The chain reaction caused by the Libra token has hit the Solana ecosystem hard, and the SOL token has plummeted by nearly 45% in the past month. The Bybit incident is now basically under control, and the exchange claims to have raised enough ETH to fill a funding gap of about $1.4 billion.

There was even good news yesterday: Castle Securities announced that it would increase its layout in the encryption field, which may be related to the increasingly clear regulatory environment.

Previously, Robinhood disclosed that one-third of its fourth-quarter revenue came from crypto services, and it plans to continue to increase its investment in this field, but the market reacted coldly to the good news of the entry of such traditional financial institutions.

Citadel Securities announces plans to increase its investment in cryptocurrency market making

The current market may pay more attention to news from the US government, and be reserved about any policy moves that do not reach the level of "Strategic Bitcoin Reserve" (SBR), and even regard it as an opportunity to sell "all the good news is out". This tendency can be seen from the market's reaction to the statements and even executive orders of President Trump, David Sacks, the head of encryption and artificial intelligence affairs, and Senator Cynthia Lummis on cryptocurrencies.

The current market volatility may be largely related to Trump's policies and the unexpected reactions they have triggered. In some ways, the former president's fulfillment of his campaign promises is polarized: some policies related to the core concerns of the market have not been fulfilled, while other areas have been advanced beyond expectations. This contradiction is exacerbating market uncertainty.

1. Tariff policy

Trump has changed his mind many times since taking office: first, he announced additional tariffs on Canada and Mexico, then suspended the implementation; then implemented a new metal tariff policy, affecting both Canada and Mexico; recently, he announced that he would eventually impose comprehensive tariffs on both countries. This practice of changing orders every day not only exacerbates market uncertainty, but is also likely to lead to a policy credit dilemma of "crying wolf".

2. Immigration Policy

The Trump administration has so far deported fewer illegal immigrants than previous administrations, which could be a positive sign for markets, as large and rapid deportations could cause market turmoil in labor-intensive sectors such as agriculture, residential construction and services.

3. Foreign Policy

The Trump administration has shown a tendency to distance itself from Europe and to negotiate directly with Russia, bypassing regional countries such as Ukraine. Although this move may not be a major negative factor that triggers a unilateral market reaction, it did catch some observers off guard.

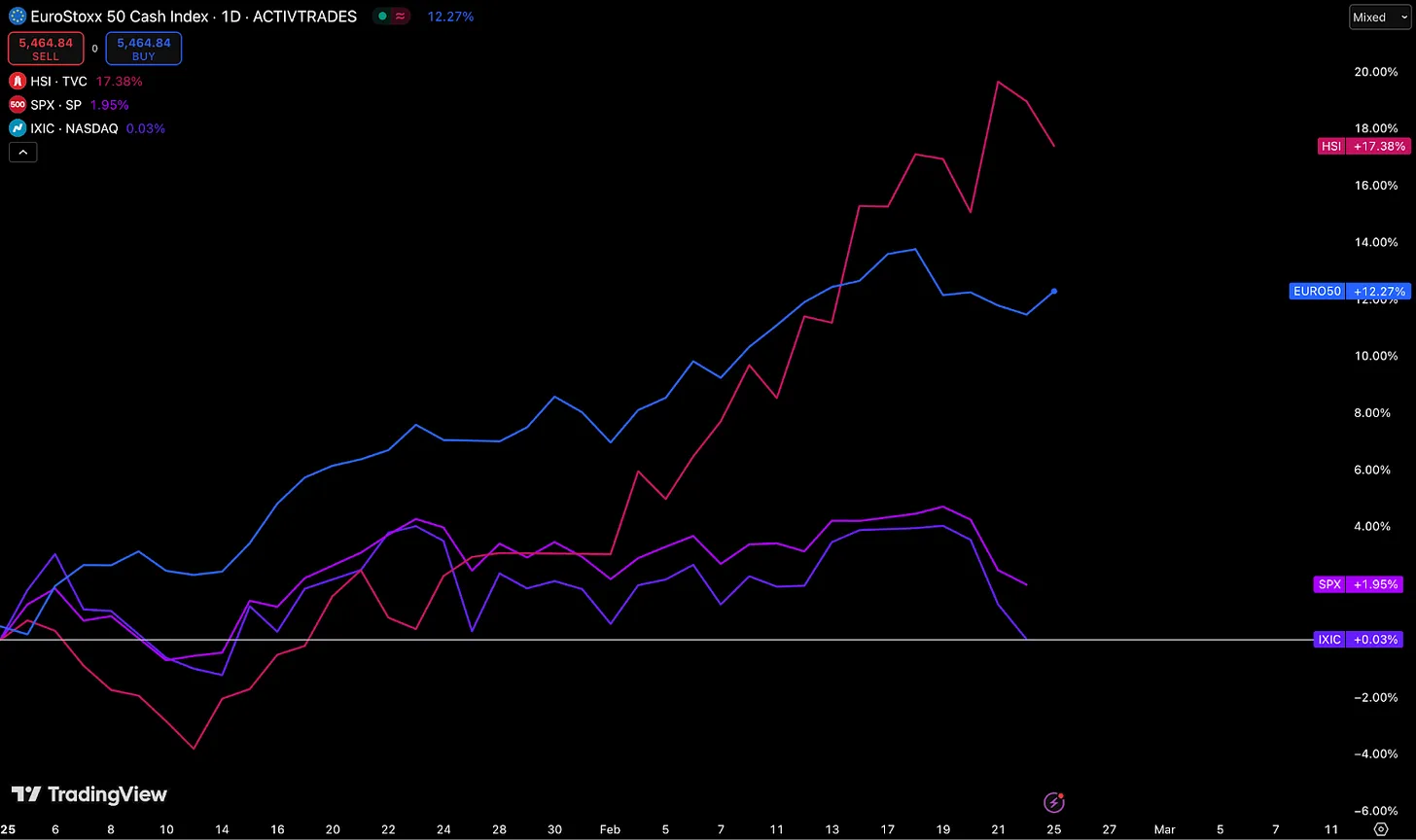

The market has always hated uncertainty, and the Trump administration has fully demonstrated its ability to create uncertainty in its first month in office. Since the beginning of the year, U.S. stocks have underperformed European and Chinese stocks, and the Nasdaq index has almost fallen into negative territory. This may reasonably explain why cryptocurrencies performed poorly in the first quarter: although Michael Saylor's "strategic hoarding" brought liquidity support and ETF fund inflows, Bitcoin still remained at a relatively high level, the overall crypto market performance still lagged far behind.

The goal has changed drastically, with more emphasis on debt and less on stocks?

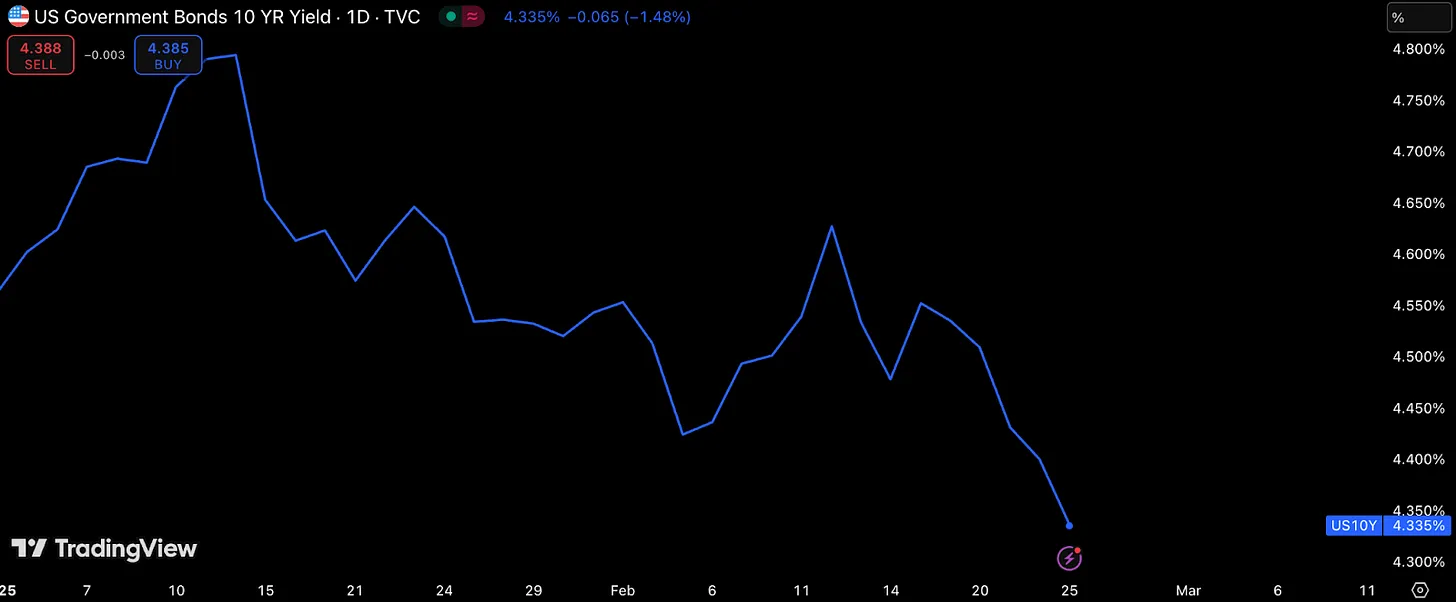

The weak performance of both cryptocurrencies and U.S. stocks may be closely related to the Trump administration's policy focus shifting to lowering bond yields rather than boosting the stock market (not to mention Bitcoin prices, in fact, the White House pays little attention to the overall performance of the crypto market). If lowering bond yields is regarded as a measure of policy success, then the current situation may be more optimistic than judging simply by stock market performance.

Since Trump took office, the 10-year Treasury yield has fallen significantly. This indicator can be used as an alternative benchmark to assess the long-term resilience of the US economy: lower interest rates help reduce the cost of capital for home buyers, large companies and other groups.

Under the current macro landscape, the US government needs to strike a balance between short-term interests and long-term goals, that is, the stock market frenzy may not meet the success criteria set by the Trump team. Over time, the market may gradually adapt to the unconventional operations of this administration. On the positive side, if regulatory barriers can be substantially eliminated (as DOGE metaphorically implies), more economic vitality may be released. However, in the short and medium term, large-scale layoffs and budget cuts by the federal government may have a contractionary effect on the economy and intercept some of the funds that could have been injected into the market.

Related Links:

Current Crypto Market Structure Newsletter

Citadel $BTC Tweet

Jim Bianco Bond Market Tweet

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Qatar pushes tokenization with launch of QCD money market fund