Bitcoin ETFs log $250M outflows while Ethereum funds see nearly $94M exit

Bitcoin spot ETFs recorded $249.99 million in net outflows on January 9, extending a multi-day redemption streak.

- Bitcoin ETFs saw $1.38B in outflows over four days, led by BlackRock’s IBIT.

- Ethereum ETFs posted $351M in redemptions after a strong start to January.

- Solana ETFs were flat while XRP ETFs still attracted fresh inflows.

BlackRock’s IBIT led withdrawals with $251.97 million in outflows, while Fidelity’s FBTC posted the only inflow at $7.87 million.

Ethereum spot ETFs saw $93.82 million in net outflows on the same day and was the third consecutive session of redemptions.

Solana spot ETFs recorded zero flows, while XRP spot ETFs attracted $4.93 million in inflows.

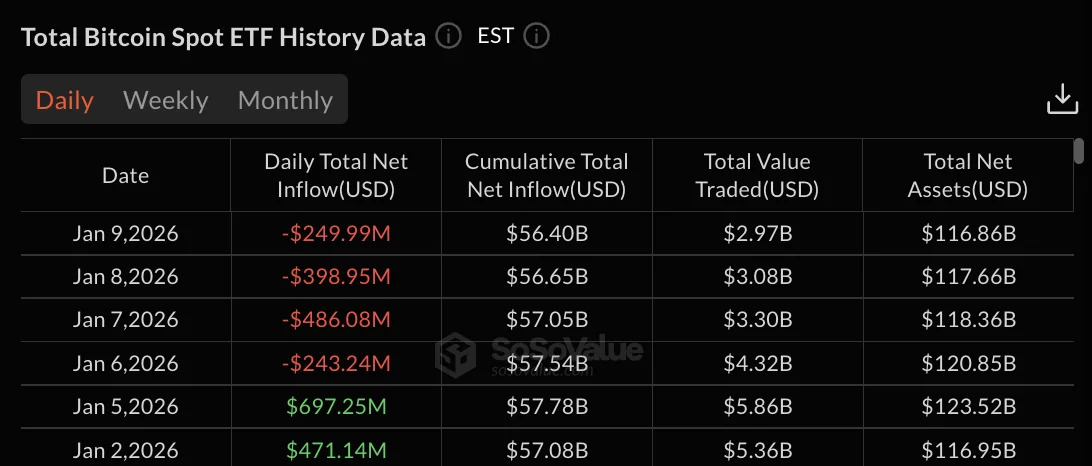

Four-day Bitcoin outflow streak totals $1.38 billion

Bitcoin ETFs posted $243.24 million in outflows that day, followed by $486.08 million on January 7 and $398.95 million on January 8. The four-day total reaches $1.38 billion in net redemptions.

The selling wave reversed January’s opening rally. January 2 brought $471.14 million in inflows, followed by $697.25 million on January 5. It was also the strongest single-day performance since December 17.

Bitwise’s BITB posted $5.89 million in outflows on January 9. Grayscale’s GBTC and mini BTC trust, along with Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero flows.

Total net assets under management fell to $116.86 billion on January 9 from $123.52 billion on January 5.

Cumulative total net inflow dropped to $56.40 billion from $57.78 billion over the same period. Total value traded declined to $2.97 billion on January 9.

BlackRock’s IBIT holds $62.41 billion in cumulative net inflows. Fidelity’s FBTC has accumulated $11.72 billion in total inflows.

Grayscale’s GBTC maintains -$25.41 billion in net outflows since converting from a trust structure.

Ethereum funds bleed $351M across three days

Ethereum ETFs began the outflow cycle January 7 with $98.45 million in redemptions, followed by $159.17 million on January 8. The three-day total reaches $351.44 million in net withdrawals.

Like Bitcoin, Ethereum products started January with strong inflows. January 2 posted $174.43 million, January 5 saw $168.13 million, and January 6 attracted $114.74 million before the reversal.

Total net assets for Ethereum ETFs fell to $18.70 billion on January 9 from $20.06 billion on January 6. Cumulative total net inflow dropped to $12.43 billion from $12.79 billion. Total value traded reached $1.11 billion on January 9.

You May Also Like

Ukraine Gains Leverage With Strikes On Russian Refineries

![[HOMESTRETCH] Beyond the bell: Nesthy Petecio’s becoming](https://www.rappler.com/tachyon/2026/01/home-stretch-nesthy-petecio.jpeg)

[HOMESTRETCH] Beyond the bell: Nesthy Petecio’s becoming