BitMine Opens NYSE Options Trading, Targeting 5% Ethereum – Thiel Backs Move

BitMine Immersion Technologies, a crypto mining company known for its Ethereum-focused treasury strategy, has announced that its common stock will begin trading as listed options on the New York Stock Exchange.

The new listing, which launches today, is trading under the ticker symbol “BMNR.” This listing introduces a new level of market access for investors interested in BitMine’s performance.

The availability of options allows market participants to hedge positions, gain leverage, or take directional views on the company’s equity. A variety of strike prices and expiration dates will be available.

A Milestone in BitMine’s Expansion

According to BitMine Chairman Thomas Lee of Fundstrat, this launch marks a major step in the company’s market development.

“Options trading on the NYSE is a major milestone for BitMine, giving investors more ways to participate in our continued growth,” he said.

Lee stressed that the move shows confidence in BitMine’s strategic vision, which includes acquiring up to 5% of the total Ethereum supply over time.

This ambition places BitMine in a small circle of institutions pursuing aggressive ETH accumulation strategies. BitMine is also positioning itself as a hybrid player at the intersection of legacy financial infrastructure and blockchain-based innovation.

Trading Infrastructure and Oversight

According to the press release, the options contracts will be cleared by the Options Clearing Corporation (OCC) and governed by NYSE and OCC standards.

Investors can expect the usual regulatory oversight applied to all equity options, including standardized contract terms and settlement mechanisms.

The addition of options trading has the potential to increase trading volume and visibility for BitMine’s stock. It also allows the company’s shares to appeal to a broader segment of institutional and retail investors.

Peter Thiel Reveals 9.1% Stake in BitMine

Tech billionaire Peter Thiel disclosed a 9.1% stake in the crypto mining and services firm, Reuters reported. Thiel, a vocal supporter of Bitcoin, has previously expressed a strong belief in blockchain-based assets. His venture capital firm, Founders Fund, was one of the earliest institutional backers of the cryptocurrency.

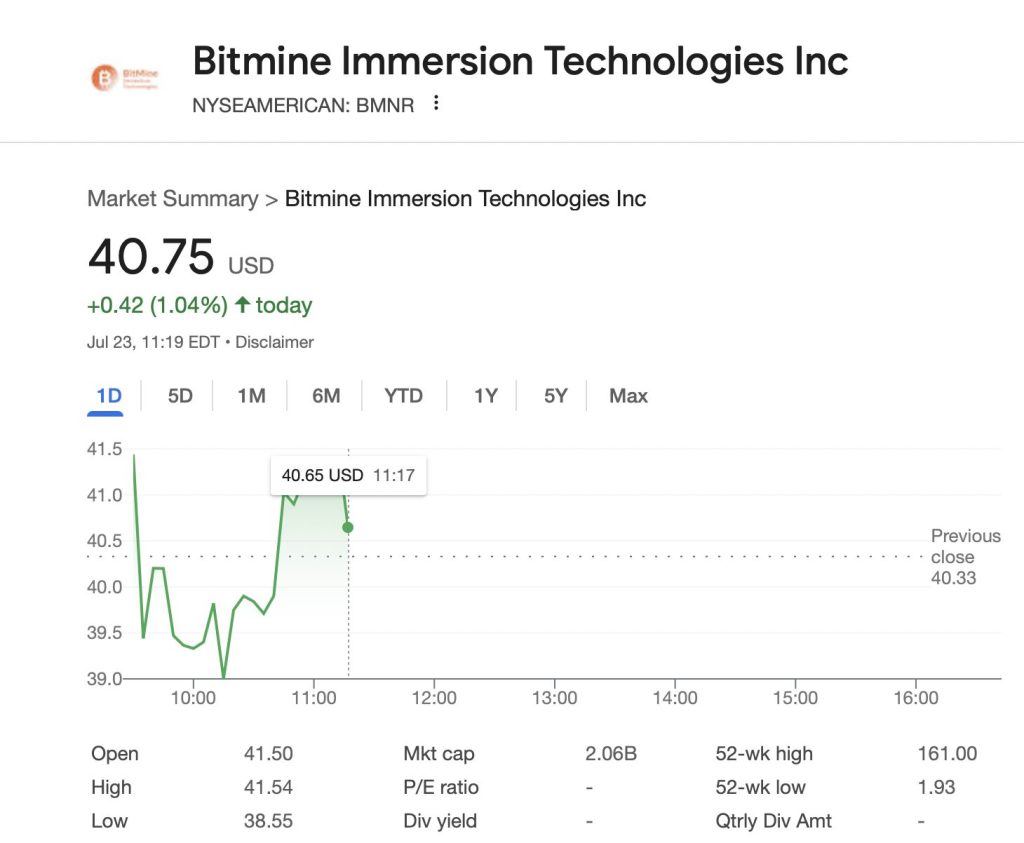

At the time of publication, BitMine Immersion Technologies (BMNR.A) shares rose 1.04% in early trading on Wednesday.

You May Also Like

Whales keep selling XRP despite ETF success — Data signals deeper weakness

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued