Metaplanet Buys 775 BTC, Now Holds $1.94 Billion In Bitcoin

Japanese Bitcoin treasury company Metaplanet has announced a fresh BTC acquisition, adding $93 million worth of the asset to its reserves.

Metaplanet Has Expanded Its Bitcoin Treasury Holdings

As revealed by Metaplanet president Simon Gerovich in a new post on X, the company has acquired another 775 BTC. The purchase occurred at an average price of $120,006 per token, meaning that the firm spent a total of $93 million on the stack.

This buy has taken Metaplanet’s holdings to 18,888 BTC, with a total cost basis of $1.94 billion. At the current price, the company’s reserve is worth around $2.17 billion, implying a positive unrealized gain of just under 12%.

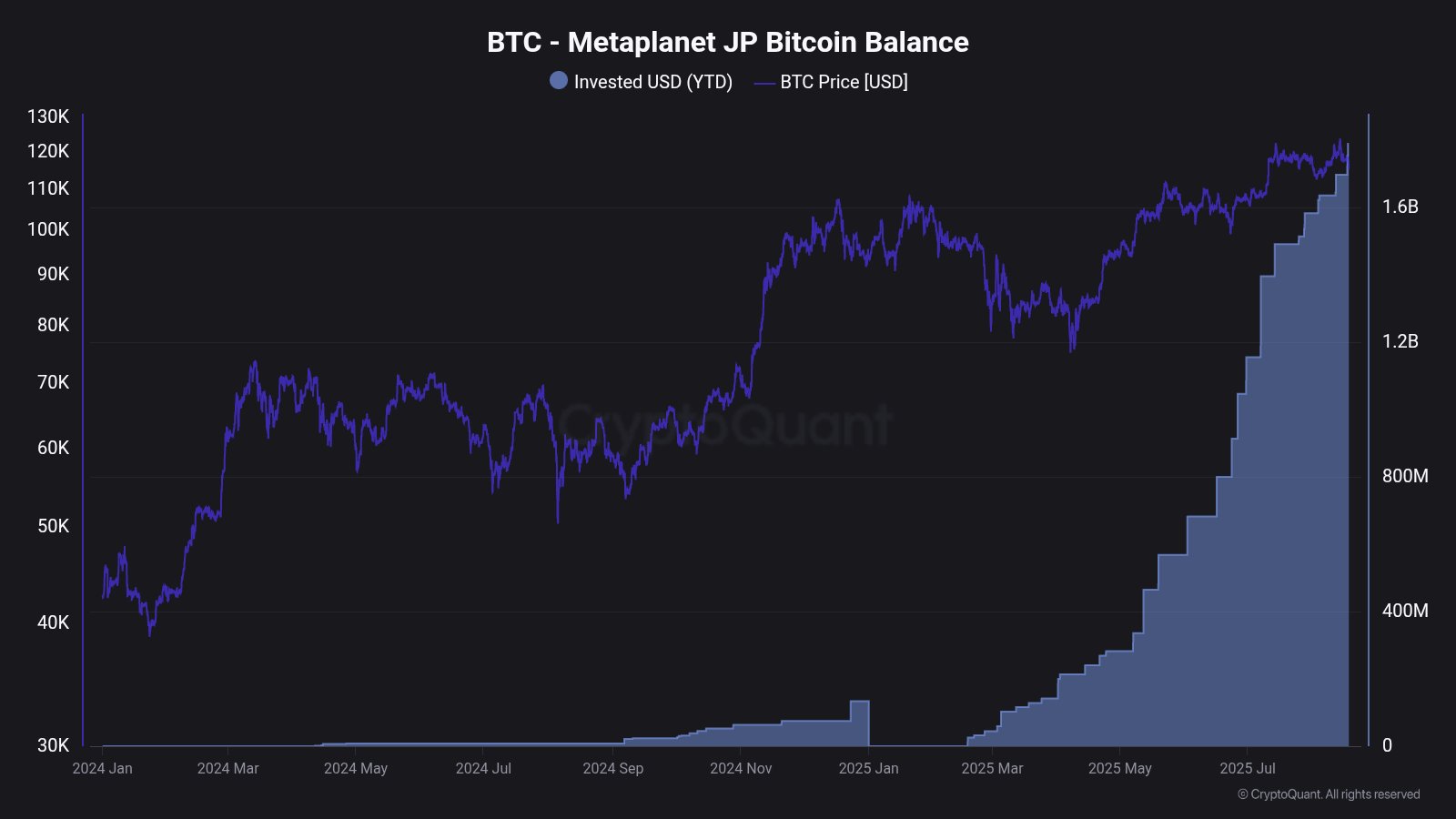

CryptoQuant community analyst Maartunn has shared a chart that shows how the firm’s buys have looked since it adopted a treasury strategy last year:

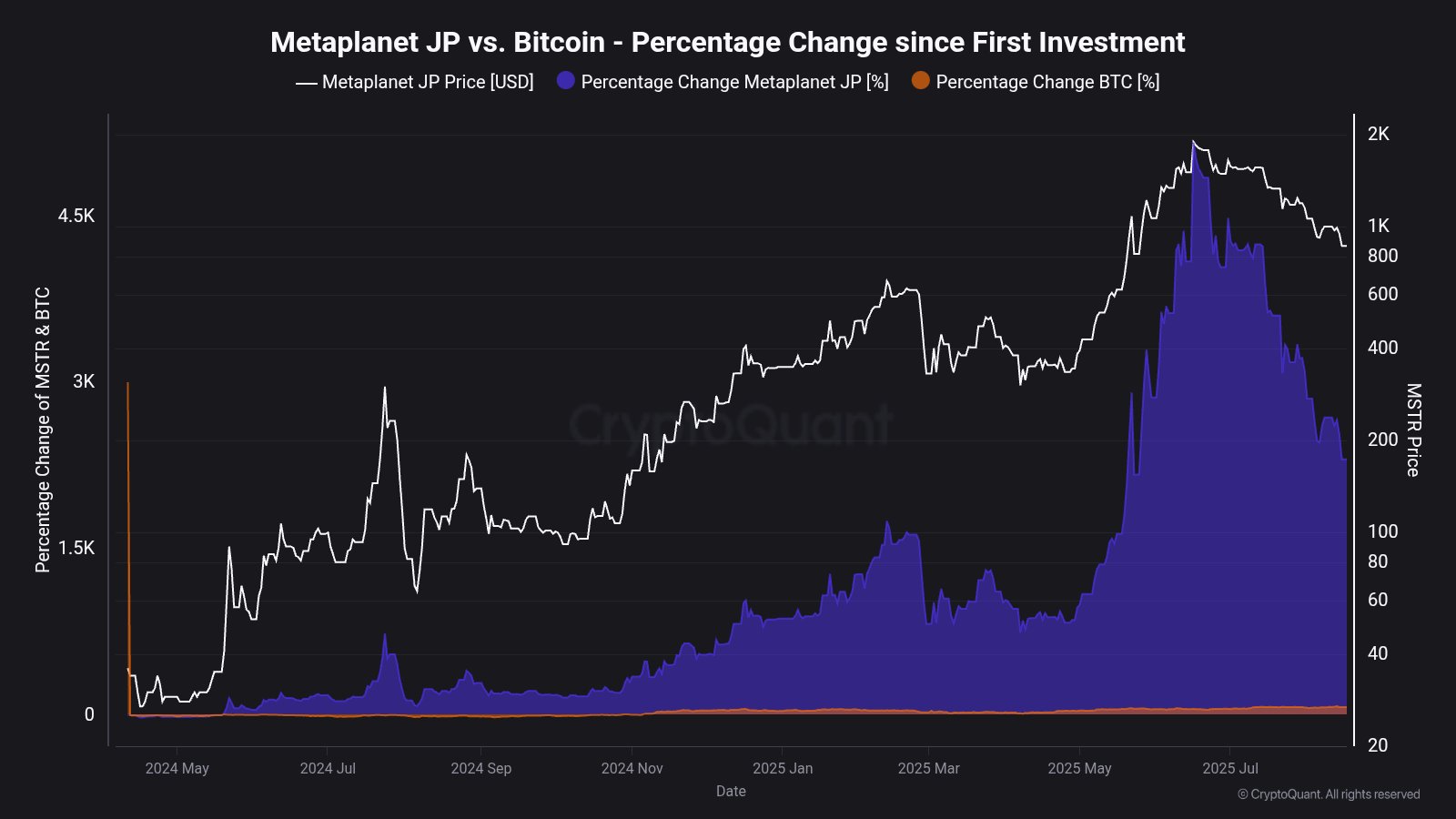

The latest acquisition has come after the firm last week reported that Q2 2025 was its strongest quarter ever, with huge turnarounds occurring in ordinary profit and net income. Though, despite this performance, the stock price of Gerovich’s company remains 50% down since the all-time high (ATH) set back in June.

The OG Bitcoin treasury company, Strategy, has also just unveiled a new purchase. According to Chairman Michael Saylor, the acquisition has involved 430 BTC bought for a total of $51.4 million. This has taken the total reserve of the company to 629,376 BTC with a cumulative cost of $46.15 billion.

Saylor usually hints at purchases a day in advance by posting the Strategy BTC portfolio tracker with a cryptic caption. This time was no different, as the chairman made a post on Sunday sharing the tracker with the words: “Insufficient Orange.”

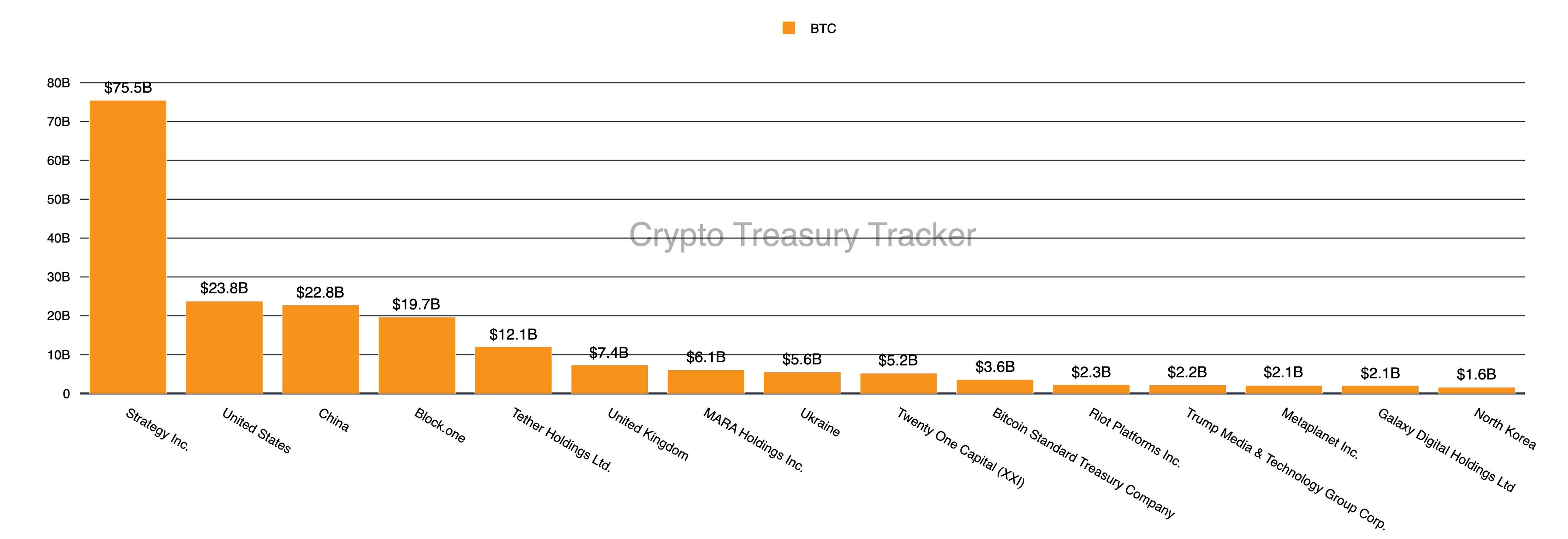

Strategy is currently the largest holder of the cryptocurrency among both companies and governments. Here is a chart shared by institutional DeFi solutions provider Sentora in its report on BTC treasuries, which puts into perspective how the firm compares to Metaplanet and others:

As displayed in the graph, Strategy’s Bitcoin holdings are significantly higher than those of the next largest holder, the US government. The difference is more gradual from there, with third-placed China sitting just $1 billion under the US.

Metaplanet is all the way down in the thirteenth position, but if its accumulation remains as consistent as it has been lately, it might be able to climb up a couple of spots in the near future.

BTC Price

While treasury companies may be busy accumulating Bitcoin, the asset’s price has plunged to the $115,100 mark.

You May Also Like

WLFI Bank Charter Faces Urgent Halt as Warren Exposes Trump’s Alarming Conflict of Interest

UNI Price Prediction: Targets $5.85-$6.29 by Late January 2026