Foundation Investors In Cardano Have Been Spotted Buying Rollblock? Is This A Big New Player?

As the crypto market gears up for the most explosive phase of the cycle, smart money has started rotating profits from majors into low cap crypto gems. On-chain analysis shows that legacy Cardano investors have been accumulating Rollblock at low prices during the ongoing presale of the RBLK token.

Rollblock is an innovative GambleFi platform, and it’s been gaining significant traction thanks to its revenue-sharing model and proven track record of processing over $15 million in wagers since launch. Let’s discover what makes this newcomer special and why analysts have been tipping it as the next 100x moonshot.

Rollblock: Enter The GambleFi Revolution

The reported interest from Cardano bulls in Rollblock represents a significant validation of the platform’s potential within the crypto world. Operating as a fully gaming platform for over 12 months, it has demonstrated profitability and scalability, setting itself apart from the numerous vaporware projects that populate the space.

The platform addresses critical pain points in traditional online gaming through blockchain integration. Built on Ethereum’s smart contracts infrastructure, Rollblock provides provably fair gaming mechanics with transparent, immutable transaction records. This eliminates the trust issues that plague legacy providers, while delivering near-instantaneous payments across 50 different cryptocurrencies.

Rollblock’s gaming ecosystem spans over 12,000 entertainment titles, from classic staples like blackjack and poker to cutting-edge blockchain exclusives. The platform’s sports betting functionality adds another dimension of play, covering major leagues and tournaments to capture the growing sports wagering market.

Rollblock’s gaming ecosystem spans over 12,000 entertainment titles, from classic staples like blackjack and poker to cutting-edge blockchain exclusives. The platform’s sports betting functionality adds another dimension of play, covering major leagues and tournaments to capture the growing sports wagering market.

Apart from its vast gaming offering, Rollblock also boasts a revolutionary rev-sharing model which places it on the list of the top DeFi tokens. Up to 30% of weekly revenue funds systematic token buybacks from the open market, 40% of which are then redistributed to holders as recurring staking crypto rewards.

The remaining 60% of repurchased tokens are burned forever, permanently reducing the circulating supply and creating the ideal deflationary environment for RBLK to rise sustainably in value.

Rollblock Highlights:

- Proven operational platform generating verified revenue streams • Transparent weekly profit distribution through buyback programs

- Systematic token burning creating long-term supply scarcity

- Market-leading staking yields for passive income generation • Growing user base with thousands of daily active participants

- Regulatory compliance through Anjouan Gaming licensing

- Security validation via comprehensive SolidProof auditing

- Continuous platform expansion driving user growth and revenue

As smart money recognizes Rollblock’s position in the crypto gaming space, institutional accumulation could accelerate significantly. This could position early retail bidders for potentially exponential gains as the platform moves toward major exchange listings and broader market adoption.

Cardano Starts The Week In The Red, Will Support Hold?

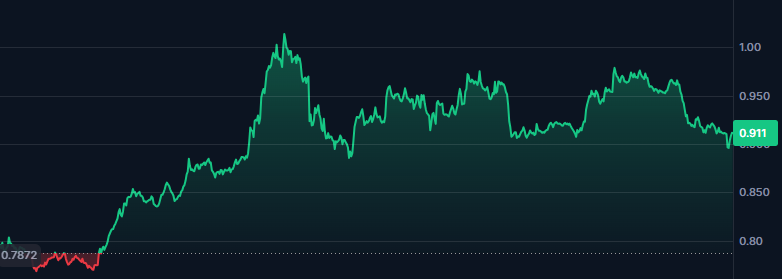

Cardano (ADA) has been rising steadily over the last two months, bouncing off the $0.54 bottom and nearly doubling in value. Over the week, Cardano finally retested the critical $1 resistance, but this is where selling pressure began mounting and consolidation failed, forcing Cardano to retrace.

Source: CoinMarketCap

Source: CoinMarketCap

Currently, Cardano trades at $0.91, following a 5.1% intraday decrease. This is where a cool-off phase could start for Cardano, however, its long-term prospects remain sound, as prominent analysts point out. Web3MATO has shared a compelling macro overview of Cardano’s price action and he expects that a 100%-150% rally is well within the realm of possibility. The Long Investor seems to share a similar opinion as well.

On the other hand, it’s worth noting that at a $32 billion market cap, Cardano’s room for growth is substantially smaller when compared to low cap projects such as Rollblock that have yet to enter their parabolic phase, which is why investing in RBLK could yield much higher returns in the long run.

Join The Rollblock Presale Before The Next Price Surge

Cardano remains a solid bet for predictable returns, but they are eclipsed by Rollblock’s crypto moonshot potential, which could bring a 100x multiplier to early buyers..

The RBLK presale offers a great opportunity to stock up on tokens at a discounted price of just $0.068. As demand is growing rapidly, experts believe that an 800% increase is in the cards before the end of the presale, making today the best time to get involved!

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Foundation Investors In Cardano Have Been Spotted Buying Rollblock? Is This A Big New Player? appeared first on Blockonomi.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

The man accused of stealing $11 million in XRP has filed a countersuit against the widow of American country music singer George Jones.