Best Altcoins to Buy as Ethereum Outflows Signal Renewed Accumulation

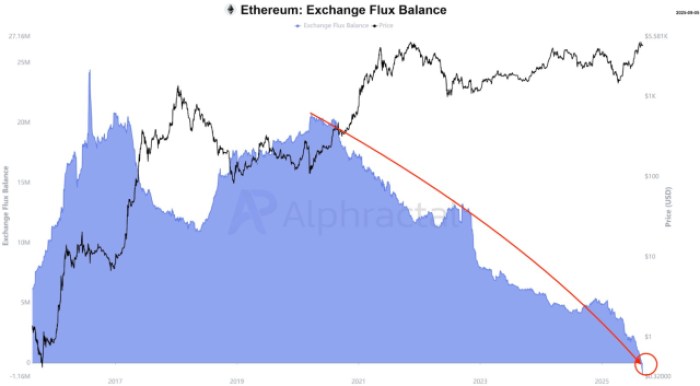

Ethereum exchanges are drying up quickly as ETH exchange ‘flux’ turns negative for the first time ever.

Flux, by the way, calculates the cumulative net flow of ETH across all exchanges.

A positive flux means there are more ETH deposits, which simply shows people are selling more ETH and buying less.

A negative flux balance, however, indicates more outflows of ETH from exchanges than inflows, suggesting aggressive buying among market participants.

Data from CryptoQuant also suggests that the balance of ETH on exchanges has now hit a new rock bottom, indicating strong institutional buying.

- Recently, Yunfeng Financial Group, backed by Chinese tycoon Jack Ma, bought 10,000 ETH worth $44M as part of its reserve strategy.

- Meanwhile, BitMine Immersion Technologies, the largest institutional holder of ETH, added around 153,000 tokens, taking their stash past the $8B mark with 1.86M ETH in holdings. BitMine, in fact, now holds 1.5% of the total ETH supply.

Additionally, three ICO-era whales recently moved $645M worth of Ethereum to a new staking address.

These 150,000 ETH were originally bought for just $0.31, and instead of booking $643M in gains, these whales chose to stake the tokens for steady yields.

This highlights how institutions increasingly view Ethereum as a yield-generating asset rather than just a speculative bet.

Let’s dig into ETH’s technical charts to understand how the next few weeks could pan out. We’ll also suggest the best altcoins to buy now to make the most of this momentum.

Ethereum Technical Analysis: Awaiting a Breakout

After surging 139% since the beginning of May and teasing the $5K level on August 24, Ethereum has now entered a symmetrical triangle pattern, with key support at around $4,000.

A symmetrical triangle typically signals the continuation of a strong bull run. A breakout here could see $ETH quickly reclaim previous highs and march toward $5,500 and beyond.

According to Bitbull, a crypto trader with 67K followers on X, $ETH is holding a rising trendline on the daily timeframe. And as long as it doesn’t break below, $ETH remains a good buy.

More importantly, as $ETH rises, so does the broader altcoin market, which often delivers astronomical returns.

If you’re looking to make the most of Ethereum’s upcoming rally, here are a few cryptocurrencies worth watching right now.

1. Bitcoin Hyper ($HYPER) – Supercharging the Bitcoin Blockchain with Solana-Like Performance

Bitcoin Hyper ($HYPER) is the best crypto to buy now thanks to its game-changing mission to improve Bitcoin’s real-world utility.

$HYPER is building the first true Layer 2 solution for Bitcoin, aimed at turbocharging the network with lightning-fast speeds, ultra-low fees, and full Web3 compatibility.

Why’s this important? Because beyond its appeal as an investment vehicle, Bitcoin doesn’t provide much value to core crypto users: it’s painfully slow, congested, and expensive.

By integrating the Solana Virtual Machine (SVM), $HYPER will let developers build smart contracts and decentralized applications on Bitcoin itself.

Additionally, a decentralized, non-custodial canonical bridge will let you interact with Hyper’s Web3 environment by converting your native Bitcoin into Layer-2-compatible tokens.

You can then use these wrapped $BTC tokens to engage in high-speed DeFi trading, NFTs, lending, staking, and DAOs – all without leaving the Bitcoin blockchain.Buy $HYPER now while it’s still in presale and available at some of its lowest-ever prices.

At the moment, 1 $HYPER is priced at just $0.012865, and the project has already raised a whopping $14.1M from early investors.

Plus, according to our Bitcoin Hyper price prediction, the token could hit $0.32 by year-end – a staggering 2,400% gain for early buyers.

Visit Bitcoin Hyper’s official website for more information.

2. Maxi Doge ($MAXI) – Hype-Driven Meme Coin Gunning for 1000x Returns

If you think you’ve leaned a little too much on the cautious side and stacked only mainstream, utility-driven altcoins, consider Maxi Doge ($MAXI).

It’s a new meme coin in presale, fronted by a bulked-up, angrier, and potentially more profitable version of Dogecoin.

Maxi is, in fact, Dogecoin’s distant cousin – but the two are anything but close. Dogecoin’s success and ‘cute’ vibe ruined Maxi’s childhood, as his family members were too busy hyping Doge to pay him any attention.

Looking for revenge, Maxi found solace in the gym and in front of the charts.

He built up his muscles and his crypto brain, crafting both a robust personality and a creative plan to overthrow Doge as the best meme coin on the planet.

The plan? Aggressive marketing. Think PR campaigns, influencer collaborations, and social media blitzes.

In fact, the project’s developers have reserved a whopping 40% of the total $MAXI supply for marketing purposes.

And despite not having any ‘revolutionary’ utility, holding $MAXI could still be extremely rewarding. You’ll get access to holder-only events, like weekly trading competitions and leaderboard prizes.Currently in presale, $MAXI has already pulled in over $1.88M from early investors, with each token priced at just $0.000256.

Check out Maxi Doge’s official website for more information.

3. Tutorial ($TUT) – Viral Altcoin Capable of Riding Crypto’s Renewed Momentum

Tutorial ($TUT) emerged as one of the top trending cryptos in the June–July rally, gaining a whopping 200%.

And now, with another run-up on the cards, the token is again showing signs of a potential explosive move to the upside.

It’s up over 16% in the past week, currently trading around $0.06886 – just one big green candle away from its all-time highs.

Beyond that, there’s really no resistance stopping the token from going absolutely bonkers and potentially becoming the next 1000x crypto.

What’s driving its momentum? Hype and community backing, of course – but $TUT is also one of the few tokens that hits the sweet spot between popularity and utility.

As the name suggests, Tutorial is an education-based crypto offering easy-to-understand lessons on topics like setting up a crypto wallet, writing smart contracts, and trading on decentralized exchanges, helping newbies learn the ropes of crypto and blockchain.

Wrapping Up

Ethereum exchanges are drying up at a record pace, signaling a never-before-seen interest from deep-pocketed players looking to load up as much of the ‘digital silver’ as possible.

This trend, combined with a potential interest rate cut in September, could send $ETH and other altcoins straight to the moon.

If you want to capitalize on this rally, consider loading up on low-cap, high-upside tokens like Bitcoin Hyper ($HYPER), Maxi Doge ($MAXI), and Tutorial ($TUT).That said, kindly remember that the crypto market is highly volatile and unpredictable. This article is not financial advice. Always do your own research before investing.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Will XRP Price Increase In September 2025?