AERO price stalls, but smart money buying points to a surge

The Aerodrome Finance token, or AERO, remains under pressure. It dropped for the third consecutive day, and yet the ongoing smart money buyers aren’t giving up.

Aerodrome (AERO) price dropped to $0.8920, below this week’s high of $0.98. It remains about 205% above its lowest point in April this year.

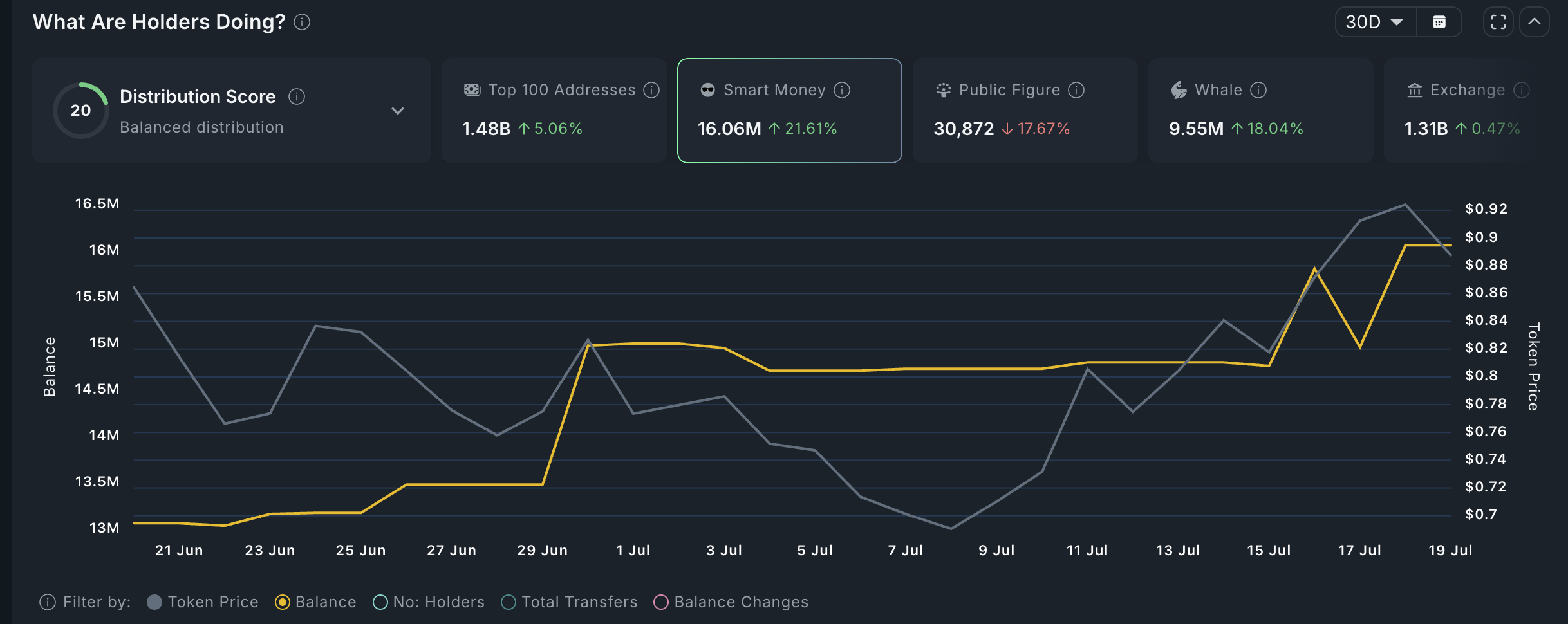

On the positive side, third-party data shows that smart money investors continue to accumulate AERO. They bought tokens worth $1.3 million in the last seven days, bringing their holdings to over $16 million.

The same is happening with whales, who have increased their holdings by 18% in the last 30 days to 9.55 million. Whales are investors with vast holdings of a token, while smart money investors are those with a successful track record of success.

AERO wavered even as its weekly network volume jumped. DeFi Llama data shows that Aerodrome, the biggest decentralized exchange on Base, handled over $4 billion this week, up from $2.6 billion in the previous week.

The volume could continue to rise after Coinbase announced major changes to its ecosystem. It launched TBA or The Base App as the replacement to the Coinbase Wallet. TBA will combine wallet, trading, payments, social media, messaging, and mini-applications. Aerodrome will be one of the top trading platforms on the applications.

AERO price technical analysis

The daily chart shows that the AERO price has been in a bull run in the past three months. This rally started when the token bottomed at $0.2850 in April.

It has jumped above the 50-day and 100-day Exponential Moving Averages, a sign that bulls are in control. The token has also formed an ascending channel and moved above the 23.6% retracement level.

Therefore, the Aerodrome price will likely continue rising as bulls target the 50% retracement level at $1.3085, which is up by 45% above the current level.

The potential risk to the thesis is that it has formed a rising wedge pattern, which may lead to more downside in the near term.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Coinbase Joins Ethereum Foundation to Back Open Intents Framework