ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

40304 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Quantum Computing Crypto Threat Is Exaggerated: CoinShares Reveals Sobering Reality

2026/02/09 06:25

Platinum Near $2,100 as Gold and Silver Face Speculative Exodus

2026/02/09 06:15

Tom Lee Says Ethereum’s 40% Crash Fits a Classic V-Shaped Recovery Pattern

2026/02/09 06:03

Top Crypto Presales for February Include Pepepawn and OPZ, but the Upcoming Crypto That Looks Like a True 100x Thunder Is DeepSnitch AI

2026/02/09 06:00

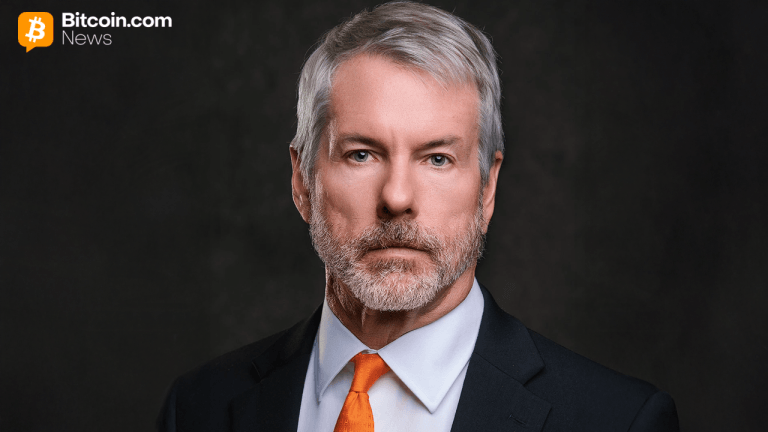

Strategy’s Boss Hints at New Bitcoin Accumulation as Unrealized Loss Tops $3.4 Billion

2026/02/09 05:30