ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

40185 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Next 1000x Meme Coin Signal: APEMARS Stage 7 Tops Best Crypto to Buy Today With 9763% Upside While SHIB, FARTCOIN Lag

2026/02/08 08:15

Top Altcoin Picks: Origin Expands Ecosystem, and Maker Strengthens DeFi While APEMARS Lead as Next Crypto To Hit $1 With 9,700% ROI

2026/02/08 08:15

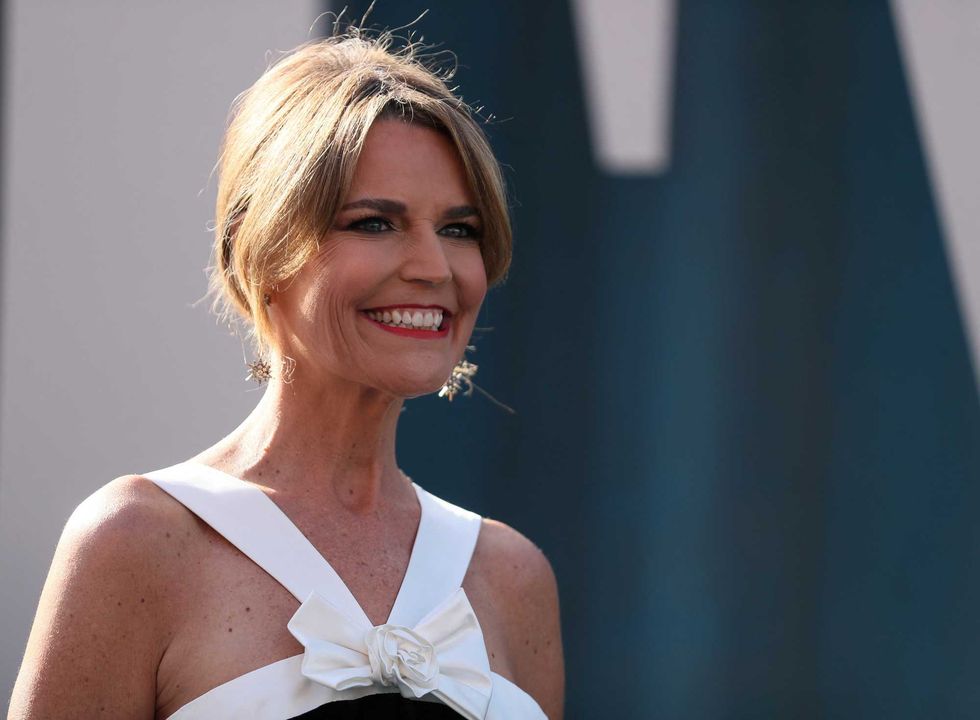

Savannah Guthrie communicates with mom's kidnappers in new vid: 'We received your message'

2026/02/08 08:13

Trading volume for BTC and ETH surged unusually in the early hours of the morning, causing sharp price fluctuations in a short period.

2026/02/08 08:02

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

2026/02/08 07:30