ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

39989 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

“cnjrefcod” 30% Off Trading Fees

2026/02/07 06:42

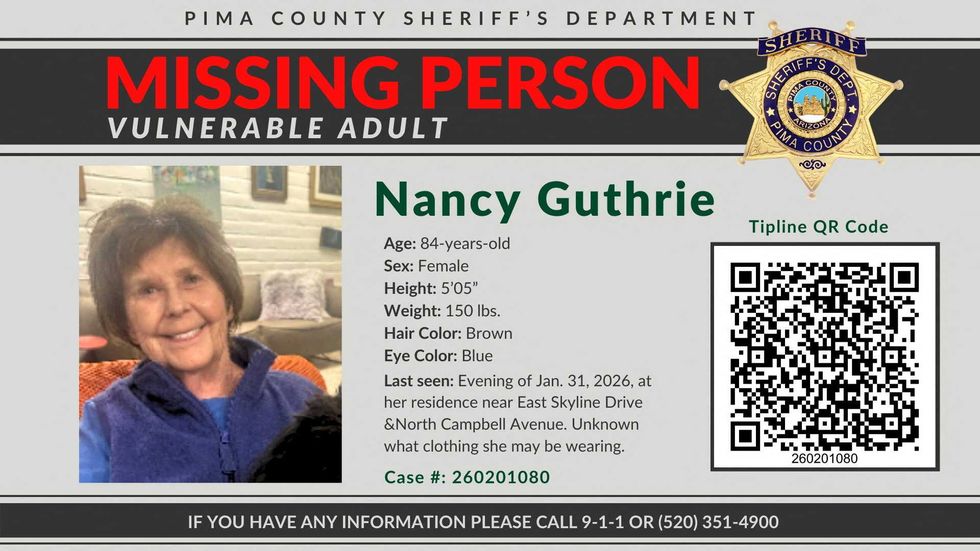

New note emerges in abduction of Nancy Guthrie

2026/02/07 06:32

Stablecoin Inflows Surge as Bitcoin Struggles Under Persistent Selling Pressure

2026/02/07 06:04

XRP snaps back after near-20% sell-off as volatility dominates post-crash trading

2026/02/07 06:03

Stellar (XLM) Jumps 7% as $0.183 Breakout Signals Potential Reversal

2026/02/07 06:00