ETF

Share

A crypto ETF is a regulated investment fund that tracks the price of one or more digital assets and trades on traditional stock exchanges like the NYSE or Nasdaq.Following the success of Bitcoin and Ethereum ETFs, the 2026 market now includes Solana ETFs and diversified Altcoin Baskets. ETFs serve as the primary vehicle for institutional capital and retirement funds (401k/IRA) to enter the Web3 space. This tag tracks regulatory approvals, AUM (Assets Under Management) inflows, and the impact of Wall Street on crypto liquidity.

39593 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Waymo’s ‘Self-Driving’ Claims Get a Reality Check on Capitol Hill

2026/02/06 07:08

AomiFin Insights on the Largest Bitcoin Whales and Current BTC Holding Distribution

2026/02/06 07:01

Ethereum Network Activity Breaks Records Even As ETH Price Stalls

2026/02/06 07:00

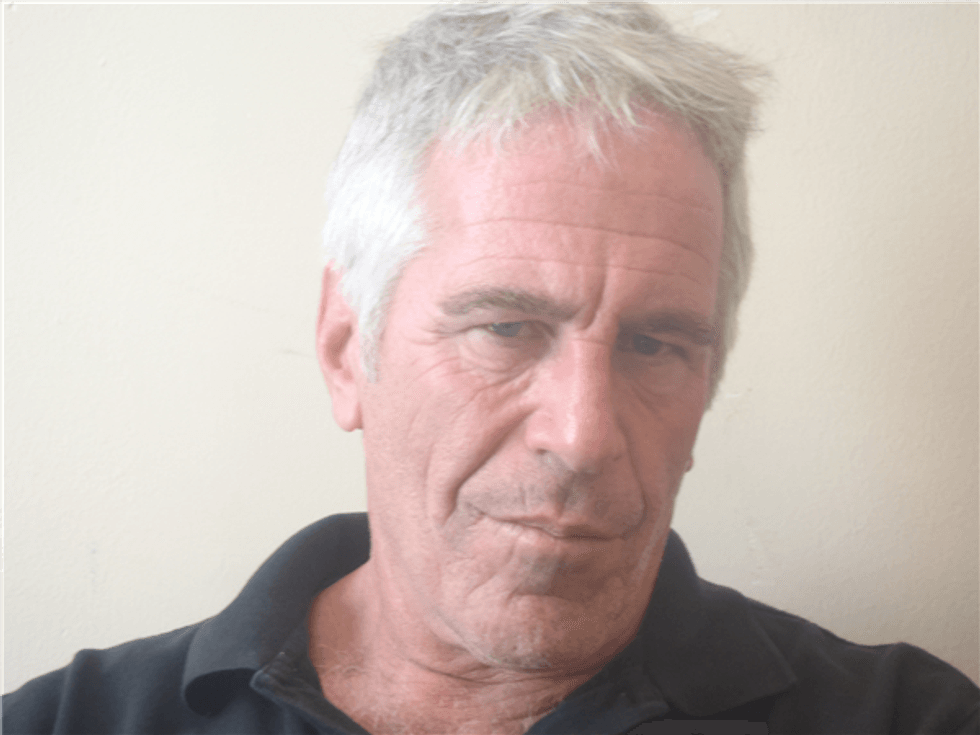

Epstein waged 'full court press' to get clemency from ex-Florida gov: report

2026/02/06 06:54

Crypto Treasuries Fall Deeply Underwater as Bitcoin, Ethereum and Solana Dive

2026/02/06 06:47