Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

16655 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Taiwan Semiconductor (TSM) Stock: The One Play That Wins Every Time a Data Center Gets Built

2026/02/23 01:34

GOP congressman pounces after Alex Jones accuses him of Epstein cover-up

2026/02/23 01:28

Pundit to XRP Holders: I Can’t Believe This. Something Massive Is Coming

2026/02/23 01:05

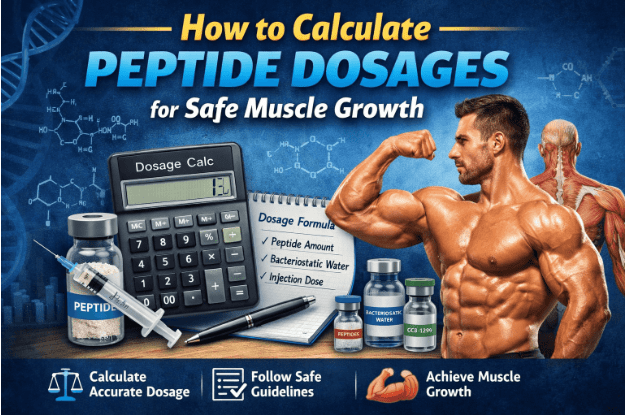

How to Calculate Peptide Dosages for Safe Muscle Growth

2026/02/23 00:48

Leading PR Firms for Crypto Exchanges in 2026

2026/02/23 00:31