Which trading tool is best for both bull and bear markets? An in-depth analysis of the winners and losers of TG, AI agents, and DEX/CEX trading robots

By ELAINE HU , Cointelegraph

Compiled by: Tim, PANews

The crypto market has witnessed a significant adoption of automated trading solutions, with trading bots gaining prominence due to their ability to analyze vast amounts of data and execute trades with pinpoint accuracy.

This article takes an in-depth look at the historical performance of trading robots and the dramatic fluctuations in token prices. By backtesting the returns of strategies against a "buy and hold" benchmark, it decodes which robots performed best in specific market cycles and when they performed well, helping you accurately match the best trading robot based on your investment style and risk tolerance.

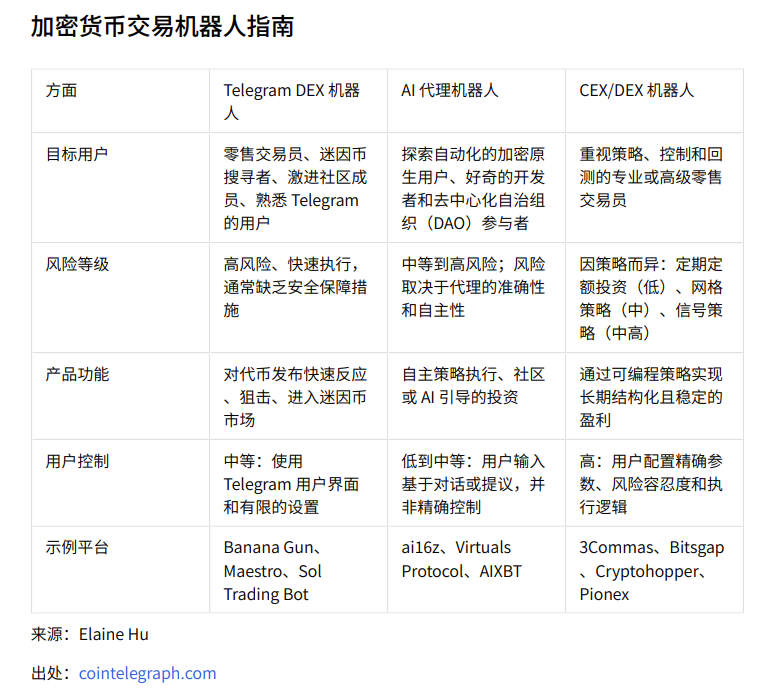

This article examines three types of trading bots: Telegram-based DEX trading bots; non-Telegram bots that trade on DEXs and centralized exchanges; and the more recent and evolving AI agent bots.

Choosing the right trading robot requires considering the user’s goals, risk tolerance, and experience.

in short:

Telegram robots are ideal for opportunistic trading scenarios such as token issuance and memecoins, which require quick response and timing.

Artificial intelligence agent bots (such as ai16z or Virtuals) are suitable for users who want to fully automate operations and are willing to try experimental strategies.

Centralized exchange bots offer the most control and are particularly suited for executing structured strategies such as DCA, grid trading, or signal-based trading.

Robot Trading Strategies and Performance

Trading bots are complex automated systems that analyze crypto market data through algorithms and autonomously execute trades on centralized exchanges or decentralized platforms. Such systems typically run 24 hours a day, 7 days a week with little human intervention. Their core function is to analyze massive amounts of real-time and historical market data, including key indicators such as price fluctuations, trading volume, and order book information.

There are many potential advantages to using AI agent trading robots. Their continuous operation ensures that no trading opportunities are missed, as these robots can monitor the market 24/7 and adapt to the dynamic changes in the global market. Some platforms that provide such robots also have backtesting functions, which allow users to evaluate the potential effectiveness of different trading strategies through historical data before investing real funds in actual trading.

Telegram DEX bot

Telegram trading bots run on the Telegram platform, taking advantage of its convenience and real-time communication to execute transactions directly on decentralized exchanges. Such bots usually focus on improving transaction speed and snapping up new tokens, especially attracting users of ecosystems such as Solana. The newly launched protocol also integrates common features of centralized exchange trading bots, such as grid trading, cost averaging (DCA) and limit orders.

Telegram bots, such as Maestro and Unibot, first appeared around 2020-2021. By 2022, many of them had begun offering advanced features, such as copy trading and arbitrage.

By the end of 2023, Solana-chain-based trading bots such as BONKBot and Trojan Bot have attracted much attention for their ability to quickly trade Meme coins on decentralized exchanges. The biggest advantage of this type of Telegram bot is that users can complete transactions directly on their mobile devices without having to connect to their wallets through browser plug-ins. This feature greatly optimizes the ease of use of mobile transactions, while strengthening market monitoring functions and seamless integration with social networks.

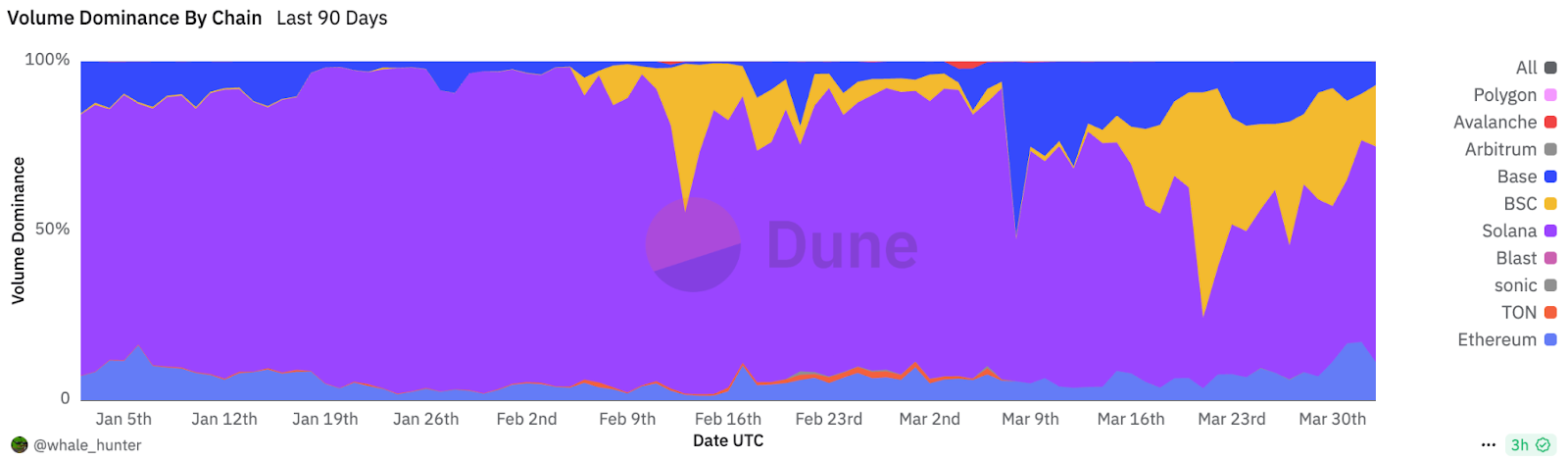

The top five Telegram bots across blockchain platforms by historical transaction volume are Trojan, BonkBot, Maestro, Banana Gun, and Sol Trading Bot. Over the past 90 days, the vast majority of transactions occurred on the Solana blockchain, and all five of these top Telegram bots operate on the Solana chain.

The Battle of DEX Trading Bots Source: Dune Analytics

The functionality offered by the Telegram bots is very similar, with the difference being that some of them, such as Maestro and Banana Gun, focus on multi-chain operations, while the rest focus on the Solana chain.

The main purpose of Telegram robots is to automatically identify profitable trading entry and exit points and quickly execute trades; however, since the individual profits and losses of users generated by each transaction are difficult to track, some Telegram robots (such as Banana Gun and BonkBot) use a revenue sharing model tied to their tokens, that is, using the 1% handling fee collected to repurchase their own tokens, and use the token price and protocol income (collected handling fees) as approximate indicators to measure the market performance of trading robots.

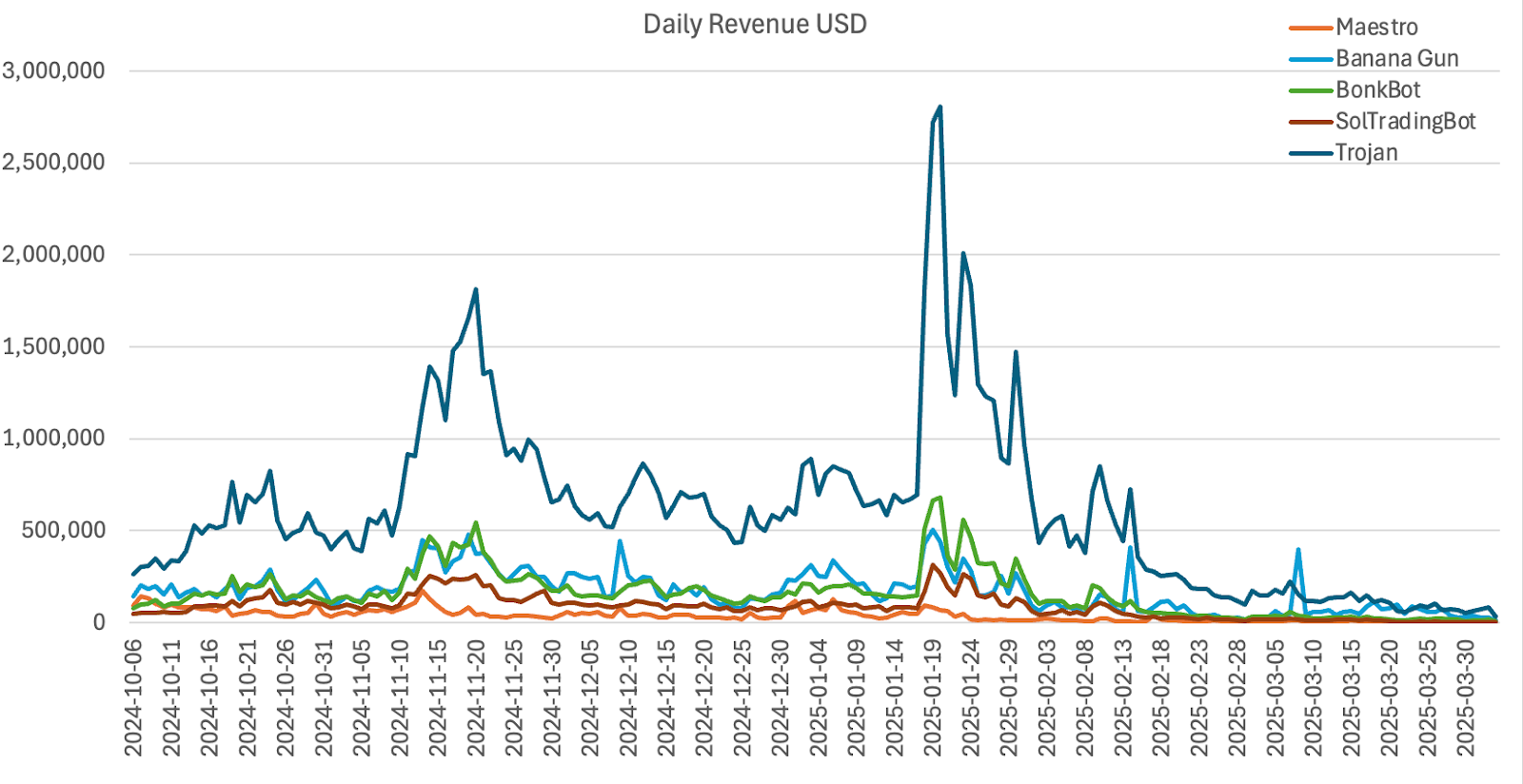

Daily revenue of Telegram bots (in USD) Source: Dune Dashboard

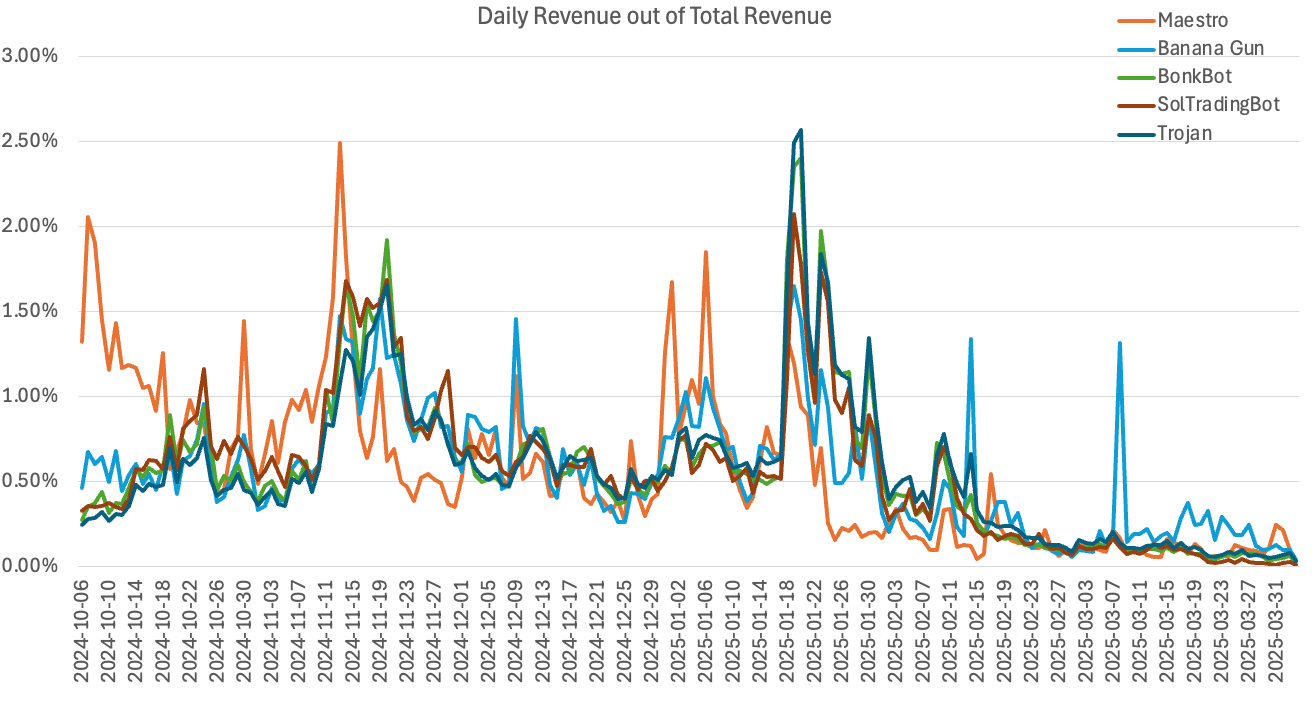

Daily income as a percentage of total income Source: Dune Dashboard

Telegram DEX bot revenue in the past 6 months

Looking at overall revenue over the past six months, Trojan had the highest nominal fee amount (approximately $109 million), while Sol Trading Bot had the highest median daily revenue after normalizing daily revenue to total revenue.

They all peaked during the meme coin boom around January 2025, but are now facing sharply declining returns due to the broader market downturn.

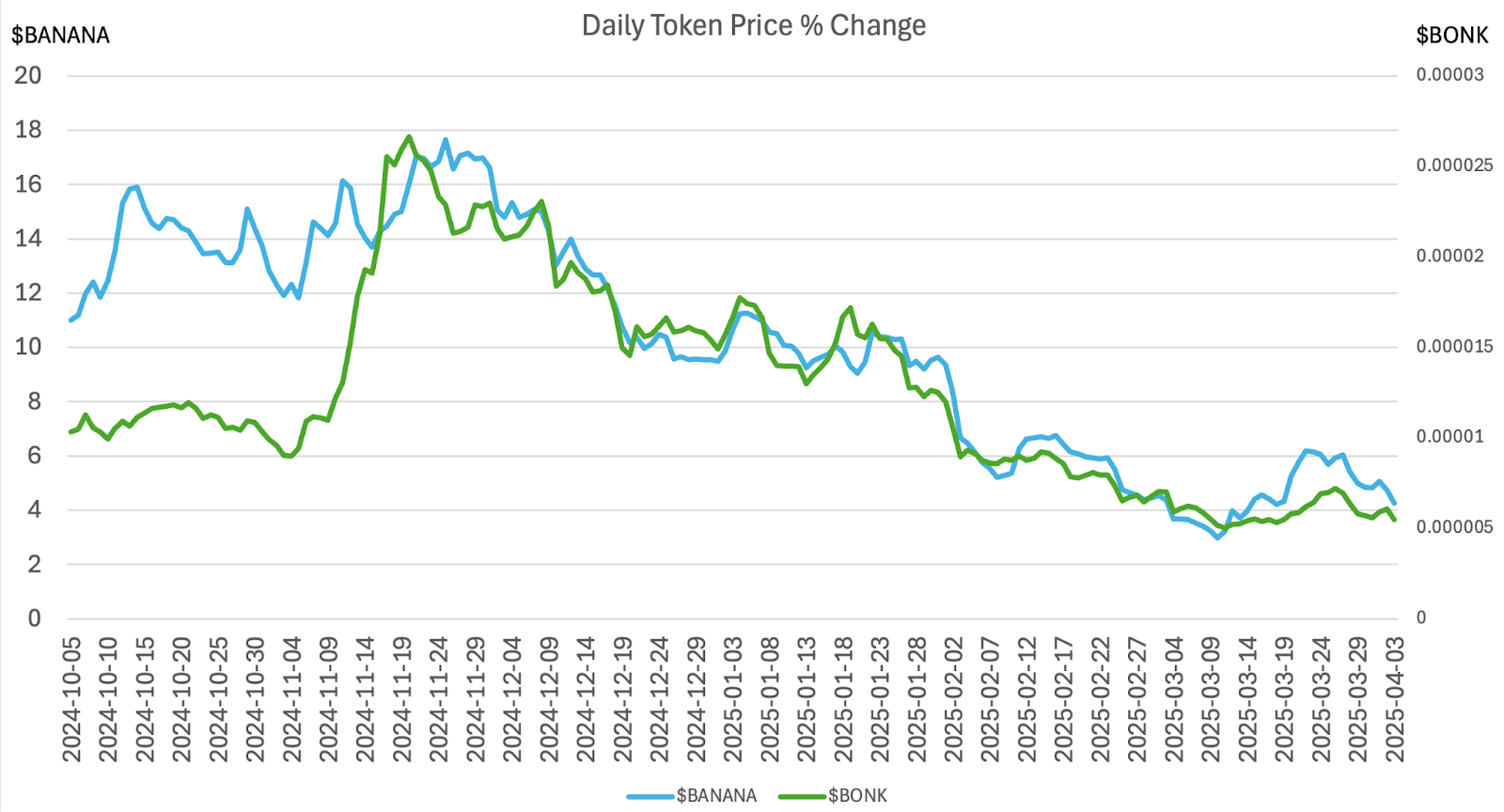

Daily token price change percentage Source: Dune Analytics

BANANA and BONK token price performance

The price action over the past six months shows that, with the exception of the BONK token, which saw a significant rise in November 2024, the rest of the two Telegram bots that share revenue via tokens, Banana Gun and BonkBot, have performed very similarly. Both have experienced significant price drops in the recent bearish market environment.

AI Agent Robot

AI agent trading robots are highly sophisticated automated systems that use artificial intelligence (AI) and machine learning (ML) algorithms to analyze cryptocurrency market data and execute trades autonomously.

The term "agent" indicates that this type of robot has a certain degree of autonomy and decision-making ability, which goes beyond the fixed rule-based operation in traditional automated trading systems. The most well-known AI agent frameworks are Virtuals and ai16z.

AI Agent Robot Comparison

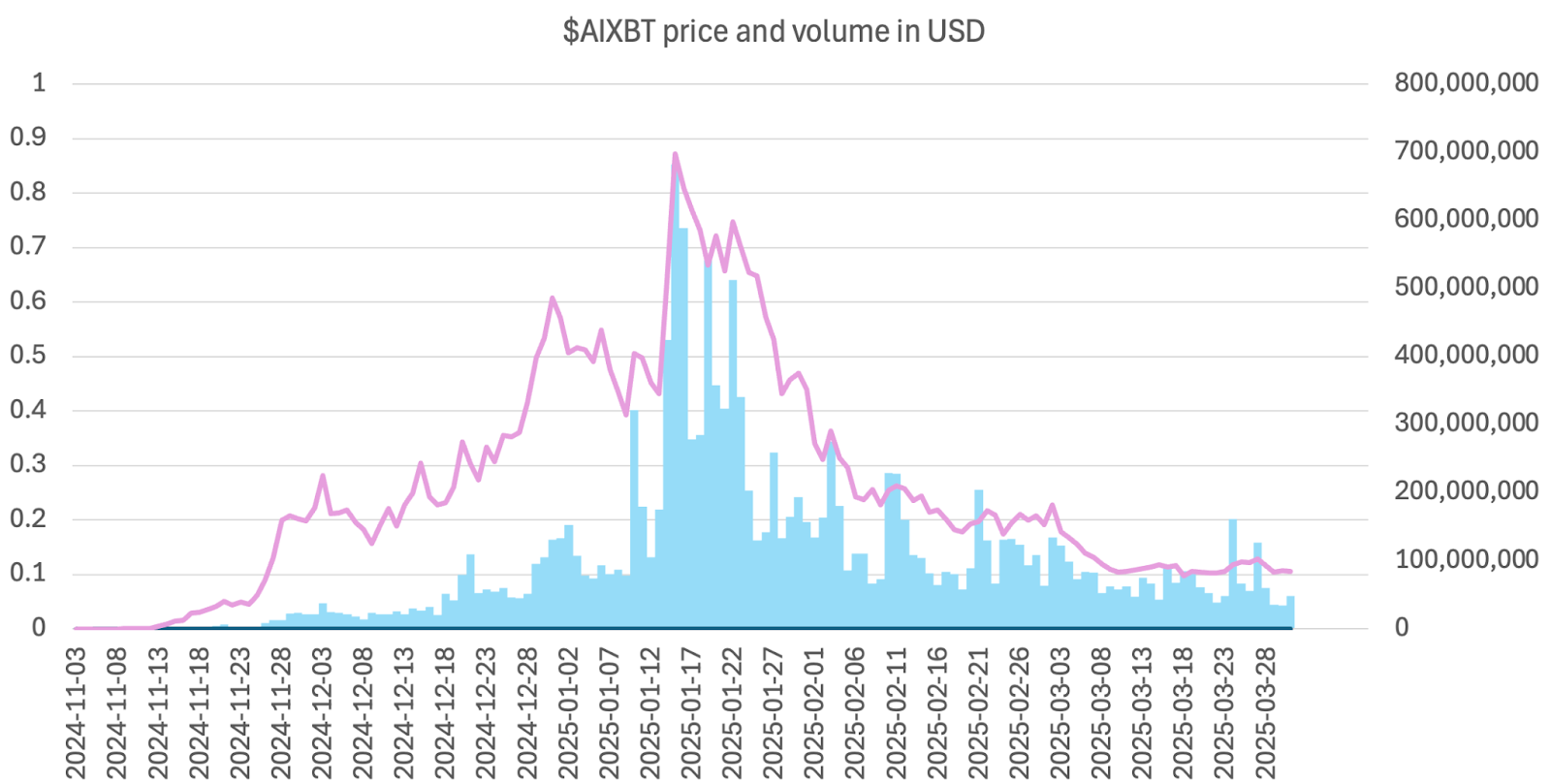

Launched on Ethereum's second-layer network Base in October 2024, Virtuals Protocol is an AI agent generation platform that aims to simplify the creation and deployment process of AI agents on the blockchain. Although the protocol is not designed for trading, its platform supports the development of AI agents that may be used for trading purposes. For example, the experimental AI agent Aixbt on the platform is able to track the hot topics of discussion on social media X, identify potential market signals by analyzing user conversations, and generate strategy recommendations that can assist trading decisions.

Since the Virtuals Protocol adopts a LaunchPad model where individual agents (such as LUNA and AIXBT) are issued as independent tokens and operate in a number of different areas such as gaming, trading, and entertainment, we will focus on analyzing the market performance of the trading agent token with the largest market capitalization on the platform: AIXBT.

AIXBT price history Source: CoinMarketCap

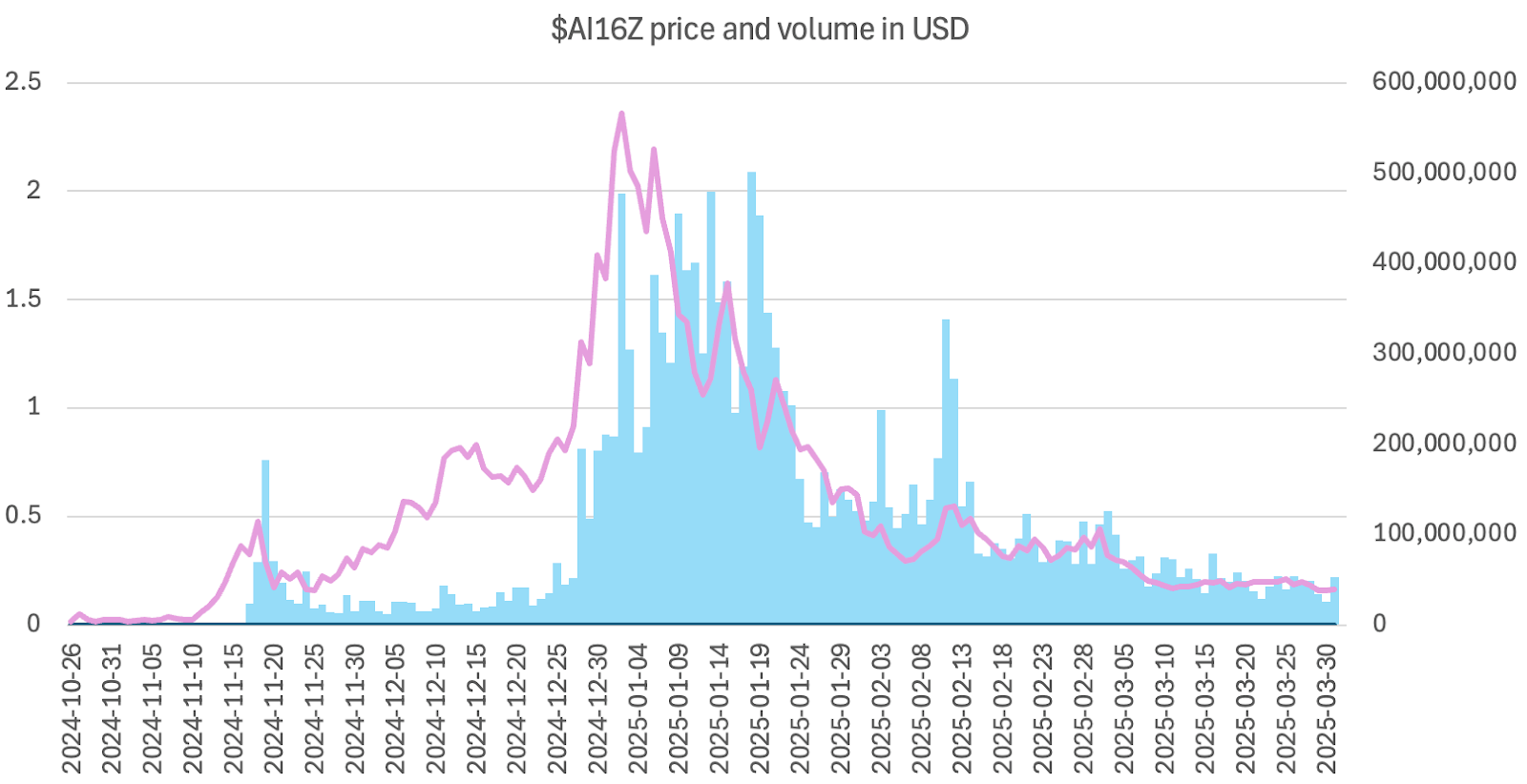

Ai16z is an AI-driven trading fund running on the Solana blockchain. Launched in October 2024, the fund uses a sophisticated AI agent built on the Eliza framework to autonomously analyze market information such as market price fluctuations, social media sentiment, and on-chain data, and automatically execute trading decisions.

The fund operates as a decentralized autonomous organization (DAO), allowing its native token holders to participate in key decision-making governance through voting and influence trading strategies through a "virtual trust market". Marc, a virtual fund manager AI built by the Eliza framework, is responsible for managing fund trading activities. The AI16Z token represents fund ownership and grants governance rights, and the operations of its intelligent agents will directly affect the value of the token.

AI16Z price history source: CoinMarketCap

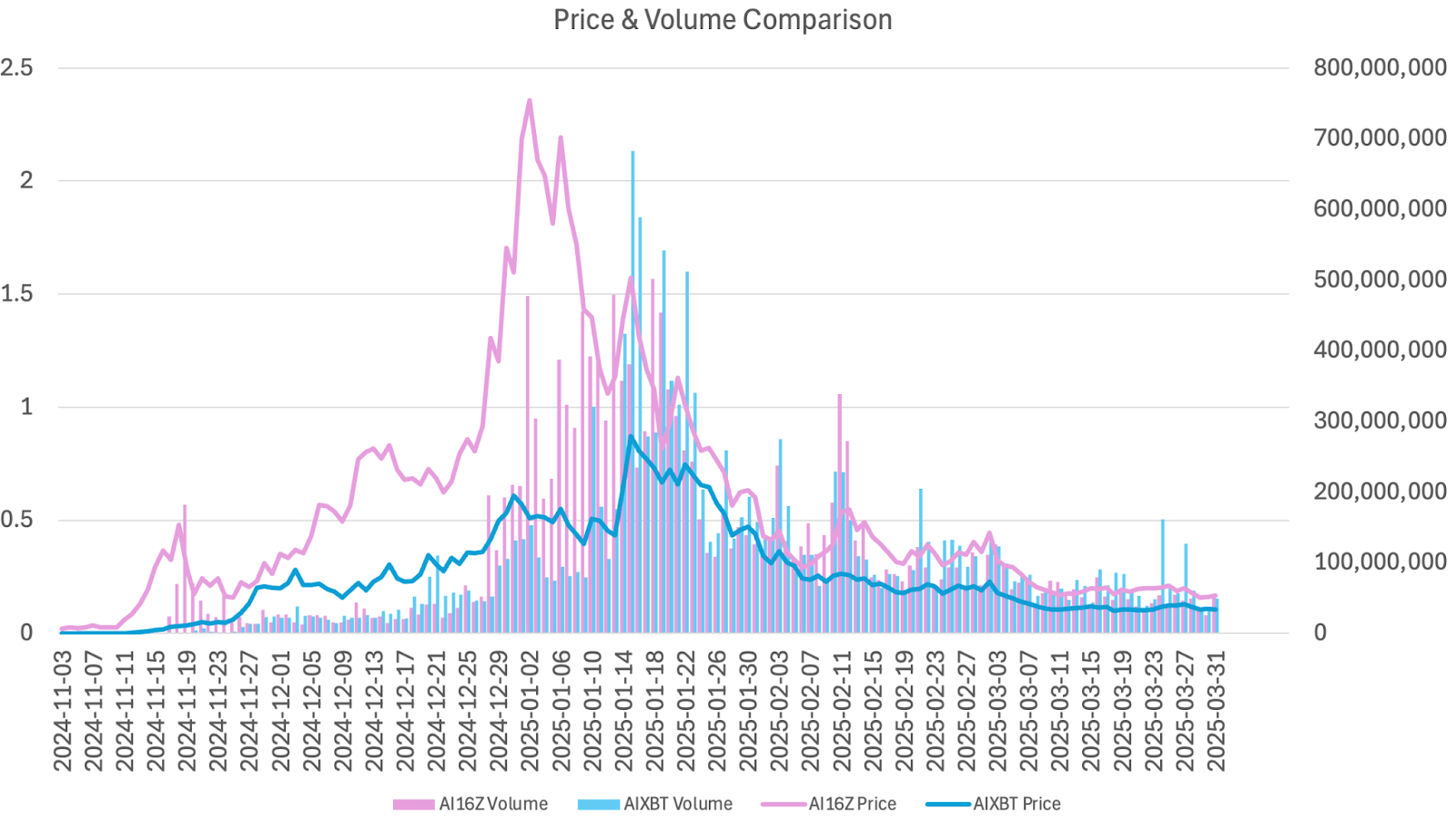

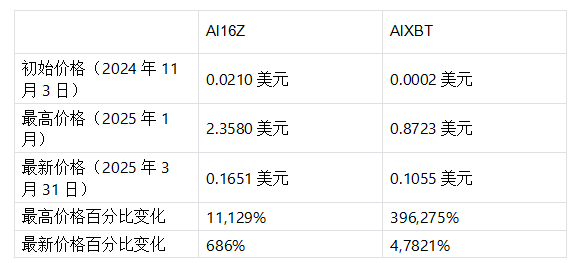

By comparing the transaction volume data of the two agents, it can be found that they both reached their peak in January 2025, with AI16Z's transaction volume of US$501 million and AIXBT's transaction volume of US$682 million setting a higher record. It is worth noting that AI16Z's price peak appeared slightly earlier than its transaction volume peak, while AIXBT's price and transaction volume peak were basically synchronized during the same period, showing a closer correlation between the two in terms of time dimension.

Comparison of prices and trading volumes of AI16Z and AIXBT. Source: CoinMarketCap

AI16Z and AIXBT price performance

AIXBT's price performance is more impressive than AI16Z. At its peak in November 2024, its token price soared nearly 4,000 times from its initial offering price, while AI16Z only increased by about 111 times during the same period. Even with the recent decline and the overall market in a downward trend, the latest price records as of the end of March 2025 show that AIXBT still maintains a 478-fold increase from its initial price, while AI16Z remains at 6.8 times.

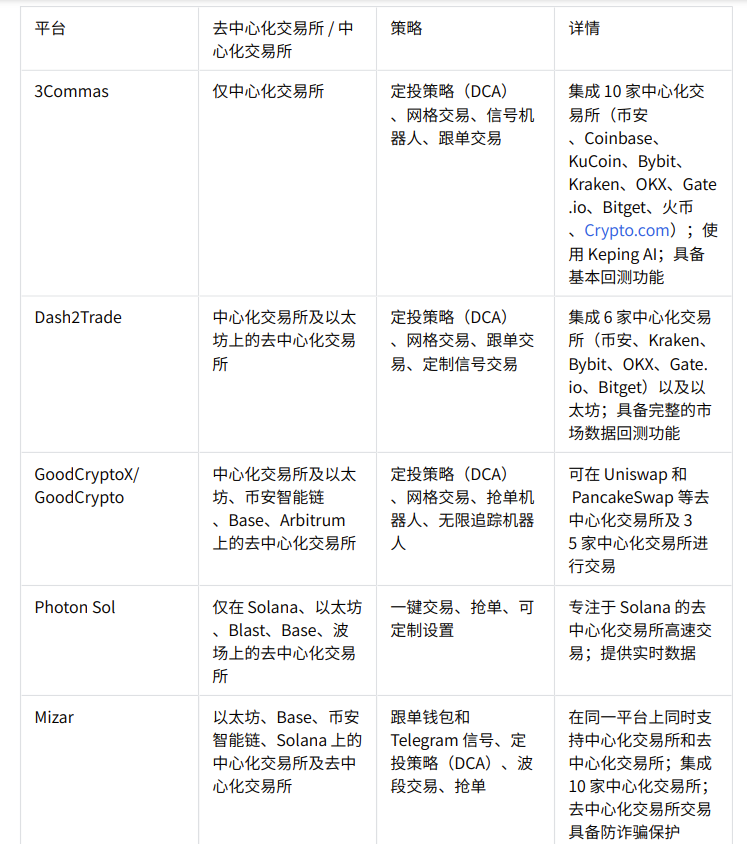

DEX/CEX Robots

These platforms are built on the web and run independently of Telegram. Users can trade directly on DEX through wallet connection, or connect to CEX through API interface or simple login. These functions are all part of the exchange solution integrated by the platform.

These web-based platforms offer a wide range of strategy options and broader market access channels, and their functional design takes into account both the user's demand for CEX liquidity and reliability, as well as the non-custodial and decentralized characteristics of DEX. Some platforms also support quick switching between DEX and CEX with one-click operation, making it easier to capture the price difference between centralized exchanges and decentralized exchanges (i.e., CEX-DEX arbitrage opportunities).

The most common strategies on these platforms include grid trading, dollar cost averaging, and signal bots. Dollar cost averaging bots invest a fixed amount of money in cryptocurrencies at fixed intervals (regardless of how the asset price fluctuates). The core idea of this strategy is to spread out entry points over time, thereby reducing the impact of market fluctuations. This type of strategy tends to perform well in markets where prices are showing clear trends.

Designed for active trading, the grid trading robot profits from price fluctuations through a structured buy low, sell high strategy. The robot places a series of limit buy and sell orders at set intervals above and below a preset price range, thereby constructing an order "grid". Each completed buy low, sell high cycle will generate a profit, and this strategy performs best in sideways and volatile markets.

Signal trading robots execute trades based on external signals, which usually come from technical indicators, market analysis or third-party services. Common signal indicators include Relative Strength Index (RSI), Exponential Moving Average (EMA), Bollinger Bands, etc.

Comparison of different DEX/CEX strategies

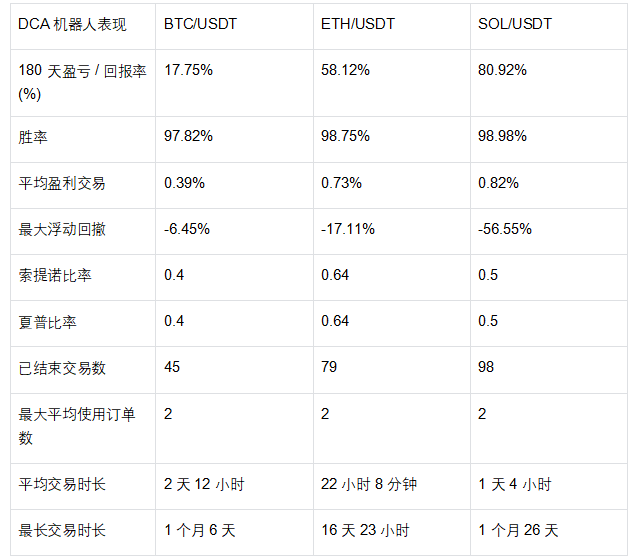

The following table shows the historical performance of the three token pairs BTC/USDT, ETH/USDT and SOL/USDT under three trading strategies. Among them, the parameter selection of the grid trading robot uses the built-in AI optimization function of the 3Commas platform to automatically select the best parameters; and for the average cost method, the most popular classic trading strategy among the platform users is used.

For signal robots, Dash2Trade provides a strategy preset function, and the system automatically selects the best strategy for each token. These strategies are based on historical backtesting verification of the self-developed trading system and have been applied to real market transactions, but the validity period of the strategy is limited to the trading cycle within 120 days before January 26, 2025.

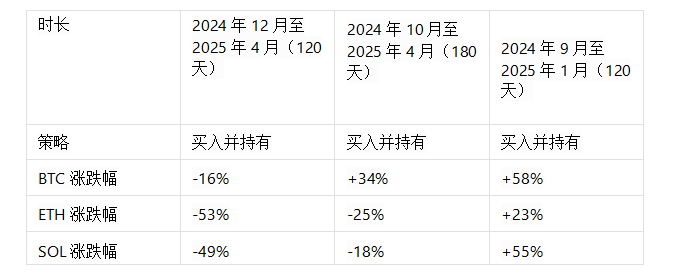

Due to the lack of consistent data available on various platforms, we used three backtesting periods for each strategy. The following table shows the simple price changes during the corresponding period, which also represents the return rate of a simple benchmark buy and hold strategy.

DEX/CEX robot strategy rise and fall

Available data suggests that the performance of trading robots can vary significantly, depending on the specific trading robot used, the trading strategy adopted, and the market conditions at the time of the backtest.

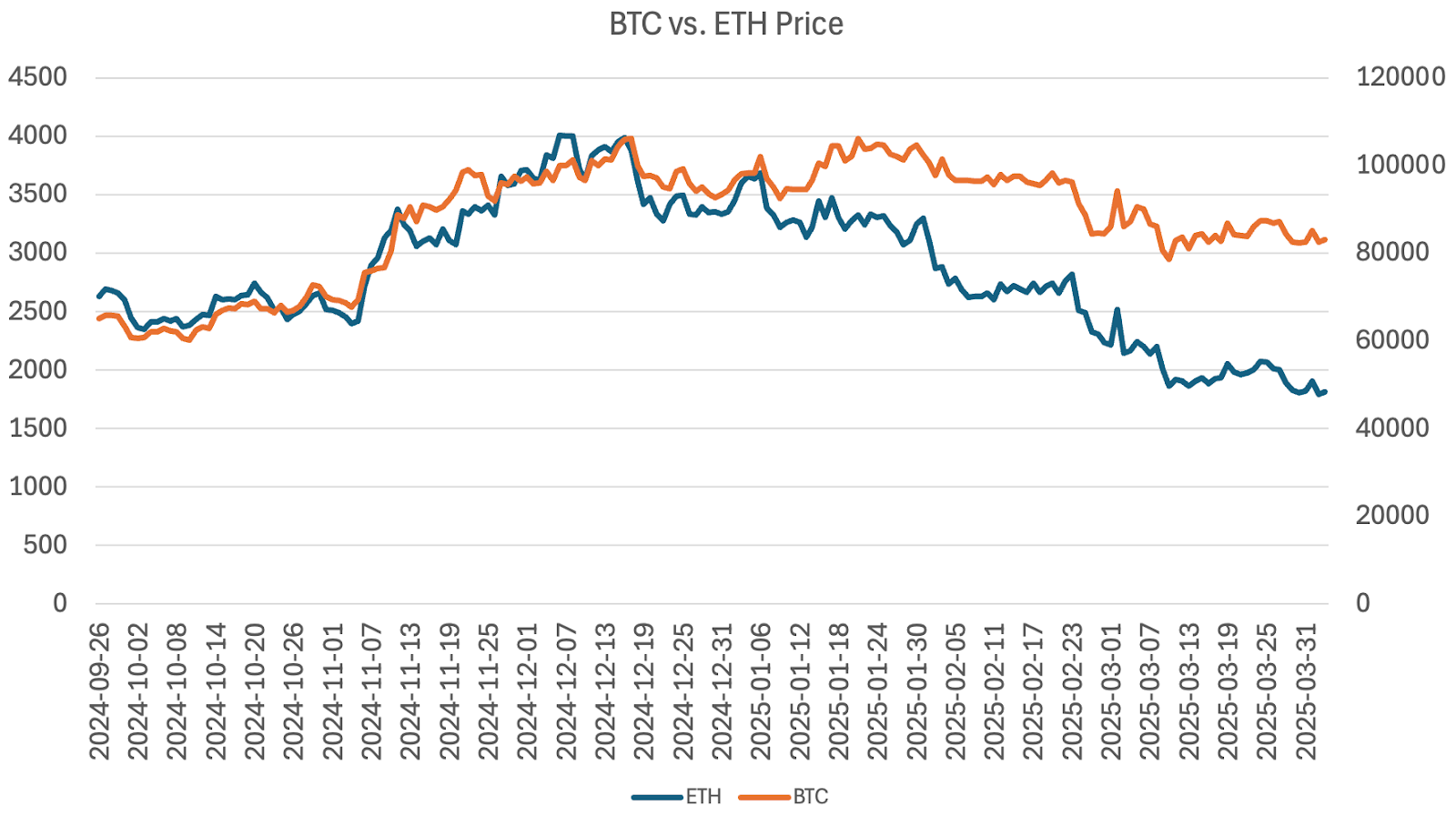

Bitcoin and Ethereum price data source: CoinMarketCap

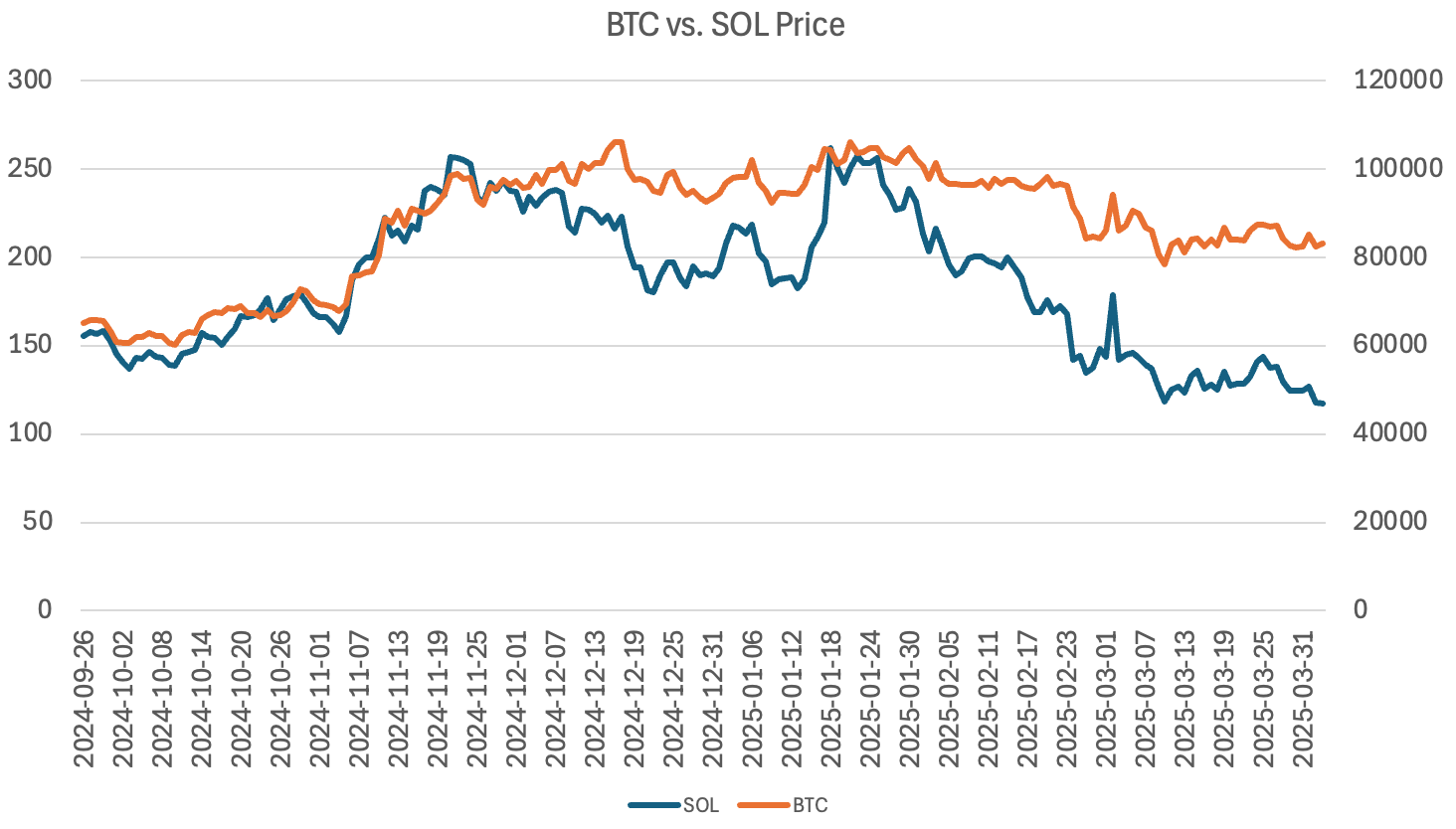

During the 120-day backtest period from September 26, 2024 to January 26, 2025, Bitcoin, Ethereum, and Solana all showed an upward trend, with buy-and-hold returns of 58%, 23%, and 55%, respectively. During this period, the Signal Robot's strategy performance was basically the same as the buy-and-hold strategy (some currencies were slightly inferior), specifically: Bitcoin strategy returns 58.15%, Ethereum strategy 16.79%, Solana strategy 48.68%.

In the same 120-day period from December 4, 2024 to April 4, 2025 (during which the Gridbot strategy was backtested), the market prices of Bitcoin, Ethereum, and Solana all showed a downward trend, and the returns of their buy-and-hold strategies were -16%, -53%, and -49%, respectively. This is in stark contrast to the market environment in the previous 120-day backtest period. In the market with a clear downward trend and volatile market conditions, the Gridbot strategy performed significantly better than the buy-and-hold strategy, creating positive returns for BTC (9.6%), ETH (10.4%), and SOL (21.88%).

Bitcoin and Solana price data source: CoinMarketCap

When the bot was backtested over the longest 180-day backtest period, from October 4, 2024 to April 4, 2025, the buy-and-hold strategy returned 34%, -25%, and -18% for Bitcoin, Ethereum, and Solana, respectively. In stark contrast, the Signal bot’s strategy performed very differently to the buy-and-hold strategy for these three tokens.

For Bitcoin, the DCA robot achieved a return rate of 17.75%, which is weaker than the one-time buy and hold strategy. However, the DCA returns of Ethereum (ETH, 58.12%) and Solana (SOL, 80.92%) significantly outperformed the one-time investment. This difference may be due to the fact that the volatility of ETH and SOL is significantly higher than that of BTC during the statistical period, and the DCA strategy effectively reduces the timing risk by investing funds in batches and dispersing the entry price.

Trading robot performance comparison

In the past six months, DEX robots such as Trojan and Sol Trading Bot have dominated in terms of revenue performance, with Trojan earning approximately $109 million in fees, while Sol Trading Bot has stood out due to its stable daily returns relative to its size.

However, the revenue of all trading robots peaked during the meme coin craze in January 2025, and then slowed down due to low market sentiment. Robots linked to tokens (such as BANANA and BONK) also showed a similar trend. After a short-term surge (especially BONK's outstanding performance in November 2024), they all fell sharply due to the overall market trend.

The AI agent robot market has seen explosive growth during the same period. The AIXBT token price has reached 4,000 times the issue price, far outperforming AI16Z (111 times). Even after a market correction, AIXBT remains at 478 times the issue price, while AI16Z has fallen back to 6.8 times. In terms of trading volume, both peaked in January 2025, but the AIXBT token price and trading volume have grown in lockstep, indicating strong speculative buying momentum.

CEX/DEX signals, grid trading, and fixed investment robots demonstrate the importance of market conditions, and there are significant differences in the returns of these strategies compared to buy-and-hold strategies.

In a rising market environment (backtest period September 2024 to January 2025), the signal robot performs close to the buy-and-hold strategy, but with slightly lower or comparable returns.

The Grid Robot outperformed in downtrends and high volatility environments (backtest period December 2024 to April 2025), beating the buy-and-hold strategy by a significant margin and reversing negative market returns into double-digit positive returns.

During the 180-day backtest period (October 2024 to April 2025), the performance of the DCA robot was clearly differentiated: although the fixed investment strategy for Bitcoin underperformed the simple holding strategy, the fixed investment in Ethereum and SOL significantly outperformed, which is likely due to the strategy's ability to absorb market fluctuations and volatility arbitrage advantages.

Key Takeaways

We delve into the wild world of AI-powered cryptocurrency trading bots: Telegram-based decentralized exchange bots, AI agent trading bots, and DEX/CEX bots for comparison. Each bot is a unique tool tailored for different traders and market conditions.

The Telegram DEX robot is designed with ease of use as the core, and its simple operation interface is directly embedded in the Telegram application. This type of robot focuses on Meme coin transactions and on-chain token issuance participation, mainly attracting investors and Meme coin enthusiasts who are proficient in mobile terminal operations and pursue fast transactions. Its special features include social copy trading, token dividend incentive mechanism, and deep integration of community attributes to meet users' needs for instant transactions and social collaboration.

In the past six months, Telegram DEX robots have generated considerable revenue, reaching a peak in the Meme Coin Season in January 2025. However, among these projects, only two tokens, BANANA and BONK, share revenue with users. In the recent bear market environment, the prices of these two tokens have suffered a sharp drop, with the BONK token plummeting 90% in three months, and the market value of the BANANA token shrinking to less than one-third of its peak. Data shows that although the overall trading volume of the DEX robot track remains active, the sustainability of the token economic model is facing severe tests.

AI agent robots lower the threshold for users to participate in governance (such as AI16Z's DAO model) or implement sentiment-driven strategies (such as AIXBT's X analysis) through natural language interfaces and AI decision-making capabilities. Its core advantage lies in the ability to abstract complex trading strategies through a conversational interface.

Although AI Agent Tokens have seen explosive growth, the recent market decline has led to a decline in trading activity and lower token prices. As a more experimental field, AI Agents are still in the development stage and are best suited for users who are curious about technology or seek solutions that combine simplicity and automation.

Trading robots running on DEX and CEX provide diversified strategies through web platforms, which are more suitable for experienced traders who need high-speed execution, multi-exchange access, high liquidity and complex configuration capabilities. Backtesting data shows that the signal robot's returns are comparable to the buy-and-hold strategy in the bull market, the grid robot performs well in the volatility decline market, and for high-volatility assets, the fixed investment robot's returns can exceed the buy-and-hold strategy.

You May Also Like

Token allocations on Binance are still a small share of total supply

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings