4 Best Altcoins For Cross-Border Payments: DigiTap ($TAP) Beats Ripple

SPONSORED POST*

Cross-border payments are one of crypto’s strongest real-world use cases. The market already processes more than $150 trillion annually and is predicted to pass $250 trillion by 2027. Ripple (XRP) set the standard for using blockchain in international transfers, but its institutional focus leaves plenty of room for consumer-ready projects.

We’ve picked four alt coins to watch—Digitap ($TAP), Toncoin (TON), TRON (TRX), and Litecoin (LTC)—because they each address the big criteria for cross-border money: speed, cost, adoption, and usability. For anyone asking what’s the best crypto to buy right now, these four deserve attention.

- Digitap ($TAP) — The Unified Money App

Digitap — the world’s first unified money app, or, as the company puts it, “a first look at the last money app you’ll ever need” — is quickly becoming one of the most talked-about projects in payments. Why? Because it’s not just making promises; it’s delivering on them.

The Visa co-branded card is already live, available in both virtual and physical form. You can spend crypto or fiat anywhere, and the balance auto-converts at checkout. Add Apple Pay and Google Pay integration, and suddenly, crypto feels as seamless as tapping your phone at Starbucks.

Next Big Presale? Watch DigiTap Closely

But let’s talk about the token itself. In presale, Digitap has already sold 8.79 million $TAP and raised over $109,000. The current stage price is $0.0125, set to climb to $0.0159 in just 18 days. That built-in price jump gives early buyers an obvious edge.

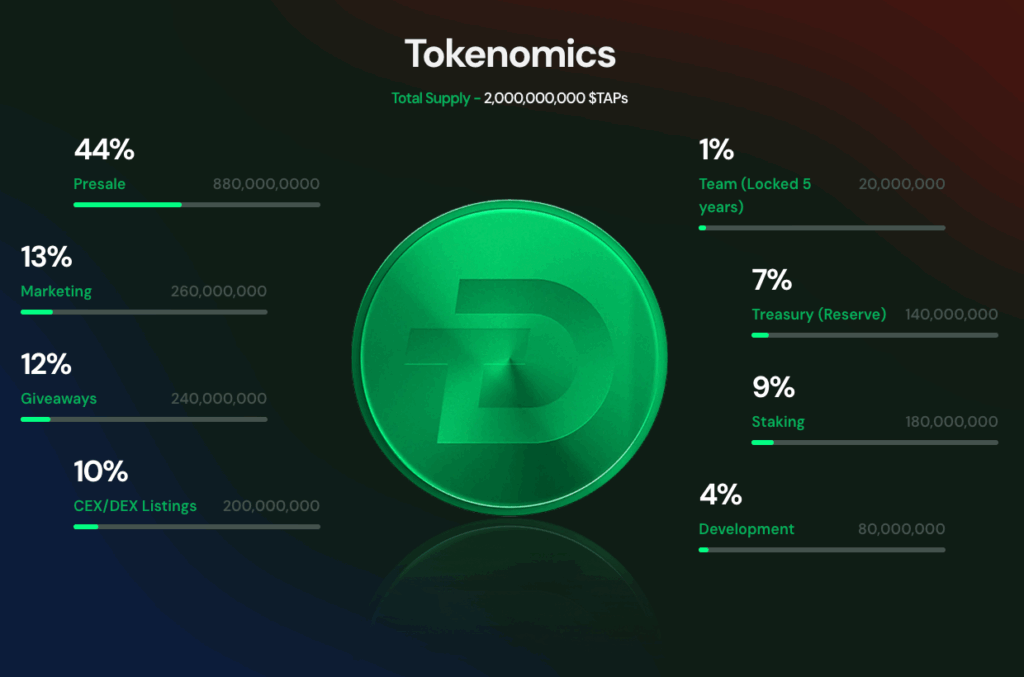

With a fixed 2B supply, staking rewards of up to 124% APR, and a deflationary buyback-and-burn model, $TAP is shaping up as one of the best crypto presales 2025. It has the rare mix of a working product and early growth momentum—a combination that makes it hard to ignore.

- Toncoin (TON) — Riding Telegram’s Wave

Toncoin has momentum thanks to its connection with Telegram, one of the largest messaging platforms on the planet. In July 2025, Telegram rolled out TON Wallet to over 87 million U.S. users, allowing crypto transfers directly inside chats. That kind of instant exposure is something most projects would kill for.

Toncoin trades around $3.15 with a market cap of about $8.1 billion. If even a slice of Telegram’s audience starts using it for payments, TON could become a mainstream rail overnight. The wildcard is regulation—tight scrutiny of a messaging-app-native coin could slow adoption. Still, TON’s distribution advantage is undeniable.

- TRON (TRX) — The Stablecoin Highway

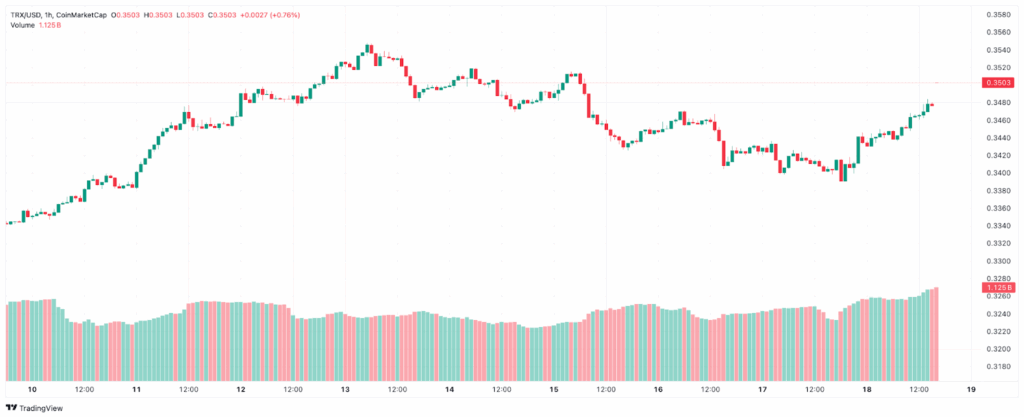

If you’ve sent USDT, chances are you’ve touched TRON. With more than $75 billion of Tether circulating on its network, it dominates stablecoin flows and has become the backbone for dollar-pegged transfers worldwide. That scale makes TRON indispensable in remittances, particularly in emerging markets where stablecoins are often a lifeline.

At around $0.34, TRON isn’t flashy, but it moves billions daily with tiny fees. The main concern is its dependence on Tether—if USDT stumbles, TRON takes the hit. Still, its efficiency has earned it a solid place in cross-border finance.

- Litecoin (LTC) — The Reliable Workhorse

Litecoin has been a workhorse in the crypto payments space for over a decade. With block times averaging 2.5 minutes and transaction fees that typically stay below a cent, it remains one of the most practical networks for small, frequent transfers. That simplicity and resilience are part of its enduring appeal.

At present, LTC is priced near $115 with a market cap of about $8.8 billion. While it doesn’t offer the flashy features of newer projects, its stability makes it a dependable option in a space where many tokens come and go. Litecoin may not be redefining payments anymore, but it continues to provide a steady rail for those who value predictability.

Which One is The Best Altcoin to Invest in?

Naturally, we came to the question: Which of these coins are the best altcoins to invest in? All four have their own strengths. Toncoin benefits from Telegram’s scale, TRON dominates stablecoin transfers, and Litecoin continues to deliver simple, low-cost payments. But if the goal is to spot innovation early, Digitap stands out.

It’s being called a new gem because it combines crypto’s efficiency with the usability of traditional banking—something the others don’t offer. And unlike established names, Digitap is still in its early-stage presale, which means plenty of room for growth as adoption builds.

The presale is tiered, so prices rise step by step before $TAP ever hits exchanges. Right now, the token is available at $0.0125, but the next increase to $0.0159 is only days away.

For investors looking to enrich their portfolio with future-proof projects, the message is simple: early entry matters. Digitap’s mix of innovation and timing gives it the clearest path to upside.

USE THE CODE “DIGITAP15” FOR 15% OFF FIRST-TIME PURCHASES

Closing Thoughts

Cross-border payments are evolving fast. Toncoin shines with mass distribution, TRON dominates stablecoin rails, and Litecoin offers reliable, low-cost transfers. But Digitap ($TAP) blends usability, privacy, and strong presale metrics into a package that everyday users can already tap into. If Ripple pioneered blockchain payments for banks, Digitap is setting the stage for the consumer era.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale https://presale.Digitap.app

Social: https://linktr.ee/Digitap.app

*This article was paid for. Cryptonomist did not write the article or test the platform.

Ayrıca Şunları da Beğenebilirsiniz

ZEC Surges Toward $480 Resistance, Is a $520 Breakout Next?

Venezuela’s Growing USDT Reliance May Aid Sanctions Evasion Amid US Tensions, TRM Report Suggests