Whales Bought $418K Bitcoin Hyper in 18 Days: Hype Builds to Over $16.9M in Presale

However, it still has limitations when it comes to scaling and programmability.

And as the crypto economy has grown and smart contracts have developed ever-more-complicated applications and utility, Bitcoin risks being left behind, or pigeonholed as a mere store of value.

But Bitcoin Hyper could just change the game entirely with a blazing-fast Bitcoin Layer 2 – here’s how.

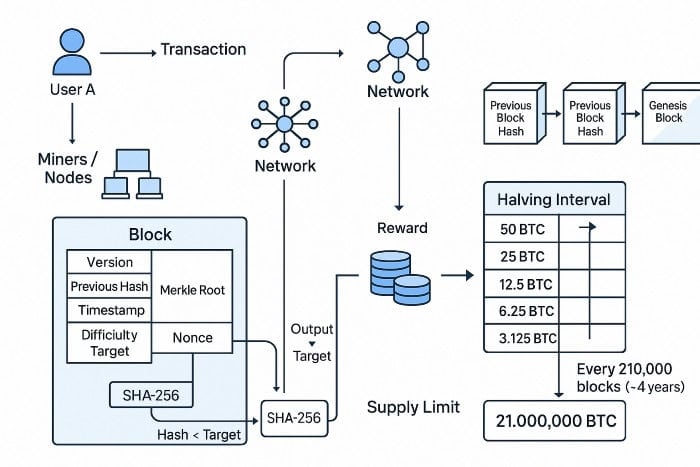

Bitcoin’s Built-In Restrictions

Bitcoin’s architecture intentionally limited some of the blockchain’s flexibility, prioritizing security and stability with simple smart contracts.

While elegant, that architecture leads to some natural restrictions:

Transaction Throughput, Speed

Bitcoin’s base layer (Layer 1) can manage only 3-7 transactions per second (TPS) in normal conditions. Block confirmation times are slow (on average 10 minutes per block), which means delays during congested periods.

High Fees During Congestion

As demand increases, transaction fees rise since blocks are limited in size. This makes small or micro-transactions economically impractical.

Lack of Smart Contract and Programmability Support

Bitcoin’s native scripting is limited; many advanced DeFi, NFT, dApp use-cases need more expressive and flexible smart contracts. Other blockchains, such as Solana, Base, and Ethereum, have ecosystems built around that flexibility.

Scalability to Modern Demand

With growing demand arising from NFTs, ordinals, BRC-20 tokens, possible DeFi activity, and more global usage, the base Bitcoin network struggles to keep up.

Users want near-instant, low-fee transactions and interoperable use cases – and that’s where Bitcoin Hyper ($HYPER) comes in.

Hyper’s Hybrid Solution

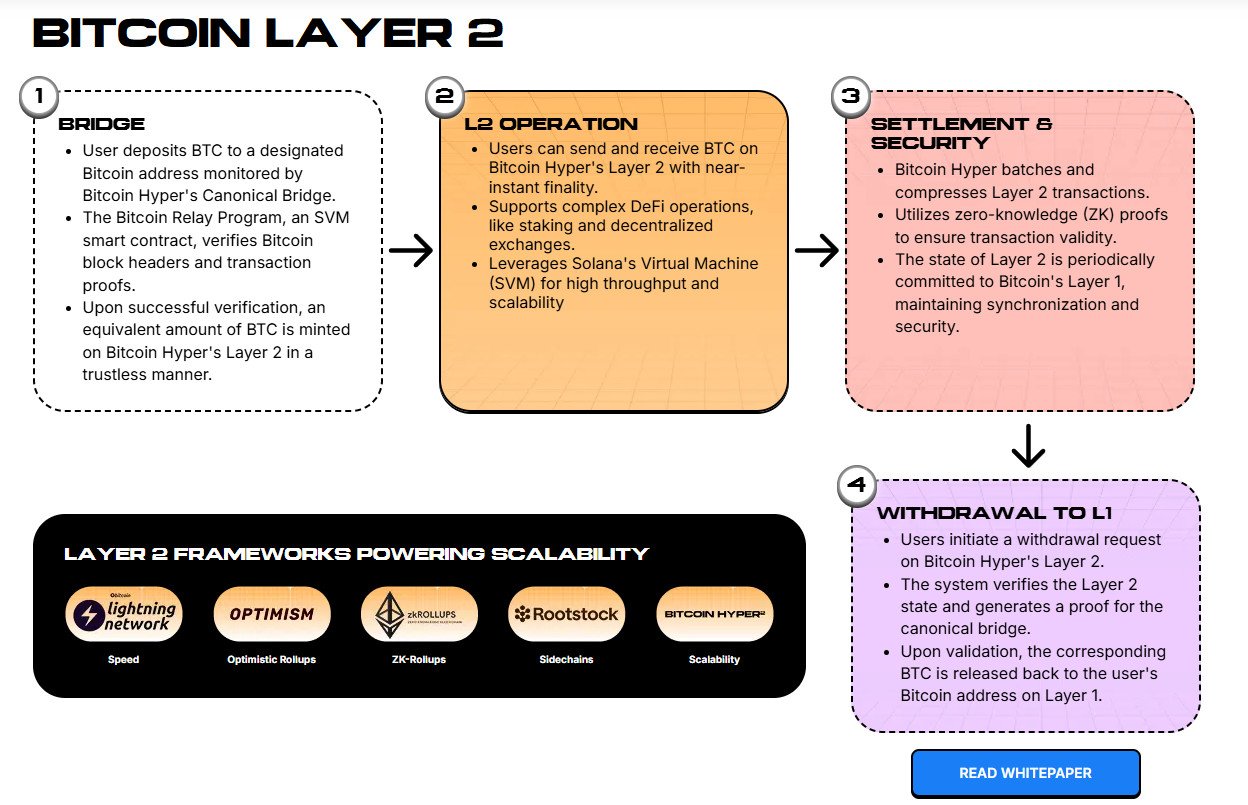

Bitcoin Hyper ($HYPER) is a Layer-2 (L2) network built on top of Bitcoin, designed to overcome Bitcoin’s inherent limitations. Key features include:

- Layer-2 scaling: Create a secondary chain or network (Layer 2) where many transactions happen off the Bitcoin mainnet, but final settlement happens on Bitcoin’s base layer. The structure provides much higher throughput, lower latency, and lower fees.

- Canonical Bridge: A canonical bridge means that when you deposit $BTC, it’s locked on Bitcoin L1, and an equivalent wrapped $BTC (or token representing that $BTC) is minted on the Hyper L2. Withdrawals reverse the process. Users can move value into the L2 to transact, then back to L1, ensuring liquidity and trust that value is preserved 1:1.

- Solana Virtual Machine (SVM) Integration: Hyper uses Solana’s VM for the L2 environment to enable fast and programmable smart contracts. This allows developers to build dApps, DeFi, NFTs, etc., more easily and with better performance.

- Decentralized Validator: The L2 will run its own validator network rather than Bitcoin’s proof-of-work. Final settlement on the L1 periodically will preserve Bitcoin’s security guarantees.

- Lower Fees and Faster Transactions: Because operations happen off the main chain, fees should be lower and transactions much faster. Batching of transactions and bridging help reduce cost overhead. The end result is a better user experience that’s more feasible for smaller payments and more usable as everyday money.

How Hyper’s Layer-2 Could Help Bitcoin Rise Even More

Faster, cheaper transactions mean more use cases, including micropayments and remittances, which are currently limited by fees and speed. This helps Bitcoin move beyond being just a digital gold and store of value.

If the L2 commits to Bitcoin’s Layer-1 regularly, then Bitcoin’s rock-solid security and reliability can protect the L2 operations. If more apps and users use Bitcoin via Hyper, more value flows through Bitcoin, increasing its relevance, not just as a speculative asset but as infrastructure.

$HYPER Presale Enters Overdrive

One way to judge the project’s utility is to examine how investors have responded to the ongoing token presale. And so far, that response has been overwhelmingly positive:

- Total funds raised: $16.9M

- $418K in whale buys in September alone:

- $85K on 17th September

- $18.2K on 17th September

- $31.5K on 15th September

- $50K on 4 September

- Token price: $0.012945

The token price will continue to increase as the presale progresses, making now the best time to buy $HYPER.

Bitcoin Hyper is a bridge in more ways than one. Positioning itself between Bitcoin’s strength and modern blockchain demands for speed, programmability, and low fees, Hyper could help push Bitcoin’s dominance into a new phase.

Ayrıca Şunları da Beğenebilirsiniz

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

Crypto ETFs see biggest exit since November – Assessing the $1.7B drain!