Cardano (ADA) Price: Symmetrical Triangle Could Trigger Massive Move

TLDR

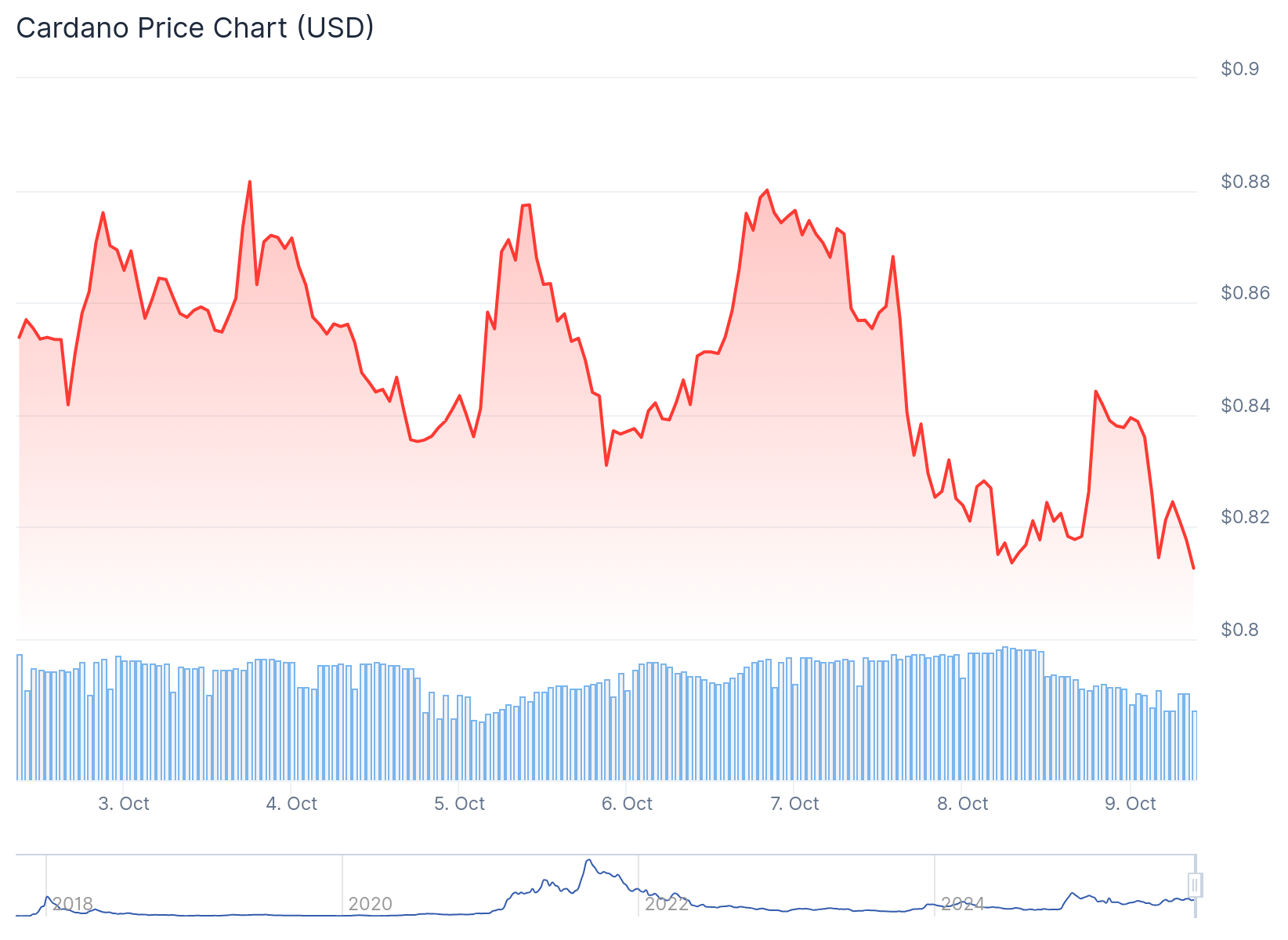

- Cardano is trading at $0.84 and forming a symmetrical triangle pattern that is reaching its apex in late October

- ADA was added to the S&P Digital Markets 50 index, bringing more institutional visibility to the project

- Key support sits at $0.78 to $0.80 with a strong buy wall, while resistance remains at $0.90 and $1.00

- The 50-week moving average continues to provide support, similar to previous rallies that pushed ADA toward $1

- Speculation about potential stablecoin launches and ETF interest is adding to positive sentiment around Cardano

Cardano is currently trading around $0.84, showing a 1.34% gain over the past 24 hours. The price has been moving in a tightening range that traders are watching closely.

Cardano (ADA) Price

Cardano (ADA) Price

The cryptocurrency is forming a symmetrical triangle pattern on its chart. This pattern shows price action compressing as it reaches the triangle’s apex, which is expected to arrive in late October.

A symmetrical triangle typically precedes a price breakout in either direction. The pattern forms when support and resistance lines converge, creating lower highs and higher lows.

Cardano recently gained inclusion in the S&P Digital Markets 50 index. This index tracks the largest digital assets and provides traditional finance institutions with a benchmark to follow.

The inclusion puts ADA alongside other major cryptocurrencies being monitored by institutional investors. This type of recognition can increase visibility with larger funds that track these indices.

Technical Levels Define Next Move

Price action shows buyers defending support levels while sellers are capping attempts to break higher. The key resistance level sits at $0.90, which would need to break for a confirmed upward move.

Support is layered between $0.78 and $0.80. This zone has been defended multiple times, with order book data showing concentrated buying interest around $0.78.

ADA recently dipped below $0.80 before quickly recovering. This type of move often clears out traders on the wrong side of the market before a larger directional move begins.

The 50-week moving average continues to provide price support. Previous times when Cardano held above this level, the price moved toward $1.

Volume will be important to confirm any breakout. Without strong buying pressure, a move above resistance would be less reliable.

Market Context and Timing

The triangle pattern is forming while Bitcoin has been pushing toward all-time highs. October typically leads into November, which has historically been favorable for altcoin performance.

The tightening volatility inside the triangle suggests a larger move is coming. Traders are positioning for a breakout that could happen as the apex approaches.

Speculation has increased around potential catalysts for ADA. Discussion includes possible stablecoin launches on the Cardano network and growing interest in cryptocurrency ETFs.

If the $0.90 level breaks with volume, the next target would be $0.95 to $1.00. If support at $0.78 fails, price could test $0.75.

The current setup shows ADA maintaining structure while waiting for a catalyst. The combination of technical patterns and institutional recognition is drawing attention from traders.

The post Cardano (ADA) Price: Symmetrical Triangle Could Trigger Massive Move appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

Aave DAO to Shut Down 50% of L2s While Doubling Down on GHO

The "1011 Insider Whale" has added approximately 15,300 ETH to its long positions in the past 24 hours, bringing its total account holdings to $723 million.