Technical Models Align on Bearish Outlook for Bitcoin

The price of Bitcoin has been unable to maintain a favorable position above the $95,500 pivot point.

BTC 4h chart (data: TradingView)

BTC 4h chart (data: TradingView)

Market participants on the bearish side continued to exert pressure beneath the $95,500 threshold, resulting in a decline in price. The sellers intensified their efforts, successfully driving the price beneath the $94,000 threshold.

A low was established at $92,890, and the price is currently stabilizing around the 23.6% Fibonacci retracement level of the recent drop from the $103,998 peak to the $92,890 low.

Bitcoin is currently priced under $95,000 and is below the 100-hour Simple Moving Average. Additionally, a bearish trend line is emerging, with resistance identified at $96,600 on the hourly chart of the BTC/USD pair.

Source: TradingView

Source: TradingView

Should the bulls make another attempt at a recovery wave, the price may encounter resistance around the $95,500 mark.

The primary level of resistance is around the $96,500 mark, coinciding with the trend line. The upcoming resistance level may be $97,200.

A breakout above the $97,200 resistance level could propel the price to new heights. In this scenario, the price has the potential to increase and approach the $98,500 resistance level.

Further increases could propel the price towards the $99,500 mark. The upcoming resistance levels for the bulls may be positioned at $100,000 and $100,500.

If Bitcoin does not manage to surpass the $96,600 resistance level, it may initiate a further downturn. Current support is positioned around the $93,500 mark. The initial significant support is around the $92,500 mark.

The subsequent support level is currently around the $91,500 area.

Further declines could push the price down to the $90,000 support level in the short term. The primary support level is established at $88,500; a breach below this point could lead to a swift decline for BTC in the short term.

Technical indicators snapshot

- Hourly MACD – The MACD is now gaining pace in the bearish zone

- Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level

- Major Support Levels – $92,500, followed by $90,000

- Major Resistance Levels – $95,500 and $96,600

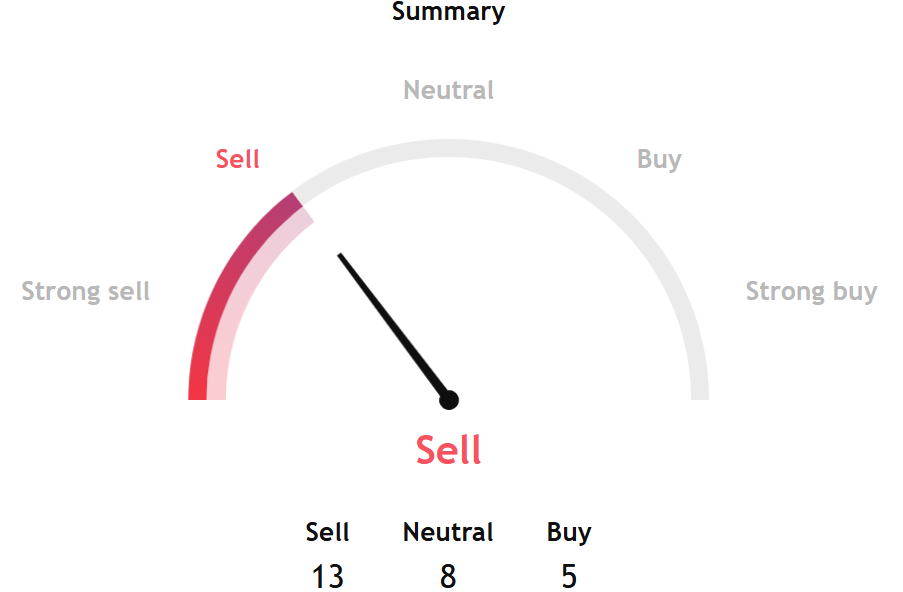

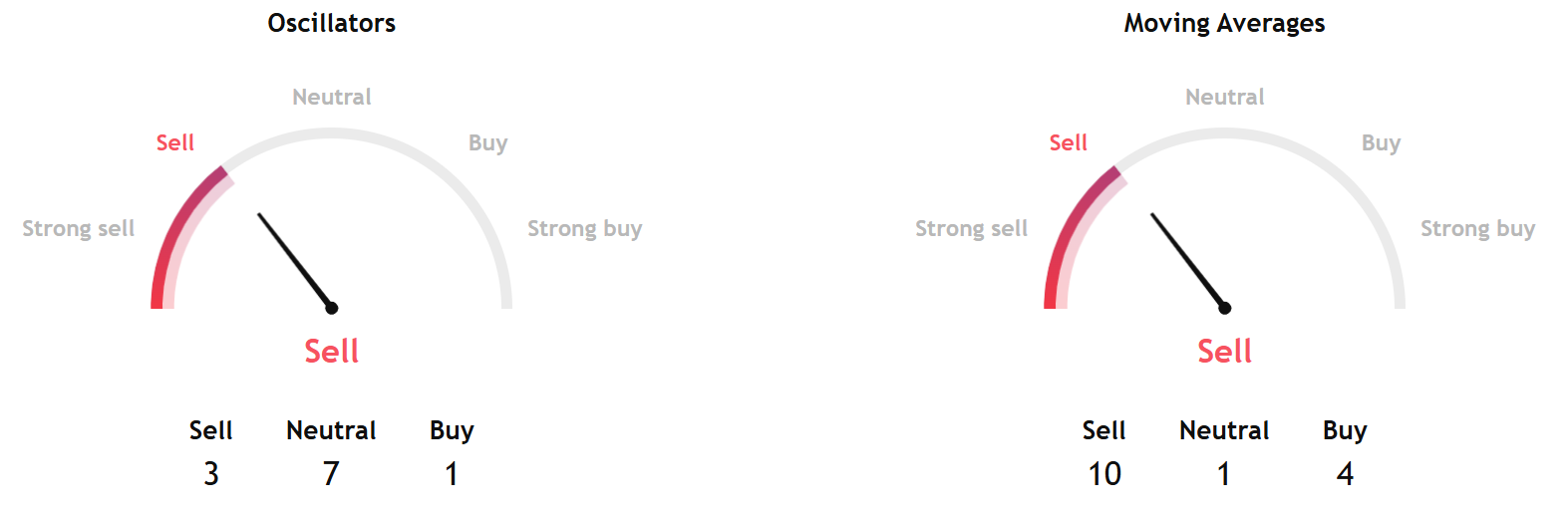

TradingView's Bitcoin gauge, based on the most popular technical indicators, such as moving averages, oscillators, and pivots, shows a sell signal for the week ahead.

Source: TradingView

Source: TradingView

A deeper dive shows both short- and long-term indicators showing a sell signal, marking a bearish view.

Source: TradingView

Source: TradingView

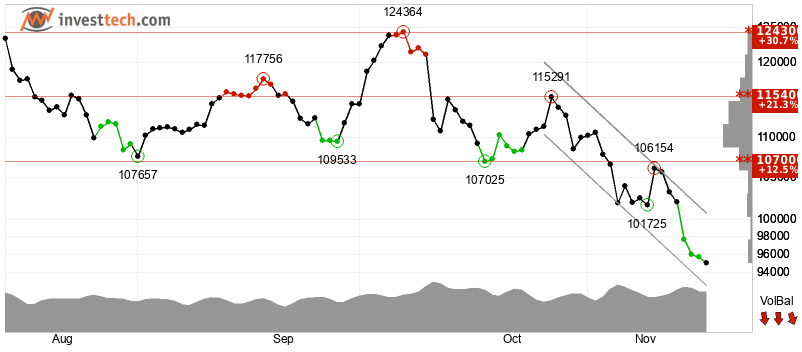

Separately, InvestTech's overall algorithmic analysis gives a negative score for Bitcoin.

The analysis and recommendation for one to six weeks is negative.

InvestTech said, "Investors have accepted lower prices over time to get out of Bitcoin, and the token is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Bitcoin. There is no support in the price chart, and further decline is indicated. In case of a positive reaction, the token has resistance at $107,000 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend."

The analysis added, "RSI below 30 shows that the momentum of the token is strongly negative in the short term. Investors have steadily reduced the price to sell Bitcoin, which indicates increasing pessimism and continued falling prices. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards."

Source: InvestTech

Source: InvestTech

Ayrıca Şunları da Beğenebilirsiniz

Waarom BTC niet stijgt: OG holders verkopen massaal call opties

OFAC Designates Two Iranian Finance Facilitators For Crypto Shadow Banking