Latest XRP Rich List Update Signals Strong Whale Accumulation Trend

- Within 24 hours, 78 newly created XRP wallets accumulated 77.32 million XRP, including one wallet that added 35 million tokens.

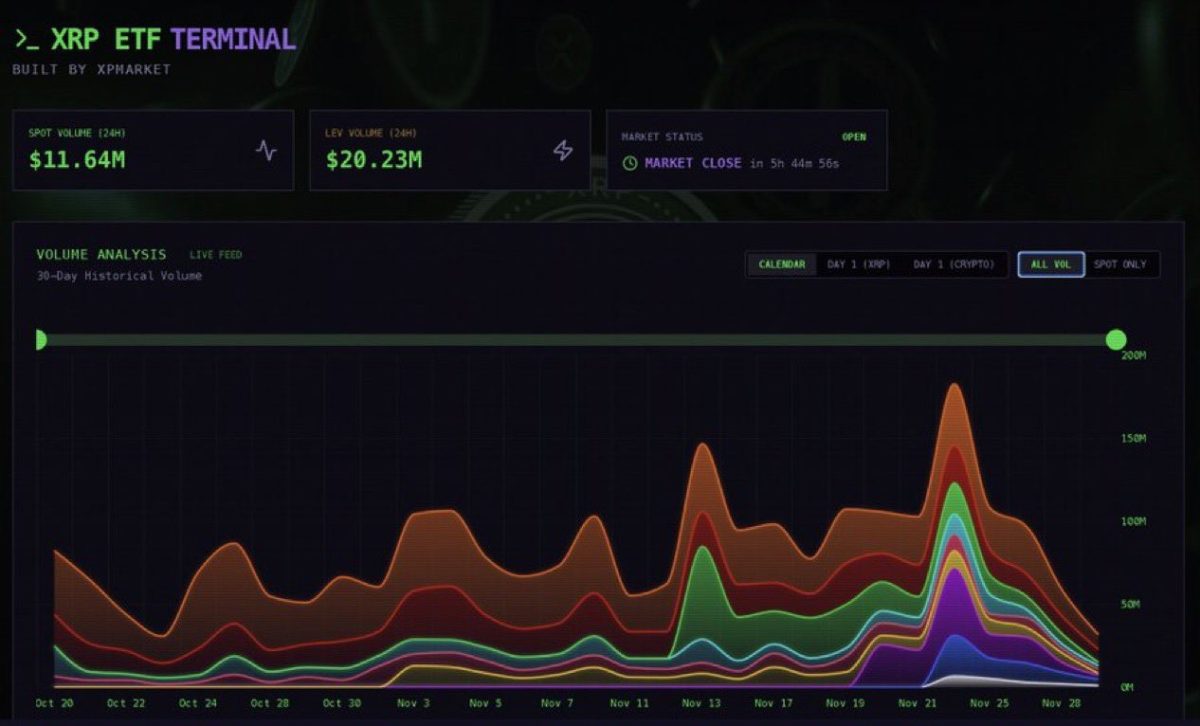

- XRP ETF demand is rising, with newly launched XRP ETFs recording $11.6 million in spot volume in early trading hours on December 1.

The latest on-chain data shows a major shift in the XRP whale wallets. New wallets highlight an aggressive accumulation of the Ripple cryptocurrency despite the massive crypto market downturn and volatility. As of press time, the XRP price is trading 7.3% down at the crucial support of $2.0.

XRP Whale Wallets See Major Reshuffle With New Wallets Accumulating Heavily

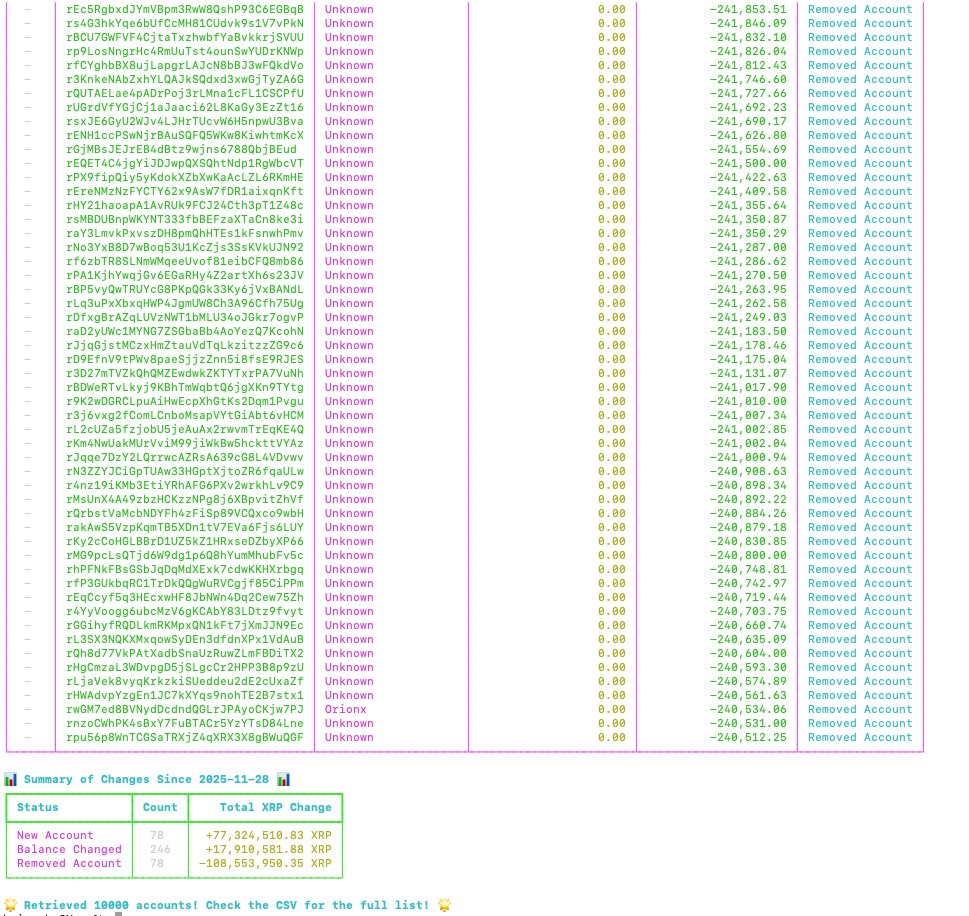

XRP community analyst Mullen shared the updated XRP rich list wherein the top 10,000 XRP wallets now hold 51.39 billion tokens, representing 85% of the circulating supply. This comes despite the Ripple cryptocurrency facing a steep downside of 18% over the past month.

As per on-chain data, there’s a clear shift in the balances of wallets with large XRP holdings. Within a day, 78 newly created wallets added a total of 77.32 million XRP, signaling an accumulation trend. Of these, the largest new wallet added 35 million XRP, while the second-biggest wallet acquired 3.63 million. At the same time, six other whale wallets accumulated 1.99 million XRP each.

A broader wave of accumulation was also observed across dozens of accounts. Up to 44 new wallets amassed more than 300 million XRP each, while 246 existing wallets increased holdings by a combined 17.91 million XRP.

Source: Mullen

Source: Mullen

At the same time, some whale wallets reduced balances. One account, associated with the Bithumb exchange, moved out 2.819 million XRP, lowering its balance to 1.785 million XRP. Experts suggest that the transfer may be customer-driven or related to internal fund movements.

More notably, 78 wallets collectively transferred out over 108.5 million XRP. Many of these accounts moved between 240 million and 241 million XRP each, effectively draining their holdings. The matching number of new accumulating wallets and emptied wallets suggests a coordinated redistribution rather than an exit of large holders.

Mullen noted that the XRP rich list is “rotating, not shrinking,” with major investors repositioning their holdings ahead of the market’s next major move.

Can XRP ETF Demand Drive Price Rally?

XRP exchange-traded funds (ETFs) recorded a sharp surge in activity! At the opening bell on December 1, these ETFs clocked $11.6 million in spot volumes. The early spike signals growing investor interest and increasing momentum behind newly launched XRP investment products.

Source: XRP Update

Source: XRP Update

Market watchers noted that the morning surge represents only the initial phase of expected inflows, suggesting stronger demand may follow as trading activity builds throughout the session. As reported by CNF, 21Shares XRP ETF will debut on the Wall Street as part of its scheduled launch.

]]>Ayrıca Şunları da Beğenebilirsiniz

Those Who Missed XRP Now Eye Apeing ($APEING) as One of 2025’s Next Crypto to Hit $1

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets