Visa (V) Stock Rallies 5% on Rare Upgrade From BofA Securities

TLDR

- Visa stock surged 5% after BofA Securities raised rating to Buy from Neutral with $382 price target

- Analysts see valuation at 10-year lows creating buying opportunity despite recent 12.42% six-month decline

- BofA views cryptocurrency stablecoins as growth opportunity rather than competitive threat to Visa’s business

- Visa unveiled stablecoin integration plans and AI-enhanced commerce features alongside the analyst upgrade

- Stock trades at $341.42, up 8.6% year-to-date with market cap of $622.87 billion

Visa stock jumped 5% in morning trading after BofA Securities upgraded the payment processor to Buy. The firm set a $382 price target, representing 17% upside potential.

Visa Inc., V

The upgrade follows months of underperformance for the stock. BofA Securities says this weakness created an attractive buying opportunity for investors.

Analysts highlighted Visa’s valuation as the primary catalyst. The stock currently trades near its lowest multiple in 10 years.

Recent stock weakness stems from investor rotation into AI and growth stocks. This shift pulled money away from established financial services companies like Visa.

Cryptocurrency Seen as Growth Driver

BofA Securities challenged common concerns about digital payment disruption. The firm sees stablecoins as a growth opportunity rather than a threat to Visa’s network.

Analysts view Visa’s regulatory challenges and litigation risks as manageable. The company maintains a dominant position in the global payments industry with a $622.87 billion market cap.

The $382 price target falls between analyst estimates ranging from $305 to $450. The stock closed at $325.73 when BofA issued the upgrade.

Visa shares declined 12.42% over the past six months. Despite this weakness, the company maintains 11.34% revenue growth.

Product Innovation and Financial Performance

Visa announced new technology initiatives coinciding with the upgrade. The company plans to integrate stablecoins directly into its payment infrastructure.

The payment processor will also deploy AI technology to enhance commerce capabilities. These moves demonstrate Visa’s response to evolving payment technologies.

The stock gained 8.6% since January 2025. Shares trade at $341.42, approaching the 52-week high of $373.31 reached in June.

Visa typically shows low volatility. The stock recorded only two moves exceeding 5% over the past year.

Fourth-quarter earnings beat expectations with $2.98 per share versus the $2.97 forecast. Revenue reached $10.7 billion, topping estimates of $10.61 billion.

UBS separately raised its price target to $425 from $415 while maintaining a Buy rating. The firm cited strong growth prospects based on fiscal 2026 guidance.

Visa forecasts low double-digit revenue growth on a foreign exchange neutral basis for fiscal 2026. The company continues global expansion with new operations planned in Syria and a European headquarters move to London’s Canary Wharf in 2028.

The post Visa (V) Stock Rallies 5% on Rare Upgrade From BofA Securities appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

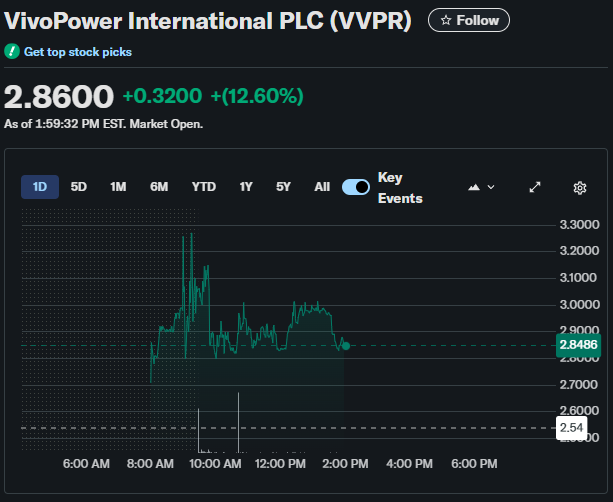

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally