Which city will be the crypto capital? Take a look at the 2025 crypto-friendly city index

Author: Multipolitan

Compiled by: Felix, PANews

We are experiencing a reshaping of the world’s financial and technology hubs. Wealth, talent, and innovation are actively migrating from jurisdictions hostile to cryptocurrencies to cities that openly embrace blockchain and digital assets. Identifying the most crypto-friendly cities is not only critical, but also insightful. The future of finance, innovation, and talent mobility is being rewritten—and understanding this shift is essential for anyone who wants to stay ahead in this rapidly evolving environment.

The next global financial center will be dominated by cryptocurrency

The next center of global finance will not only embrace cryptocurrencies, but will thrive on them. Here are the reasons why the most successful cities of the future are betting big on blockchain and digital assets:

1. Regulatory arbitrage: the new financial power game

Businesses, investors, and crypto pioneers are flocking to jurisdictions that offer clear, consistent, and crypto-friendly regulatory environments. For example, Binance is strategically relocating operations, and Coinbase is considering leaving the United States due to regulatory friction. Regulatory clarity is not only beneficial, it is essential.

2. Follow the money and talent

Crypto-friendly cities such as Dubai, Singapore and Zug (Switzerland) are quickly becoming magnets for wealth, innovation and talent, while cities with hostile regulation risk losing their competitive edge and losing talent.

3. Cryptocurrency: A parallel financial revolution

Governments that actively adopt cryptocurrencies can gain new investment, tax revenue and economic growth. Those that resist or over-regulate not only face the risk of capital flight, but also the serious consequences of brain drain. Cryptocurrency is not just an asset, but also an economic catalyst.

4. Digital nomads and a multipolar future

Crypto wealth knows no borders, and its holders are increasingly embracing a “multipolar lifestyle” – strategically dispersing residences and assets across crypto-friendly jurisdictions. Stability, low taxes and innovative policies are no longer just attractive conditions, but prerequisites for cities to attract sovereign individuals who will shape the future economy.

5. First-mover advantage: Winner takes all in crypto

Cities that embrace cryptocurrency first are gaining huge economic advantages. El Salvador rose from obscurity to become a global Bitcoin hub, while Dubai’s fintech-friendly policies have made it a global financial powerhouse. In crypto, first movers don’t just lead, they dominate.

The global financial landscape is changing. Cities that quickly embrace cryptocurrencies are not only increasing their influence, but also consolidating their position as future financial centers.

Where is the crypto wealth going?

Crypto-friendly hubs: Dubai, Singapore, Zug (Switzerland), Lisbon, Miami, Puerto Rico, Hong Kong (recently re-turned crypto-friendly).

Jurisdictions that are losing crypto talent: parts of the US (regulatory hostility), China (bans leading to brain drain), parts of the EU (uncertain regulatory path in some countries).

How to Identify a Crypto-Friendly City?

Most crypto-friendliness indexes focus only on tax incentives, but the reality is much more complicated. While tax policy is important, regulation, legal clarity, and the extent of its actual application are equally important in determining a city’s crypto-friendliness.

The Crypto Cities Index 2025 goes beyond superficial metrics. Its methodology includes multi-metric analysis to present a comprehensive picture. It first pre-selected 27 cities based on five national criteria to ensure compatibility with the thriving crypto ecosystem. Focus:

- The legal status of cryptocurrencies is clear: a stable and predictable regulatory framework.

- Strong Economic Growth: Cities that provide strong macroeconomic conditions for business development. High-growth cities offer better business opportunities, investor confidence, and a robust financial infrastructure to support crypto businesses.

- High-income category – The wealth center where cryptocurrency adoption is driven by both retail and institutional players.

- Quality of Life — Cities that rank high in happiness indices at both the national and city levels ensure that long-term cryptocurrency adoption is sustainable. A city must not only be business-friendly, but also livable. Factors such as healthcare, safety, and cost of living influence the choices of crypto entrepreneurs, digital nomads, and investors.

- More than just a regulatory haven: The best crypto cities should not only be regulatory havens, but also places where talented people want to settle and thrive.

Combining these factors, the first-ever Crypto Cities Index was created to provide a snapshot of where digital finance is truly thriving and crypto is truly becoming embedded.

After identifying 27 cities, they were assessed for their “cryptocurrency inclusion” based on five indicators:

- Regulatory Environment : Country regulations are assessed by analyzing local tax policies, licensing frameworks, and incentive programs, and scored using a three-point scale based on a comparative analysis.

- Taxation system : The tax impact is assessed using the highest potential capital gains tax rate, taking into account different legislative conditions. Scores range from 1 to 3, depending on how each jurisdiction compares to the sample average.

- Wealth and Lifestyle : The economic health of a city is measured using GDP per capita and house prices, which represent investment potential and quality of life, respectively. The score is calculated by comparing the data to an average, using a weighted average method, with a greater weight given to house prices at the city level.

- Digital Infrastructure : Measures connectivity and technological readiness through indicators such as internet speed and smart city rankings. This score reflects how well each city’s infrastructure supports cryptocurrency activity, categorizing cities into high, medium, and low.

- Crypto Infrastructure : The presence of cryptocurrency ATMs and retail adoption rates were analyzed to reflect the level of crypto cultural penetration in each city. Cities with a high concentration of these assets scored the highest, highlighting their leading position in crypto integration.

Each metric contributes to the overall score, with cryptocurrency culture weighted twice as high to highlight its importance. The final score is adjusted on a 180-point scale to determine the ranking, focusing on cities that have the right combination of legal, economic, and infrastructure advantages to attract crypto enthusiasts and investors.

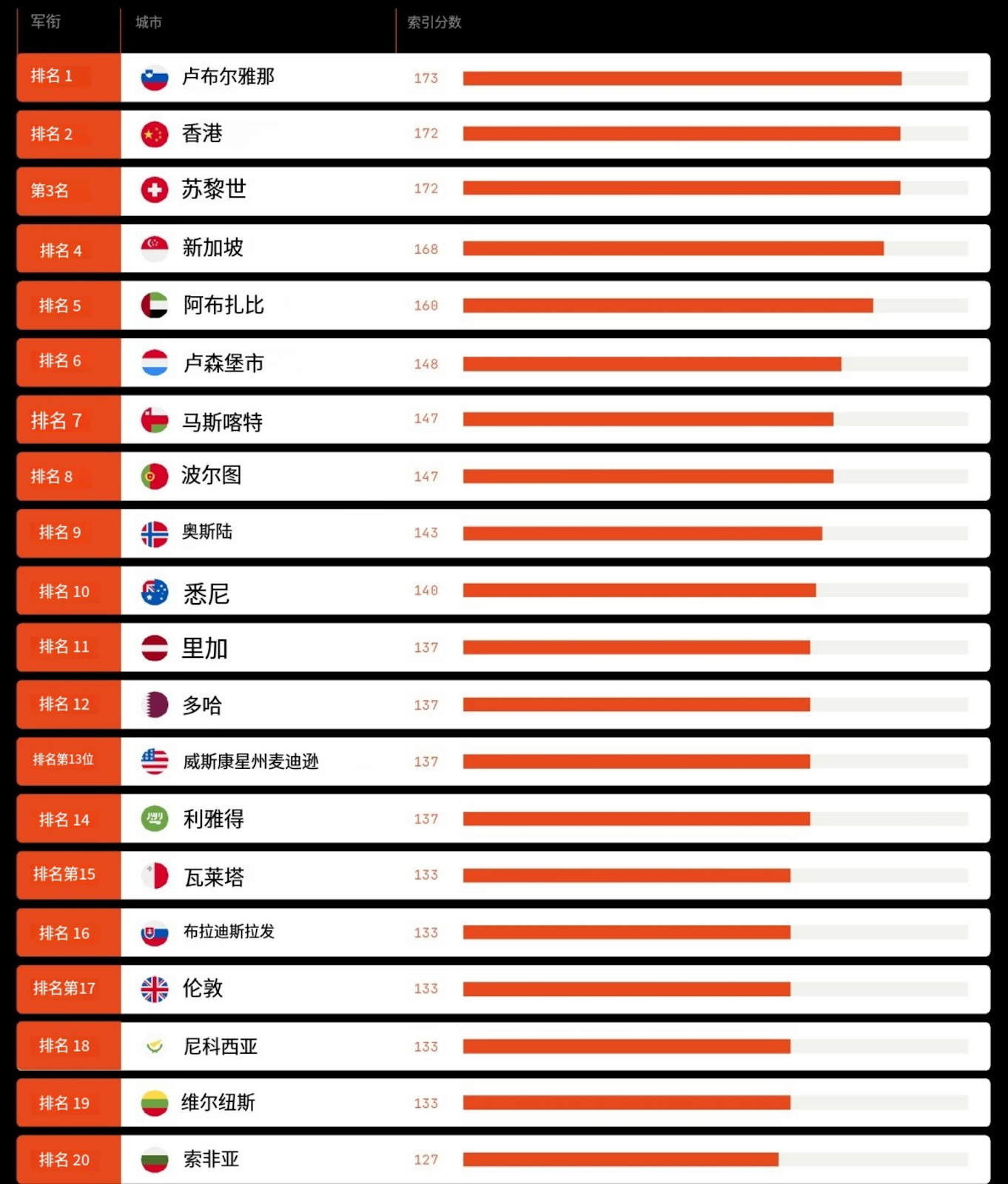

Multipolitan 2025 Crypto-Friendly Cities Index

The new financial center of the future

The global financial landscape is no longer dominated by traditional financial centers such as New York or London. The rise of crypto-friendly cities is changing this landscape.

Crypto-friendly cities: Abu Dhabi, Ljubljana, Luxembourg City, Muscat, Nicosia, Lisbon, Riga, Singapore, Zurich — each offers a clear legal framework and an attractive tax regime.

Top Smart Cities: Zurich, Oslo, Singapore, London, Abu Dhabi — Ranking high in the IMD 2024 Smart Cities Index proves that crypto-friendly cities are also leading the way in technology and infrastructure.

Crypto ATM and Merchant Leaders: Sydney tops the list with 330 crypto ATMs and retail locations, followed by Hong Kong (201) and Ljubljana (155), cities that have already incorporated real-world cryptocurrencies.

In addition, speed and connectivity are the foundation of the digital economy, and connectivity drives the adoption of cryptocurrencies. Abu Dhabi, Doha, and Oslo rank among the top in terms of internet speed, reaching 398 Mbps, 265 Mbps, and 205 Mbps, respectively, enabling high-frequency trading, digital finance, and seamless blockchain transactions.

Mapping the friendliest crypto cities fits perfectly with the industry’s borderless philosophy. As people and capital seek out favourable jurisdictions, there will be a growing demand for advisory services that help high net worth individuals move, start businesses and manage their assets.

How is crypto wealth concentrated?

It’s no longer enough to simply track how many people own cryptocurrencies. It’s also important to understand who holds the bulk of crypto wealth. Millions of users holding small amounts of cryptocurrencies look very different than a country dominated by a handful of crypto giants. Multipolitan’s Crypto Wealth Concentration Index combines cryptocurrency ownership and transaction volume (adjusted for inequality using the Gini coefficient) to provide an insightful analysis.

Cryptocurrency has transformed from a speculative novelty to a global financial phenomenon. As digital assets gain mainstream acceptance, a key question remains: where exactly is crypto wealth concentrated? To understand the emerging financial landscape, Multipolitan developed the 2025 Crypto Wealth Concentration Index, which not only sheds light on cryptocurrency adoption, but also shows the actual concentration of crypto wealth around the world.

Multipolitan 2025 Crypto Wealth Concentration Index

The global leader in cryptocurrency

UAE - Global Adoption Leader. With 25.3% of the population owning cryptocurrencies, the UAE leads the way in adoption, thanks to proactive government policies and clear regulations that have made cities like Dubai thriving cryptocurrency hubs.

India — A digital giant. With 118.9 million cryptocurrency holders, India is the world’s largest cryptocurrency community. Its retail investors are driving massive market participation despite regulatory hurdles, highlighting the country’s growing influence.

The United States - Still the leader in capital flows. Home to some of the world's largest exchanges and institutional investors, the United States dominates in terms of trading volume, reaching $2.07 trillion. Such a large amount of trading activity makes the United States a key node in the global cryptocurrency financial sector.

Slovenia, Cyprus, and Hong Kong, China - Small countries, big influence. Slovenia has the highest per capita cryptocurrency trading volume, with an average of $240,000 per person, indicating that its users are highly active and wealth is concentrated. Cyprus has $174,000 per person and Hong Kong has $77,000 per person, making these regions the places where cryptocurrency wealth is concentrated.

The future is borderless and ever-changing

Crypto wealth no longer belongs only to traditional financial centers like New York, London, or Singapore. It is borderless, ever-changing, and finding new homes where innovation and clarity intersect. Cities and countries that embrace these dynamics will lay the foundation for the next financial era. I believe that the financial capital of the future will be the cryptocurrency era.

More than just data, the index is a strategic tool that can guide decisions on migration, business growth, and asset management. Understanding where crypto wealth is concentrated today will determine the global financial landscape of tomorrow. The question today is not who is adopting crypto, but who will hold the vast wealth of crypto in the future. The race to be the ultimate crypto capital is heating up.

Related reading: Panorama of cryptocurrency taxation in Asia: What are the key points?

Ayrıca Şunları da Beğenebilirsiniz

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement