From Cosmos to Ethereum: How does Initia integrate the advantages of the two major ecosystems?

Original article: Stacy Muur , Crypto Researcher

Compiled by: Yuliya, PANews

Appchain was originally designed to provide customized, scalable and sovereign solutions, but it unexpectedly formed isolated "walled gardens". Each chain operates independently, liquidity is scattered on more than 100 chains, and users have to frequently bridge assets across chains just to complete basic service needs.

A more serious problem is the “naked chain”. These chains lack the necessary infrastructure, such as oracles, cross-chain bridges, indexers, etc., just like a city without public facilities, which may look attractive from the outside, but is actually difficult to use.

Meanwhile, the user experience is still stagnant at the level of 2017: users need to manage more than 5 wallets, each chain has different Gas tokens and UI designs, and the learning curve is steep and complicated. Although it is already 2025, interoperability is still like an unconnected network. Among the Web3 protocols that will emerge in 2025, Initia is undoubtedly a highly anticipated one. So, what makes Initia so special that it can continue to attract the attention of top researchers?

Historical Review: Cosmos and Ethereum

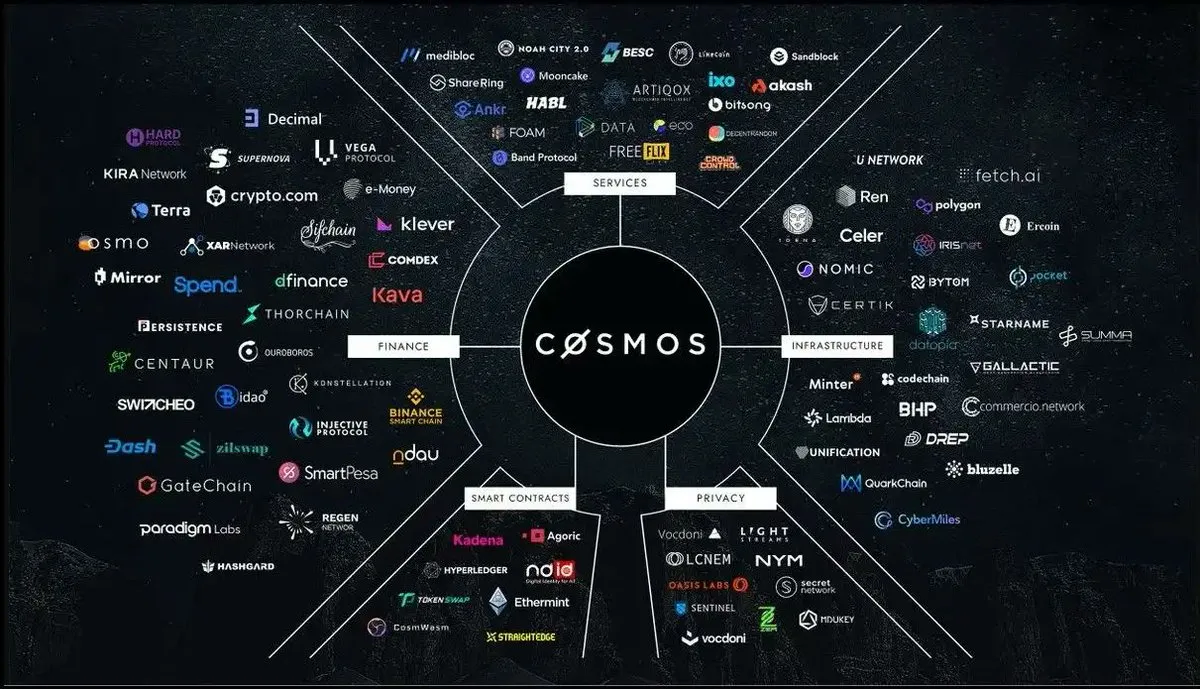

Cosmos proposed the concept of application chain, which aims to provide developers with sovereignty and professional capabilities, but faces the following major problems in practice:

- Validator startup problem: Launching a new application chain requires a strong validator network, which requires not only technical expertise but also high economic incentives, leading to serious token inflation problems.

- IBC token fragmentation: Moving assets across chains generates duplicate tokens (e.g., USDC on chain A ≠ USDC on chain B), leading to inefficient liquidity.

- Liquidity fragmentation: The Cosmos Hub failed to become a central router, but instead spawned multiple competing hubs, each competing for liquidity, ultimately weakening the network effect.

Cosmos’ theory about application chains is correct, but due to the lack of strong incentives for cooperation, these chains end up competing with each other rather than forming a cohesive ecosystem.

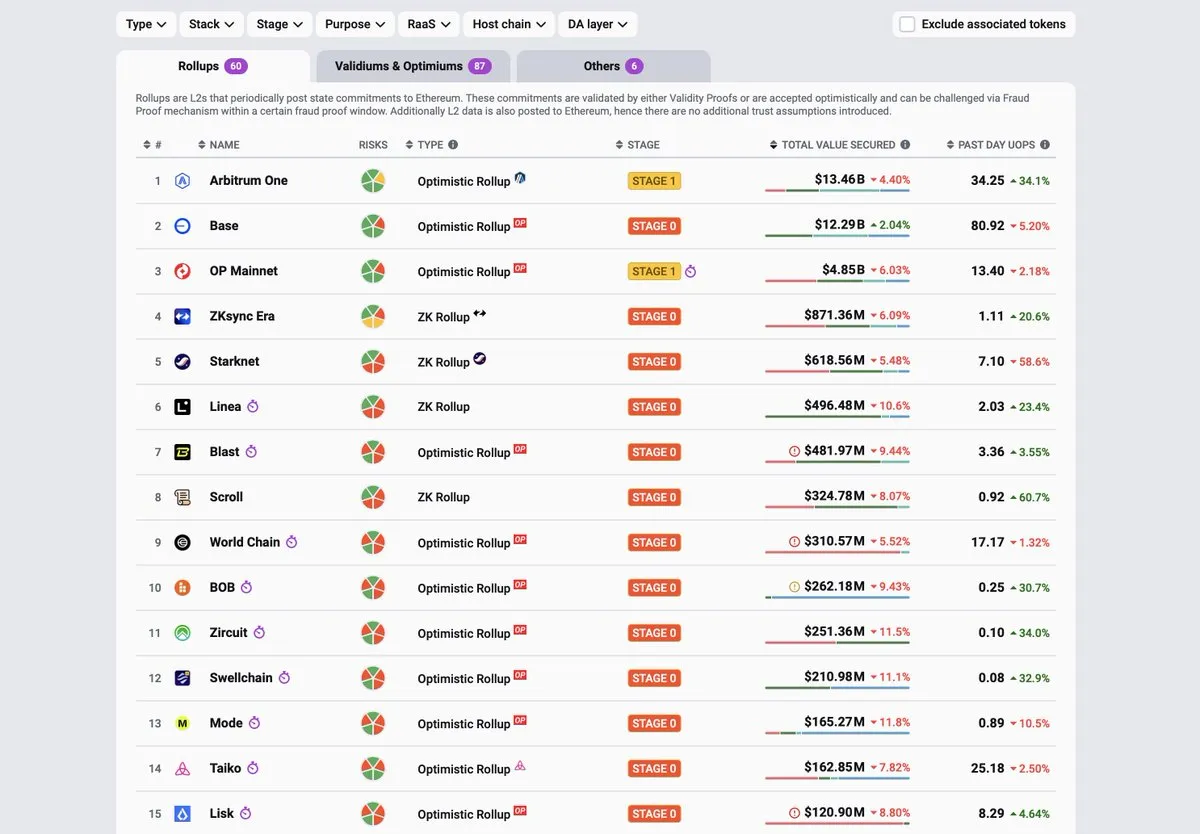

On the other hand, Ethereum's Rollup, as an alternative to application chains, has some advantages, but also faces major challenges in the following aspects:

- Limited cross-Rollup interactions: Rollups usually operate independently, and cross-Rollup asset transfers rely on third-party bridging, further exacerbating liquidity fragmentation and inconsistency in asset standards.

- Dependence on third-party solutions: Critical features such as bridging, oracles, and stablecoins are not natively supported and require reliance on external providers.

The ecosystem is in urgent need of a solution:

- Unify different application chains and ensure they follow an interoperable standard.

- Provide built-in infrastructure (bridges, oracles, liquidity) to avoid the need to “reinvent the wheel” with each new chain.

- Align incentives to ensure that launching new chains helps strengthen the overall network, rather than competing with it.

The emergence of Initia: weaving an interconnected Rollup network

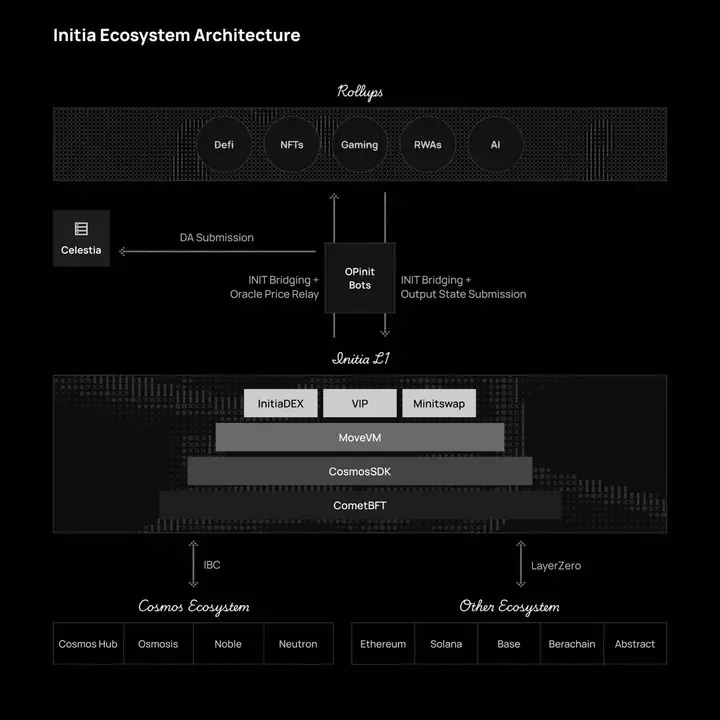

To solve these problems, Initia combines the advantages of Cosmos and Ethereum Rollup architecture to provide a comprehensive framework that eliminates fragmentation while maintaining customization capabilities. Initia's full-stack solution includes:

- Layer 1 (L1) coordination layer : handles security, governance, and liquidity coordination.

- Layer 2 (L2) Rollups (Minitias) : Provide high-speed and scalable execution capabilities.

Developers can launch customized Rollups on Initia without worrying about liquidity fragmentation or interoperability barriers, making it the first truly unified application chain network that provides both scalability and seamless cross-chain collaboration.

Initia's Four Core Pillars

Initia solves key problems in the current application chain field through the following four basic pillars, which may provide support for the most powerful application chain theory to date:

1. Focus on user and developer experience

Problem : The existing Rollup ecosystem forces developers to build critical infrastructure from scratch. Teams using existing Rollup stacks or RaaS providers only get basic tools and then have to spend huge costs to integrate important components such as oracles, bridges, block explorers, wallets, etc.

Initia’s solution : Initia reverses this model and prioritizes building a complete integrated ecosystem before the mainnet launch. Its tool suite includes:

- A complete tool suite including Initia Scan (block explorer), Initia App (portfolio dashboard), .init usernames (similar to ENS but designed for Initia), and multi-ecosystem wallet support.

- Gas abstraction technology: JIT allows users to use any token to pay for Gas fees, not just INIT.

- Native USDC integration: implemented via Noble and Circles CCTP.

- Standardization of cross-Rollup communication: adopting IBC and LayerZero protocols.

- Single-slot determinism: achieves extremely fast confirmation between L1 and L2.

- Built-in liquidity: achieved through Minitswap on L1.

This strategy allows developers to focus on building applications without spending resources on infrastructure development.

2. Reliable cross-Rollup interoperability

Problem : Transferring assets between different chains is a nightmare for users. Users either have to wait for days to withdraw (for example, more than 7 days in optimistic Rollup) or rely on third-party bridges, which is very risky. Cosmos' multi-chain transfers also generate multiple versions of tokens, further dispersing liquidity.

Initia’s solution solves this problem by embedding liquidity at the base layer.

- One token, multiple chains: Initia L1 acts as a central hub that unifies assets across all Rollups. For example, when transferring ETH from an EVM Rollup to a Cosmos chain, it is automatically converted to the correct token standard (ERC-20 ↔ CW-20) without the need for a third-party bridge.

- Instant withdrawal: Built-in AMM (MinitSwap) allows users to withdraw from Rollup instantly without waiting for 7 days. In addition, L2 tokens can be seamlessly exchanged for INIT on L1 through Peg Keepers, maintaining a 1:1 anchor.

3. “Opinion-based” Internet stack

Problem : Existing Rollup frameworks force teams to make dozens of decisions on infrastructure: which data availability layer to choose, which bridge provider to use, how to handle interoperability, etc. These choices often result in incompatible Rollup standards, poor user experience, and waste of development team resources.

Initia’s Solution : Initia standardizes core infrastructure through an “opinionated” stack while allowing customization in key areas:

- Fixed components : Initia enforces high-quality defaults - native oracles (Connect), embedded AMMs (InitiaDEX and Minitswap), unified bridges (IBC + LayerZero), uses Celestia as a data availability layer, CometBFT as a consensus mechanism, supports 10k+ TPS and 500ms block time.

- Flexible execution : Developers can choose EVM, MoveVM or WasmVM according to their needs.

- Configurable serialization : centralized by default, but supports multiple serializers via CometBFT.

- Advanced Features : Native integration with Skip Protocol’s POB (Protocol Owned Builder) and Protorev’s non-toxic MEV extraction.

4. VIP (Vested Interest Program): Aligning incentives across ecosystems

Problem : Ethereum’s application chains have leveraged Ethereum’s security and brand influence, but have not contributed much to the ecosystem. In contrast, Cosmos’ chains, although sovereign, compete with each other for liquidity and users, resulting in fragmentation, with project owners more focused on short-term token gains rather than long-term cooperation.

Initia's solution :

1.VIP (Vested Interest Program): Rollup gets esINIT (locked token) rewards based on two indicators:

- Balance Pool : Measures the total value (TVL) of INIT tokens in its ecosystem.

- Weight Pool : Measures user participation through governance voting (e.g., users “quantitatively vote” for their favorite Rollup).

Rollups can’t simply cash out their rewards and leave. By tying rewards to long-term vesting, Initia ensures that projects are financially incentivized to stay within the ecosystem and drive overall growth of the network.

2. Cabal governance : Rollup can "incentivize" INIT holders to vote for it through tokens, benefits, etc. The more votes a Rollup gets, the more esINIT rewards it gets from the VIP program. This mechanism forms a positive cycle: better applications → attract more users → users vote for them → rewards increase → further application improvements.

For example, suppose Uniswap needs to lobby Ethereum ETH holders (rather than just UNI holders) to obtain protocol rewards. This model forces Rollup to work with the broader community rather than confining itself to its own small ecosystem.

In this way, Initia ensures that the Rollup’s reward mechanism not only encourages its independent operation, but also drives its contribution to the growth and liquidity of the entire network.

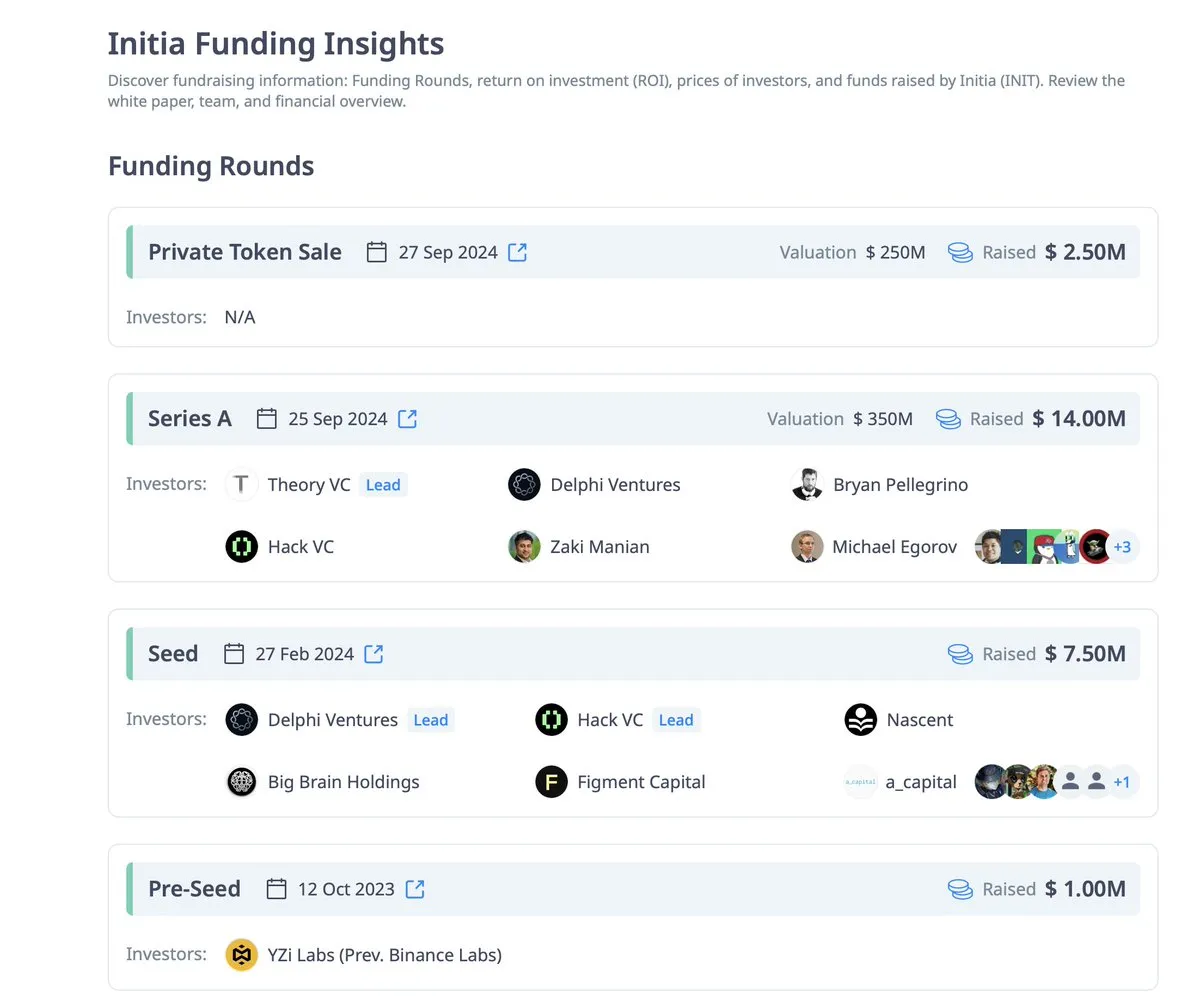

Looking ahead

Initia plans to officially launch the mainnet in March 2025 and then deploy the first batch of interconnected Rollups. At the same time, the VIP program will be further expanded to incentivize ecological growth and achieve integration with more external chains through LayerZero and IBC.

There are already several applications ready to go live in the Initia ecosystem. These projects cover a variety of areas from trading to NFT, including:

- Blackwing : A leveraged trading platform with a rapidly growing TVL.

- Milkyway : Liquid staking and re-staking market;

- Civitia : A gamified social platform based on the chain, focusing on land and income;

- Echelon : A high TVL lending protocol that aims to support multi-VM environments.

- Intergaze by Stargaze : An NFT launchpad designed specifically for the Initia ecosystem.

Initia’s ecosystem follows a strategic cycle to gradually solve key problems facing application chains:

- Infrastructure → Applications: With pre-built toolchains, developers get complete development support from day one, eliminating infrastructure barriers.

- Apps → Users: Help projects quickly attract users through grants, joint marketing, and liquidity mining.

- Liquidity → Network Effect: Built-in AMM and VIP reward mechanisms aggregate the TVL of the ecosystem, forming a self-reinforcing growth loop - growth in one area will further drive prosperity of the entire network.

If Ethereum is the "world computer", then Initia is the "world conductor". Through a unified collaborative framework, it allows application chains to "play" together in an interconnected network, achieving true ecological synergy.

Ayrıca Şunları da Beğenebilirsiniz

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Will XRP Price Increase In September 2025?