Privacy coins explained: Why secrecy may shape crypto’s next era

Privacy coins are cryptocurrencies designed to conceal transaction details that are typically visible on public blockchains.

- Privacy-focused cryptocurrencies use advanced cryptography to hide transaction details, offering stronger financial privacy than public blockchains like Bitcoin and Ethereum.

- Investors and builders are refocusing on privacy as a competitive advantage, with a16z crypto arguing it could become crypto’s most important “moat” by 2026.

- The debate is intensifying as privacy coins face regulatory scrutiny while positioning themselves as essential infrastructure for real-world crypto adoption.

Unlike Bitcoin (BTC) or Ethereum (ETH)—where wallet addresses, transaction amounts, and fund movements can be tracked—privacy coins use cryptographic tools to obscure who is sending funds, who is receiving them, and how much is being transferred.

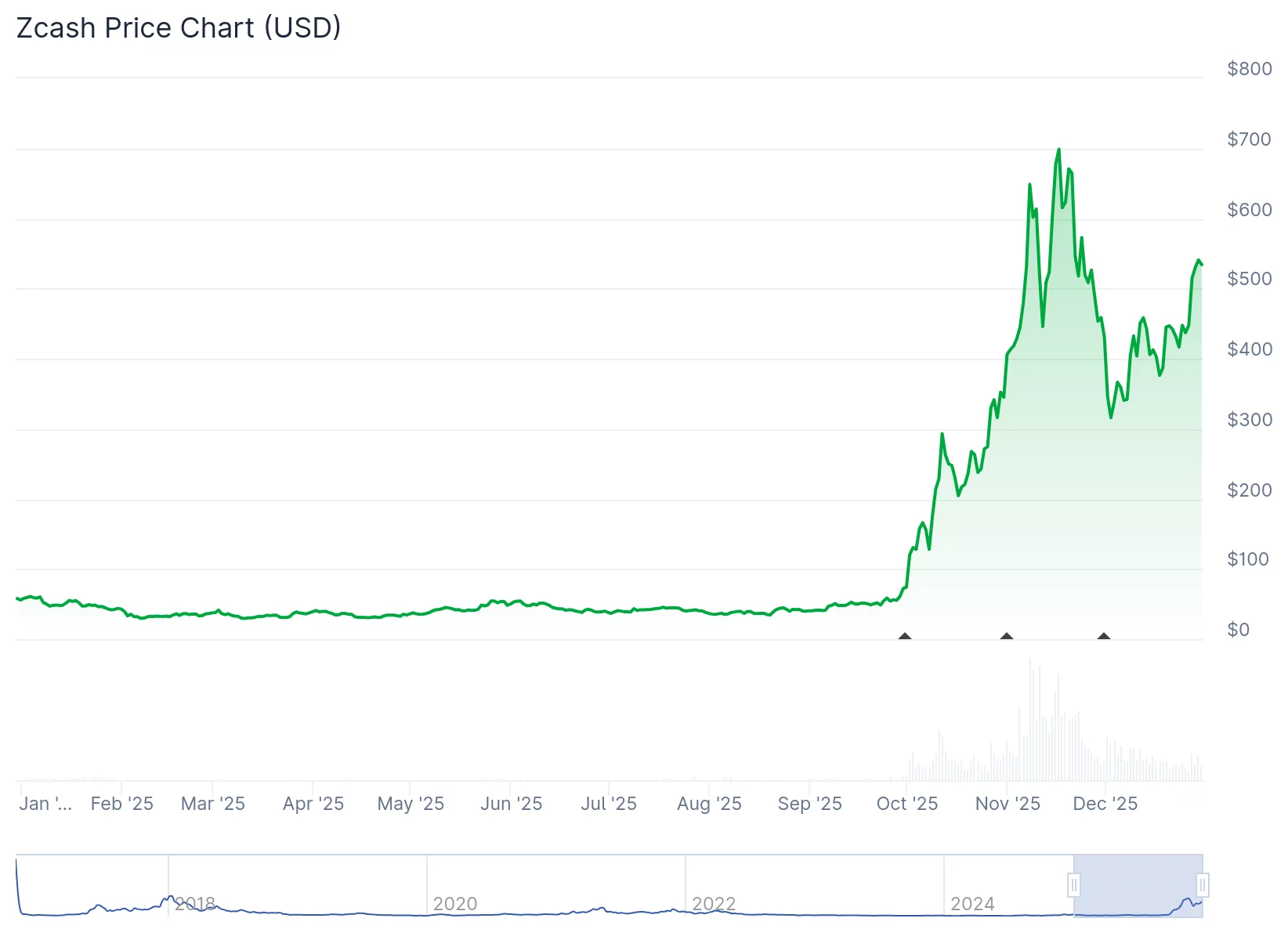

Some of them even outperformed Bitcoin in 2025. For example, Monero (XRM) is up more than 130% for the year. Zcash (ZEC) is up over 820%.

Bitcoin and Ethereum, however, are down roughly 5% and 12%, respectively.

While major blockchains are often described as anonymous, they are more accurately pseudonymous. Transaction histories are publicly recorded, and with enough data, wallet activity can often be linked to real-world identities.

Privacy-focused cryptocurrencies aim to close that gap by embedding privacy directly into their protocols.

How privacy coins work

Privacy-focused cryptocurrencies rely on advanced cryptographic techniques to prevent transaction tracing. Common methods include:

- Ring signatures, which mix a user’s transaction with others to mask the true sender

- Stealth addresses, which generate one-time wallet addresses so recipients cannot be easily identified

- Zero-knowledge proofs (such as zk-SNARKs), which verify transactions without revealing transaction details

- Transaction mixing, which pools funds to break observable links between wallets

Some networks make these privacy features mandatory, while others allow users to opt in.

Notable privacy-focused cryptocurrencies

- Firo (FIRO): Focuses on anonymity using zero-knowledge-based transaction models

- Monero: Privacy by default, hiding sender, receiver, and transaction amount

- Zcash: Uses zero-knowledge proofs with optional shielded transactions

- Dash (DASH): Offers optional privacy through its PrivateSend feature

- Secret Network (SCRT): Enables privacy-preserving smart contracts

Why privacy is becoming central to crypto’s future

Beyond individual users, privacy is increasingly viewed as a strategic advantage for blockchain networks themselves. A16z crypto, the venture capital arm of Andreessen Horowitz, recently posted on X that “privacy will be the most important moat in crypto” heading into 2026.

Ali Yahya, a general partner at Andreessen Horowitz, has emphasized that privacy fundamentally changes how blockchains compete. On public blockchains, users can easily move assets and interact across chains with little friction. Privacy-focused blockchains, by contrast, create stronger network lock-in.

“When users are on private blockchains, the chain they choose matters much more because, once they join one, they’re less likely to move and risk being exposed,” Yahya said. “And because privacy is essential for most real-world use cases, a handful of privacy chains could own most of crypto.”

This dynamic suggests privacy could drive a “winner-take-most” outcome, where a small number of dominant privacy-focused networks capture a disproportionate share of users and activity.

Regulatory challenges and controversy

Privacy coins remain controversial. Regulators and law enforcement agencies have raised concerns that enhanced anonymity could enable illicit activity, leading some exchanges to restrict or delist privacy-focused cryptocurrencies in certain jurisdictions.

Privacy advocates counter that the technology itself is neutral, drawing parallels to cash, encryption, and private messaging platforms—all of which can be misused but are widely accepted as legitimate tools.

The bigger picture

As crypto heads toward 2026, the debate over transparency versus privacy is intensifying. Privacy-focused cryptocurrencies sit at the center of that discussion, challenging the idea that full financial visibility should be the default in a digital economy.

Whether privacy coins become niche instruments or foundational infrastructure may depend on regulation, usability, and whether the industry ultimately agrees with a16z’s thesis: that in crypto’s next phase, privacy isn’t optional—it’s the moat.

Ayrıca Şunları da Beğenebilirsiniz

The Channel Factories We’ve Been Waiting For

WHAT NOT TO MISS AT CES 2026