Ether.fi: The Decentralized Wealth Management Platform

Ether.fi is rapidly evolving from a simple liquid staking protocol into a comprehensive, decentralized wealth management platform. It aims to be a "DeFi bank," providing users with a seamless experience to manage, grow, and spend their digital assets while maintaining full control over their funds. This vision places it at the forefront of the emerging neo-bank and stablecoin ecosystem.

Table of Content

- The Genesis of Ether.fi

- Core Offerings: A Synergy of Staking, Spending, and Strategy

- Stake: Non-Custodial Staking and Restaking

- Liquid: Automated DeFi Strategies

- Cash: Your Crypto-Native Credit Card

- The Road Ahead: Governance and Future Plans

- The Bigger Picture: Ether.fi's Role in the Neo-Bank and Stablecoin Revolution

- Conclusion: Is Ether.fi the Future of Banking?

- About OnFinality

The Genesis of Ether.fi

Founded in 2022 by Mike Silagadze and Rok Kopp, Ether.fi launched its liquid staking protocol in February 2023. The platform quickly gained traction by offering a non-custodial solution that allowed users to stake their ETH and other assets without sacrificing liquidity or control. The introduction of eETH, their liquid restaking token, and its integration with EigenLayer, marked a significant milestone, enabling users to earn staking rewards and restaking points simultaneously.

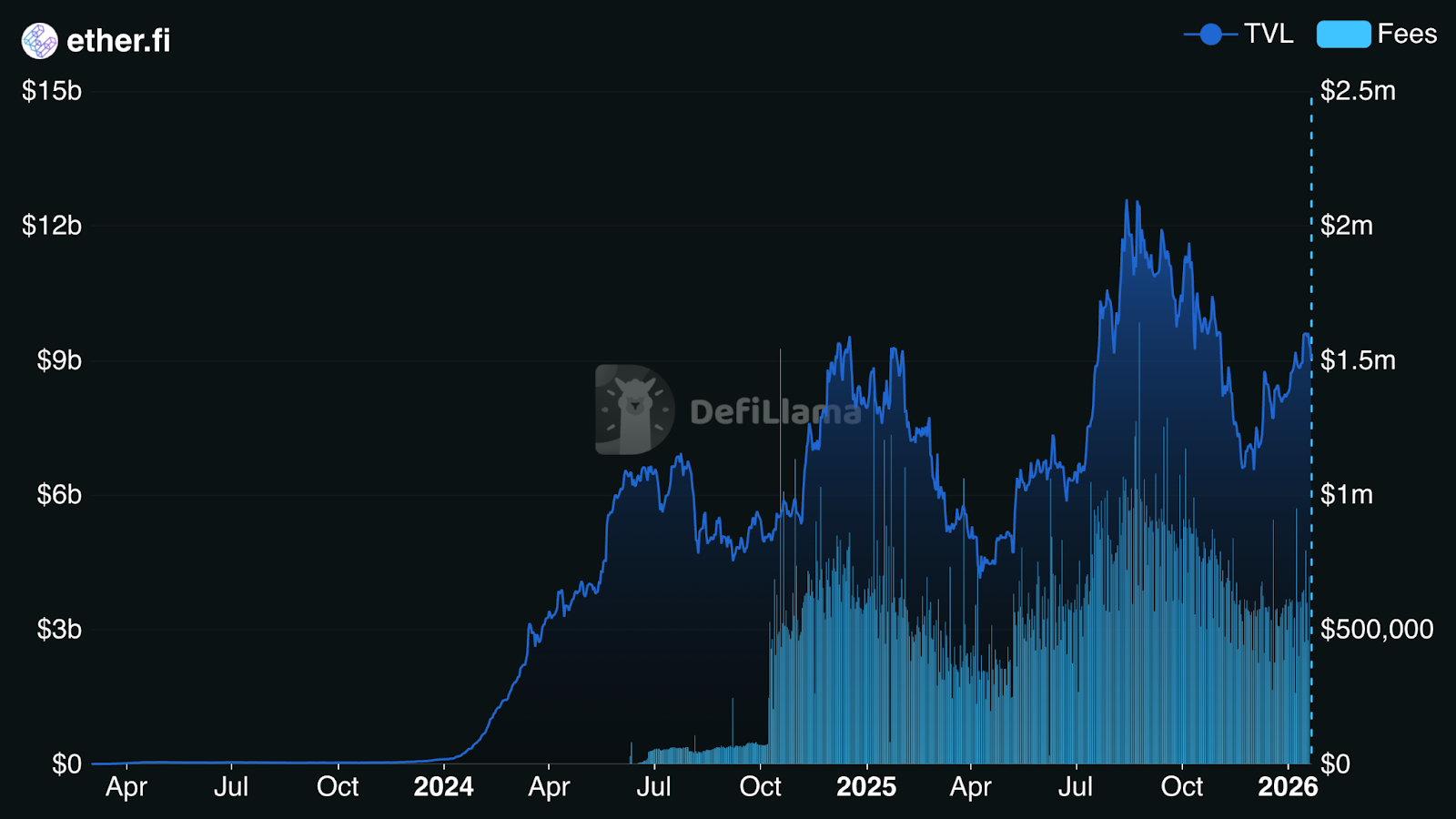

The total TVL and users on the platform speaks for the popularity and usability of the protocol. It has been growing steadily since its inception.

Source: https://defillama.com/protocol/ether.fi

Source: https://defillama.com/protocol/ether.fi

Core Offerings: A Synergy of Staking, Spending, and Strategy

Stake: Non-Custodial Staking and Restaking

At its core, Ether.fi offers a decentralized and non-custodial staking protocol. Users can stake ETH, BTC, and various stablecoins (USDC, USDe, DAI) to receive Liquid Staking Tokens (LSTs). These LSTs are then automatically restaked through EigenLayer, allowing users to earn additional rewards without losing liquidity or the ability to use their assets in other DeFi protocols. This unique approach maximizes user control and yield potential.

Liquid: Automated DeFi Strategies

For users looking to optimize their DeFi investments, Ether.fi offers "Liquid" vaults. These are automated strategies that deploy users' tokens across a variety of DeFi protocols and positions, such as providing liquidity on Aave. The vaults are managed by Ether.fi, abstracting away the complexity of DeFi and providing users with a simple way to access competitive yields. The strategies are continuously monitored and adjusted to adapt to the ever-changing DeFi landscape.

Cash: Your Crypto-Native Credit Card

"Cash" is Ether.fi's solution for bridging the gap between DeFi and traditional finance. It's a crypto-native credit card that allows users to spend their crypto balance in the real world. Powered by a mobile app and a Visa credit card, Cash enables users to borrow against their Ether.fi assets and make everyday purchases, all while earning rewards. This product is a key component of their vision to create a seamless financial experience.

Source: https://www.ether.fi/

Source: https://www.ether.fi/

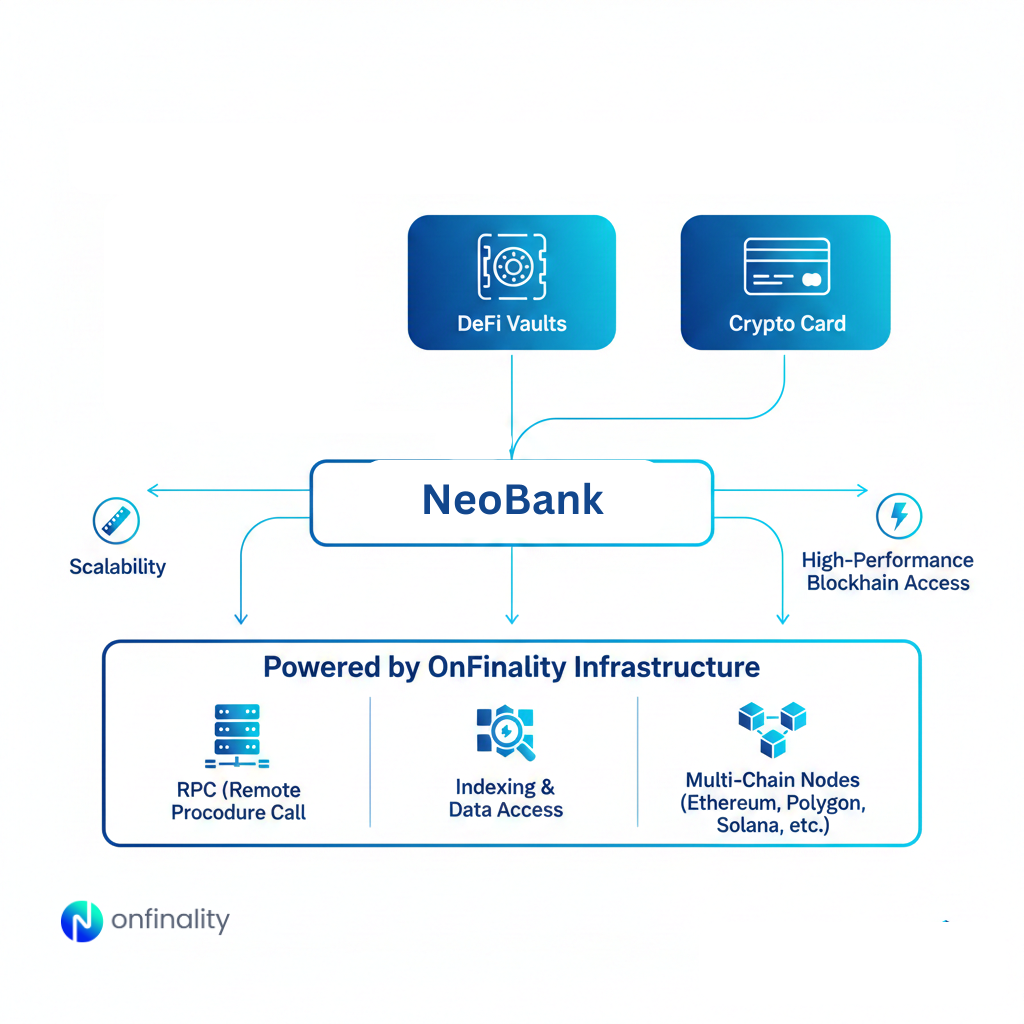

How Neobanks Like Ether.fi Can Use OnFinality

As crypto-native neobanks evolve from single-product DeFi apps into full-stack financial platforms, infrastructure reliability becomes a core dependency. For neobanks like Ether.fi, which combine staking, automated yield strategies, and real-world spending, OnFinality acts as the underlying infrastructure layer that enables scale, performance, and operational resilience.

High-Availability RPC Infrastructure

Neobanks rely on uninterrupted blockchain access for staking operations, balance updates, card transactions, and portfolio dashboards. OnFinality provides enterprise-grade RPC endpoints across major networks, ensuring low-latency reads and high uptime during peak demand, market volatility, or large user onboarding events.

Scalable Indexing for User-Facing Financial Apps

Products such as Ether.fi Cash, Liquid vault dashboards, and governance portals require fast historical and real-time data. OnFinality’s indexing services allow neobanks to query structured blockchain data efficiently, powering account statements, reward tracking, and compliance reporting without relying on slow on-chain reads.

Multi-Chain Expansion Without Infra Overhead

As neobanks expand beyond Ethereum into multi-chain environments, infrastructure complexity increases rapidly. OnFinality abstracts node management, scaling, and maintenance across 130+ supported networks, allowing teams to launch new chains and products without rebuilding backend infrastructure.

Enterprise Reliability for Consumer-Grade Finance

Unlike experimental DeFi apps, neobanks operate closer to consumer fintech expectations. OnFinality’s production-ready infrastructure supports SLA-driven uptime, predictable performance, and operational transparency, aligning Web3-native platforms with real-world financial reliability standards.

The Bigger Picture: Ether.fi's Role in the Neo-Bank and Stablecoin Revolution

The rise of stablecoins and the growing demand for decentralized financial services have created the perfect storm for the emergence of "neo-banks" like Ether.fi. These platforms are challenging traditional banking models by offering:

- Borderless Access: Financial services available to anyone, anywhere, 24/7.

- User Sovereignty: Users maintain full custody and control over their assets.

- Transparency: All transactions and operations are recorded on the blockchain.

- Higher Yields: By cutting out intermediaries, DeFi platforms can offer more competitive returns.

Ether.fi, along with pioneers like Aave, is at the forefront of this movement. By combining staking, automated yield strategies, and a crypto-native credit card, they are creating a powerful alternative to traditional banking. As regulatory clarity improves and institutional interest grows, we can expect to see these next-generation banks play an increasingly important role in the global financial system.

Conclusion: Is Ether.fi the Future of Banking?

Ether.fi has successfully evolved from a liquid staking protocol into a multifaceted DeFi platform that offers a glimpse into the future of banking. Their commitment to decentralization, user control, and innovation is evident in their product offerings and governance model. While the journey is still in its early stages, Ether.fi is well-positioned to become a major player in the decentralized wealth management space, offering a compelling alternative to the traditional financial institutions of today.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

Ayrıca Şunları da Beğenebilirsiniz

Facts Vs. Hype: Analyst Examines XRP Supply Shock Theory

US and UK Set to Seal Landmark Crypto Cooperation Deal