High Performance Hyperliquid RPC: Build Faster with OnFinality

Hyperliquid is rapidly becoming the go-to chain for real-time, low-latency on-chain trading. Its architecture combines a high-performance Layer 1 with native order-book execution and an EVM-compatible smart-contract layer (HyperEVM), giving builders the speed of a centralized exchange with the transparency and composability of Web3.

But to build production-grade apps on Hyperliquid, whether trading bots, analytics dashboards, DeFi protocols, or monitoring tools, you need reliable access to the network. That’s where a high-performance Hyperliquid RPC becomes essential.

OnFinality now provides fast, globally available Hyperliquid RPC endpoints designed for builders who need predictable performance, zero rate-limits, and infrastructure they can trust.

Why Hyperliquid Needs Better RPC Infrastructure

Hyperliquid’s architecture is built for one primary goal: lightning-fast, on-chain execution.This makes it ideal for:

- High-frequency trading bots

- Live dashboards and analytics

- On-chain market making

- Perpetuals and derivatives platforms

- Automation tools and indexers

But builders quickly run into the limits of the publicly available Hyperliquid RPC.

The issue: public RPC rate limits and shared load

Hyperliquid API provides a standard JSON-RPC endpoint for HyperEVM, but it comes with strict rate limits. As of mid-2025, the public Hyperliquid RPC is capped at ~100 requests/minute per IP - fine for experiments, but completely insufficient for:

- Trading bots that query state hundreds of times per second

- Multi-user dashboards

- Large-scale indexers

- Real-time alerting or monitoring tools

- Any app that needs to read logs, events, or state at high frequency

The moment you move past prototyping, public RPC becomes a bottleneck.

To build anything reliable, you need your own private Hyperliquid RPC endpoint.

What a Hyperliquid RPC Node Does

A Hyperliquid RPC node gives developers direct access to the HyperEVM execution layer via standard Ethereum JSON-RPC methods, including:

- eth_call

- eth_getLogs

- eth_blockNumber

- eth_getTransactionReceipt

- eth_getBalance

This is the same RPC surface area developers already know from Ethereum — meaning Hyperliquid is immediately accessible through familiar tools like:

- Ethers.js

- Web3.js

- Hardhat

- Foundry

- Indexers

- Backend services

This is what people mean when they refer to Hyperliquid EVM RPC.

Note: Hyperliquid separates the trading engine from EVM execution.RPC gives access to the EVM layer, not the trade-matching layer - a crucial architectural distinction many guides fail to mention.

Public vs Private Hyperliquid RPC: What You Actually Need

When Public Hyperliquid RPC Is Enough

- Prototyping

- Small scripts

- Occasional state reads

- Basic test dashboards

When You Need Private Hyperliquid API

- Trading bots- High-frequency automation- Real-time indexers- Advanced dashboard platforms- Historical log queries- Infrastructure for production apps- Backfilling data at scale

If you need consistency, low latency, or higher throughput a private Hyperliquid API endpoint becomes essential.

Why Builders Choose OnFinality for Hyperliquid RPC

Other ecosystem blogs emphasise why a high-quality infrastructure provider matters — predictable performance, global reliability, and a frictionless developer experience. OnFinality delivers all of that for Hyperliquid.

1. Zero rate-limits - built for high-frequency use

Our Ultimate RPC plan has no throttling. No shared bottlenecks.Just fast, reliable access to HyperEVM whenever your app needs it.

2. Global performance

OnFinality’s distributed network ensures consistently low latency for international teams and trading applications.

3. Production-grade reliability

Trading systems and analytics dashboards cannot tolerate downtime.OnFinality’s uptime, monitoring, and auto-scaling infrastructure make Hyperliquid viable for enterprise-grade workloads.

4. Plug-and-play with your existing EVM stack

Because Hyperliquid uses standard EVM RPC, you can drop in an OnFinality endpoint immediately.

How to Connect to a Hyperliquid API Endpoint

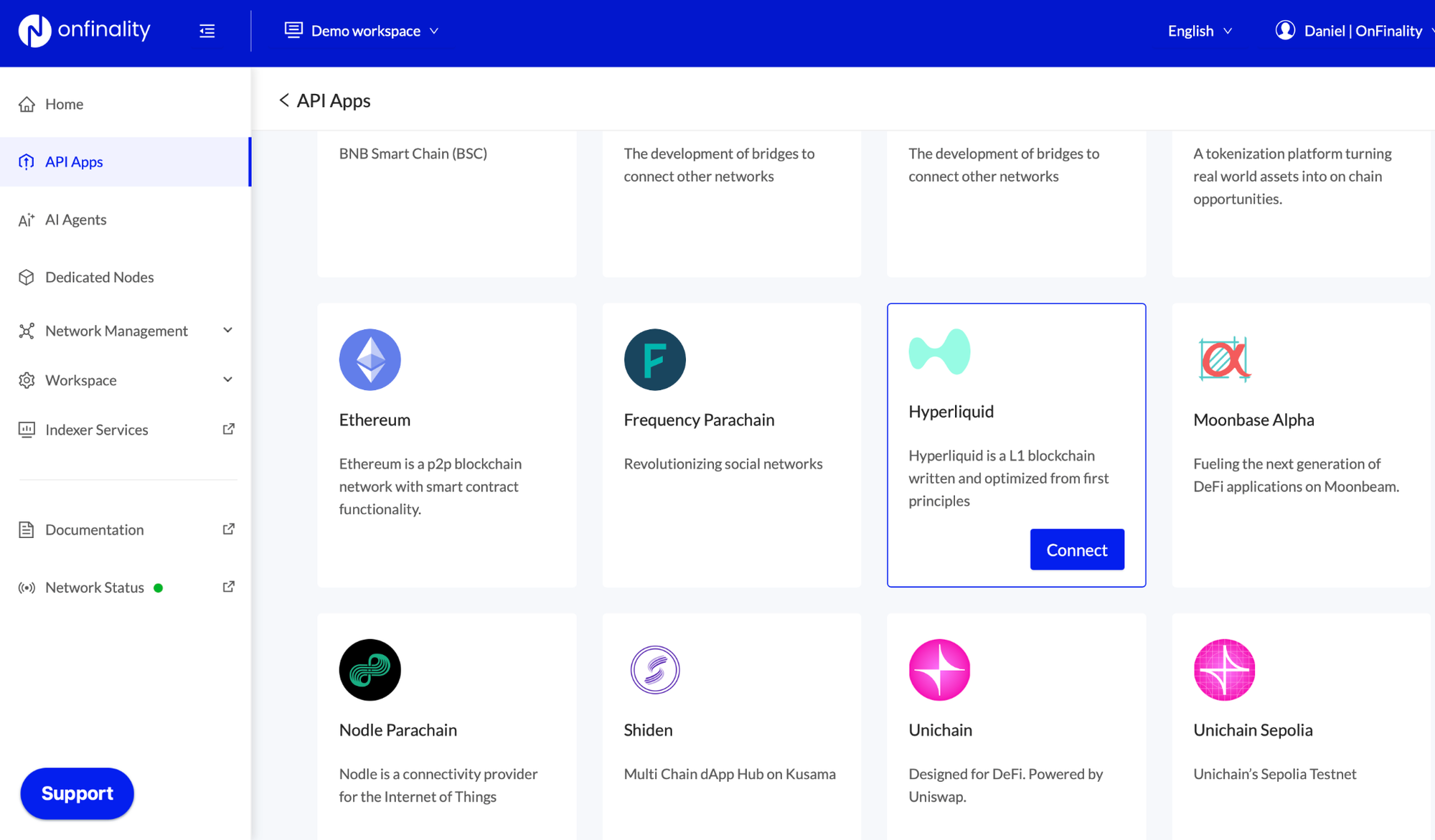

Get your OnFinality Private Hyperliquid API Endpoint

Developers can connect to Monad using OnFinality’s Dashboard and public RPC endpoints

Step 1: Sign up to the OnFinality Portal

Step 2: Open API Apps - Network Marketplace and select Hyperliquid

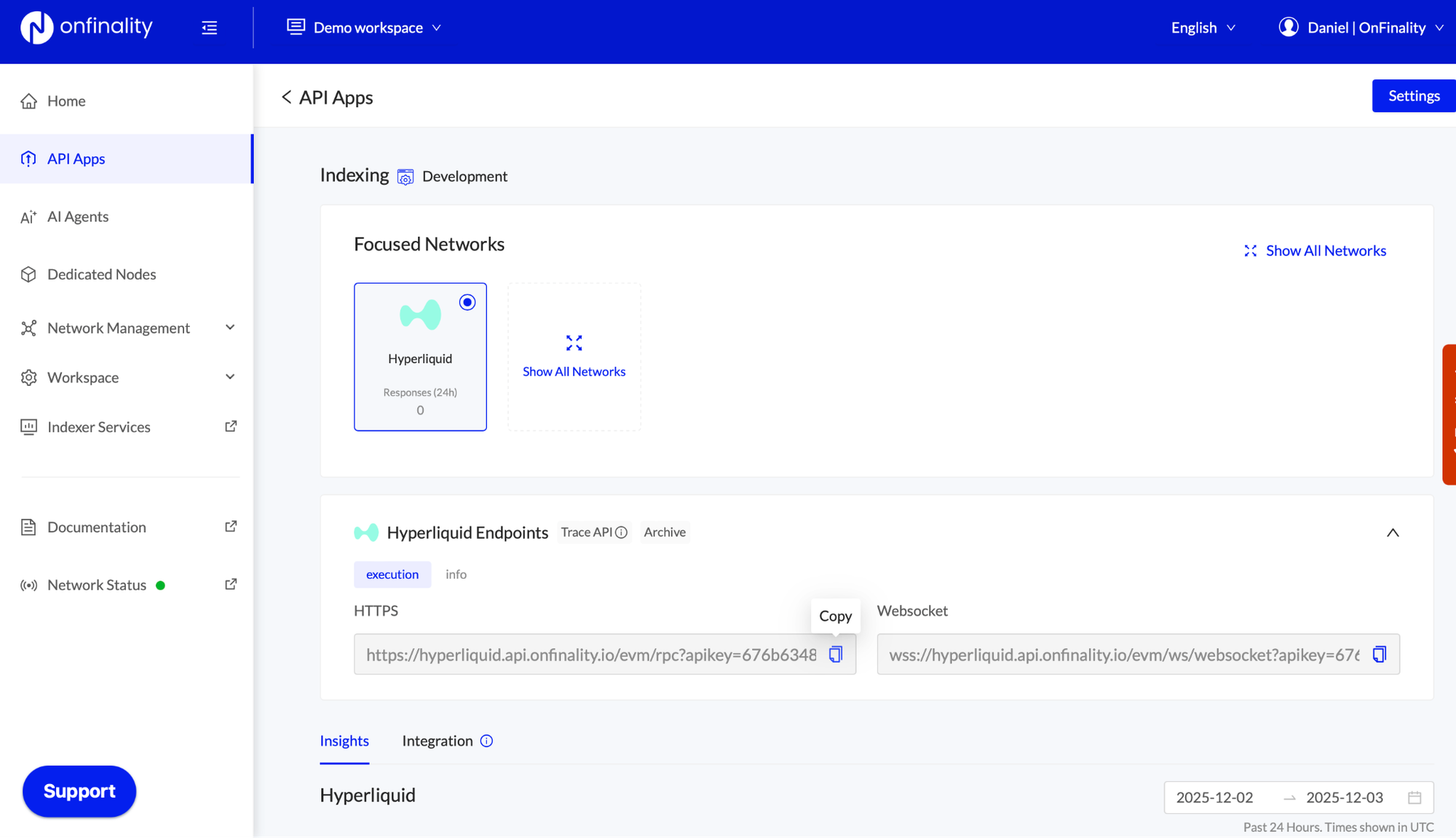

Step 3: Copy the EVM endpoint

OnFinality Public Hyperliquid API Endpoints

Hyperliquid EVM RPC Endpoint - HTTPS: https://hyperliquid.api.onfinality.io/evm/public

Hyperliquid EVM RPC Endpoint - Web Sockets: wss://hyperliquid.api.onfinality.io/evm/public-ws

Make your First Request

Copy the CURL command into your terminal. You can replace the URL with your private Hyperliquid RPC endpoint obtained above.

curl -H 'content-type:application/json' -d '{"id": 1, "jsonrpc": "2.0", "method": "eth_blockNumber"}' 'https://hyperliquid.api.onfinality.io/evm/public'

It’s identical to interacting with any Ethereum-compatible chain.

Use Cases: Where OnFinality's Hyperliquid RPC Shines

1. Trading Bots & Automation

The most obvious use case.Bots rely on fast, consistent, unlimited RPC throughput - exactly what other RPC endpoints cannot deliver.

2. Real-Time Dashboards

Live price feeds, open positions, account state, funding rates, indexed events - all require low-latency RPC.

3. Indexers & Analytics

Whether you’re indexing your own dApp or building full-chain analytics:Event logs + block scanning = huge query volumes.A private, scalable endpoint is mandatory.

4. DeFi Protocols

HyperEVM opens the door for lending, swaps, derivatives, and more.Every DeFi app needs dependable state reads.

5. Monitoring & Alerts

Alerting systems require high-frequency polling and consistent availability.

Why Developers are Choosing Hyperliquid + OnFinality Today

From the Chainstack announcement, Dwellir’s technical walkthrough, and OnFinality’s own RPC best practices, one narrative is consistent:

Hyperliquid is powerful, but only if you pair it with robust RPC infrastructure.

OnFinality gives builders:

- A fast, reliable Hyperliquid RPC

- Dedicated Hyperliquid RPC nodes

- Full compatibility with Hyperliquid EVM RPC tooling

- Integration paths for explorers, indexers, and data pipelines

- Global performance and zero rate-limits

Simply put:We handle the infrastructure so you can build what matters.

Final Thoughts

If you’re building anything serious on Hyperliquid - trading bots, dashboards, DeFi protocols, or analytics - reliable RPC access is non-negotiable.

OnFinality makes it effortless:

Fast setup - Global endpoints - No rate-limits - High-performance Hyperliquid node options - Built for scale

Get Started today and take your Hyperliquid development to production with a dedicated, enterprise-grade RPC provider.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

Ayrıca Şunları da Beğenebilirsiniz

Facts Vs. Hype: Analyst Examines XRP Supply Shock Theory

US and UK Set to Seal Landmark Crypto Cooperation Deal